Episodes 'Amelibu' and Chongkundang 'Lucenbies'

Expected Launch Early Next Year

Patients Often Choose Instead of Avastin Due to High Costs

Costs Expected to Decrease by About 30-40%

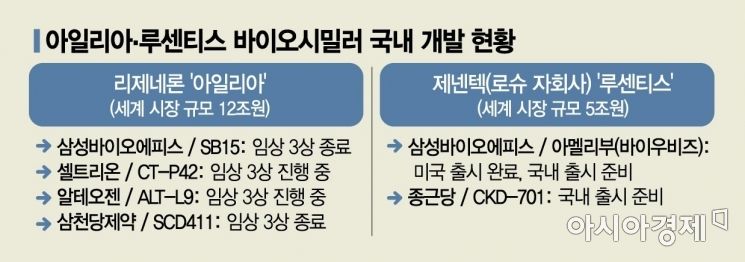

[Asia Economy Reporter Lee Chun-hee] With the imminent domestic launch of Genentech (a Roche subsidiary)'s ophthalmic disease treatment drug 'Lucentis' (active ingredient Ranibizumab) biosimilar, fierce competition is expected to take place starting next year. Since this drug has been a significant financial burden for patients, there is also anticipation that such competition will help reduce patients' expenses.

According to the industry on the 22nd, the Ministry of Health and Welfare recently issued an administrative notice proposing partial amendments to the criteria for applying health insurance benefits to Ranibizumab, extending coverage not only to Lucentis but also to other injectable drugs. The ministry added that since Ranibizumab injectable drugs are scheduled for new listing, the benefit criteria will include "etc." and administration will be allowed within the scope of each drug's approved indications.

This reflects the fact that two Lucentis biosimilars, Samsung Bioepis's 'Amelibu' and Chong Kun Dang's 'Lucenbeys,' received approval from the Ministry of Food and Drug Safety earlier this year. Currently, the indications covered by insurance for Lucentis include ▲neovascular (wet) age-related macular degeneration ▲diabetic macular edema ▲macular edema following retinal vein occlusion ▲choroidal neovascularization. Both companies have obtained full-label approval for all these indications, and since the amendment is set to take effect from January 1 next year, they are reportedly preparing for domestic launches early next year. Samsung Bioepis, which lacks its own sales network, will enter the market in partnership with Samil Pharmaceutical.

Macular degeneration, a major indication for Lucentis, is a disease where waste products accumulate in the macula, the central part of the retina, initially causing dry macular degeneration, which then progresses to wet macular degeneration characterized by excessive blood vessel growth, potentially leading to blindness. Wet macular degeneration is considered one of the top three causes of blindness among the elderly. Data analytics firm GlobalData estimates that the market size for wet macular degeneration treatments in nine major countries including the US, Germany, Japan, China, and Australia will reach $18.7 billion (approximately 24 trillion KRW) by 2028. The domestic Lucentis market size is known to be around 35 billion KRW annually.

Macular degeneration is treated by directly injecting antibody drugs such as Lucentis or Regeneron's 'Eylea' into the eye to inhibit blood vessel formation and slow disease progression. Both drugs are quite expensive, and even with health insurance coverage, the off-label use of 'Avastin' is common in Korea. Avastin, originally used as an anticancer drug, has no approved indication for macular degeneration, but its out-of-pocket cost is lower than or similar to the patient co-payments for the two insured drugs.

The launch of biosimilars is expected to reduce this burden further. Biosimilars are typically priced 30-40% lower than the original drugs. In fact, Samsung Bioepis, which began selling the Lucentis biosimilar under the brand name 'Byooviz' in the US last June, set the wholesale price about 40% lower than the original at $1,130 (approximately 1.46 million KRW).

Samsung Bioepis also obtained marketing approval in Europe last August and Australia last September, preparing to enter those markets as well. Chong Kun Dang is also pursuing market entry into Japan and Southeast Asia.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)