Telecom 3 Companies Satisfaction Ranking: SKT, LGU+, KT Order

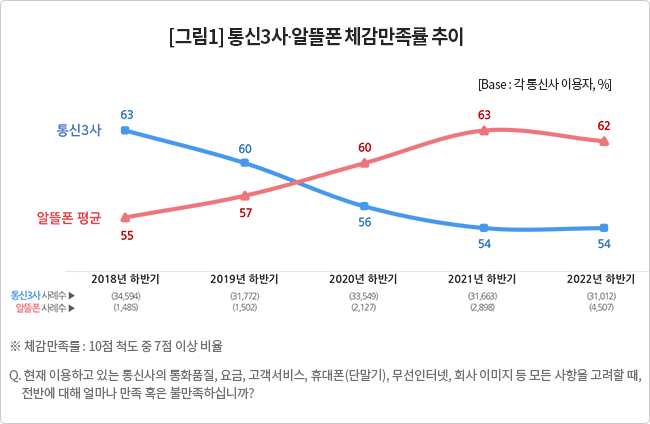

[Asia Economy Reporter Oh Su-yeon] The perceived satisfaction level of users of budget phones has surpassed that of users of the three major telecom companies for three consecutive years. Among brands, KB Livem's Liv Mobile showed the highest satisfaction.

Consumer Insight, a specialized research institute in data convergence and consumer research, announced the results on the 22nd after analyzing the mobile phone usage behavior of 35,519 users aged 14 and above through the 'Mobile Communication Planning Survey.'

The satisfaction rate of budget phone users averaged 62%, down 1 percentage point (P) from the same period last year. This marks the first decline after a trend of increasing 2-3%P annually from 55% satisfaction in 2018.

However, during the same period, the satisfaction rate of the three major telecom companies dropped from 63% to 54%, trailing behind by 8%P. This marks the third consecutive year that budget phones have outperformed the three major telecom companies.

Comparison of Perceived Satisfaction Rates by the Three Major Telecom Companies and Budget Phone Brands. Graphic by Consumer Insight

Comparison of Perceived Satisfaction Rates by the Three Major Telecom Companies and Budget Phone Brands. Graphic by Consumer Insight

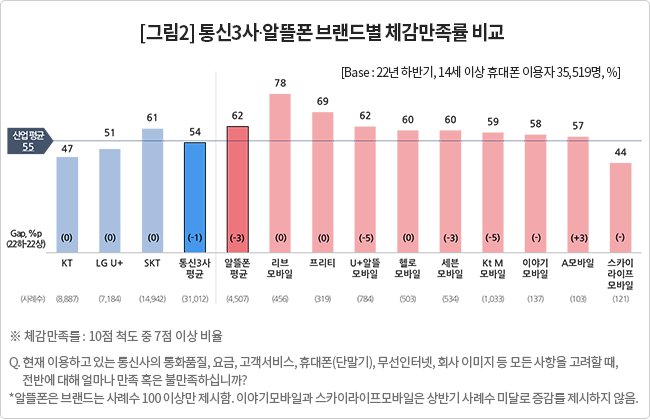

Among budget phone brands, Liv Mobile maintained the highest satisfaction rate at 78% since the second half of last year. Pretty ranked second with 69%. Following were U+ Budget Mobile (62%), Hello Mobile (60%), Seven Mobile (60%), KT M Mobile (59%), Iyagi Mobile (58%), and A Mobile (57%). Skylife Mobile was surveyed at 44%.

U+ Budget Mobile (-5%P), Seven Mobile (-3%P), and KT M Mobile (-5%P) saw a decline in satisfaction compared to the same period last year.

Among the three major telecom companies, SKT had the highest satisfaction at 61%, followed by LG Uplus at 51%, and KT at 47%.

By age group among budget phone users, those in their 20s had a satisfaction rate of 66%, and those in their 30s had 63%, higher than other age groups. Compared to users of the three major telecom companies in the same age groups (53%, 48%), budget phone users led by more than 10%P.

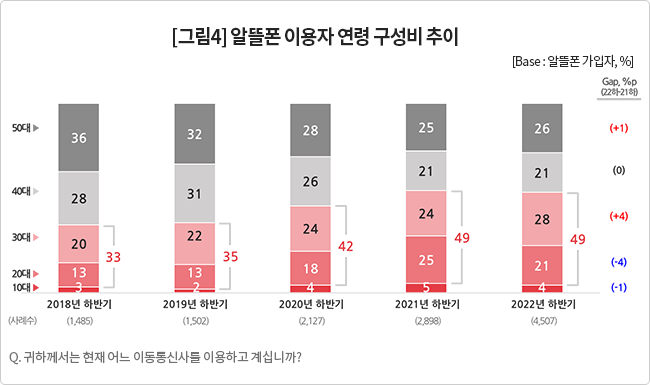

The MZ generation (born between the 1980s and early 2000s) accounted for half of budget phone users. The combined proportion of users in their 20s and 30s increased significantly from 33% in 2018 to 49% this year. This year, the proportion of users in their 30s increased compared to the second half of last year, while those in their 20s decreased.

Consumer Insight explained, "Considering the continuous growth of the budget phone market, it is interpreted that the absolute number of users in their 20s has not decreased, but rather more users in their 30s are entering the market."

The satisfaction rate for budget phone fees was 65%, 1.8 times higher than that of users of the three major telecom companies (36%).

Consumer Insight added, "The combination of 'unlocked phones + budget phones' aligns well with the lifestyle of the MZ generation, who prioritize rational consumption, contributing to its popularity. However, there is still a disadvantage in service items other than fees, and recently, the rise in device prices has weakened cost competitiveness, which is a concern."

They continued, "Following Liv Mobile, the financial platform Toss will enter the market in the new year. With the aggressive advance of these financial affiliates and the defensive strategies of the subsidiaries of the three major telecom companies, the market is expected to undergo another upheaval. A strategy to capture the hearts of the MZ generation, the core demand group for budget phones, is necessary," they added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)