$56 Million Export in First Half, Rapid Growth Continues in Second Half

Webtoons See Increases in Sales, Exports, and Workforce, with User Numbers Soaring

Global Expansion on Track, Higher Expectations for Next Year

[Asia Economy Reporter Seungjin Lee] The webtoon industry, which has rapidly grown since the COVID-19 pandemic, is expected to surpass the $100 million export milestone this year. Although the export performance for the second half of the year has not yet been finalized, exports reached $56 million in the first half alone, and it is anticipated that exports in the second half will exceed at least $60 million. The webtoon industry, which has actively expanded globally this year into markets such as the United States, Europe, Japan, and Southeast Asia, plans to focus on globalization next year through expanding export regions, increasing the number of works, and discovering local webtoons.

K-Webtoons to Surpass $100 Million Export Milestone

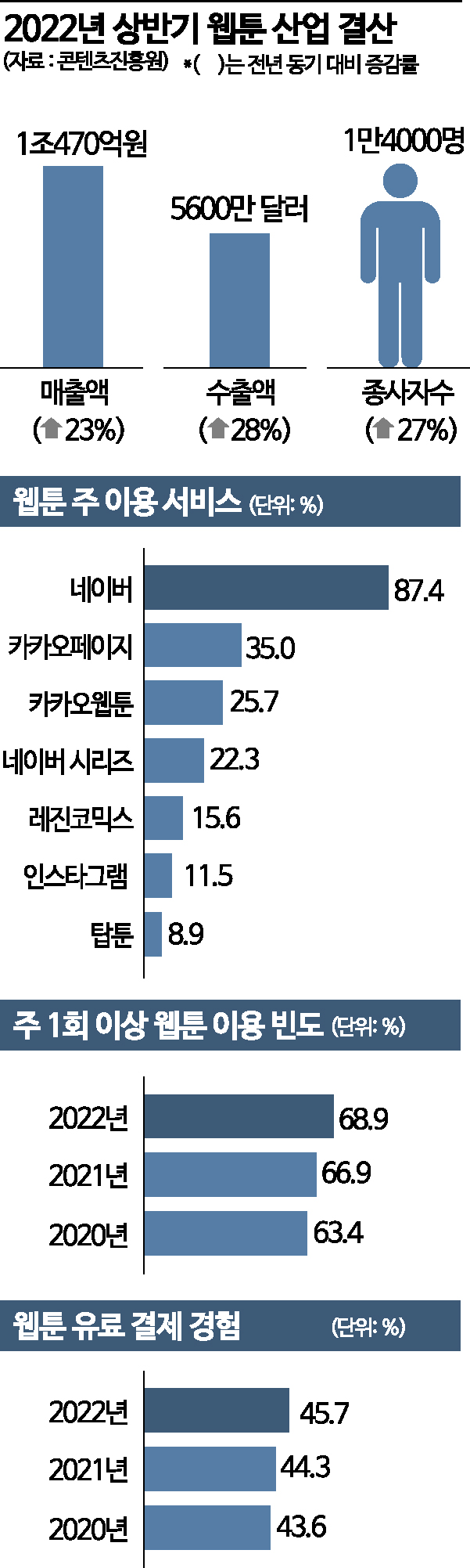

According to the Korea Creative Content Agency on the 21st, the export value of the comics (webtoons + publications) content industry in the first half of this year was $56 million (approximately 72 billion KRW), marking a 28% growth compared to the same period last year. Considering that Naver and Kakao entered the North American market in the second half and that sales surged due to strong popularity in Europe, including France, exports of at least $60 million are expected. This means that K-webtoons alone will form a market worth $100 million annually overseas. Last year’s total export value was $87 million (approximately 112 billion KRW).

In particular, this year saw more than 40 broadcast video contents produced using webtoon and web novel intellectual property (IP), generating strong interest in the original works. Content based on original IP spread worldwide through online video services (OTT), boosting the popularity of the originals as well. For example, after the drama adaptation of KakaoPage’s webtoon "Sanaematsun" aired, KakaoPage’s original webtoon sales increased fourfold compared to the previous month. Considering this trend, it is expected that this year’s export value will easily exceed $100 million.

The total sales scale of comic content exceeded 1 trillion KRW in the first half of the year, growing more than 23% compared to the same period last year. Webtoons account for the majority of sales in the comic content industry. The sales and export figures of the comic content industry do not include the numbers for secondary creations using webtoons, so the combined total is expected to significantly exceed the reported figures.

The comic content industry is also rapidly increasing its workforce centered on webtoons. As of the first half of the year, the total number of workers was 14,358, a 27% increase compared to the same period last year. Among all content industries, the comic content industry was the only one to record a double-digit growth rate in workforce numbers in the first half of this year.

In 2022, Webtoon Readers Watched More and Paid More

Users who accessed webtoons this year watched them more frequently and opened their wallets more for paid content. According to a survey by the Korea Creative Content Agency of webtoon content users aged 10 to 69 nationwide, 69% of users said they accessed webtoons at least once a week. This is an increase of more than 5 percentage points compared to 2020. In particular, 25% of respondents said they read webtoons almost daily, up about 4 percentage points from 2020.

The number of users spending money on webtoons also increased. In 2020, 44% of users reported having experience with paid webtoon purchases, but this rose to 48% this year. Among them, 48% spent between 1,000 KRW and 5,000 KRW monthly on average, and 3% of users spent more than 100,000 KRW.

The main webtoon platforms used were Naver Webtoon, KakaoPage, Kakao Webtoon, Naver Series, Lezhin Comics, Instagram, TopToon, Toomics, Facebook, and Ridi, in that order.

K-Webtoon Global Growth to Accelerate from Next Year

Content businesses such as webtoons and web novels, which Naver and Kakao have been focusing on for global expansion, have begun to enter the main track. Starting next year, they are expected to begin producing tangible results and achieve even steeper growth than this year.

Naver Webtoon recently launched 'Yonder,' a premium web novel platform in North America. Yonder operates in connection with 'Wattpad,' a North American web novel platform acquired by Naver last year. Starting with the acquisition of Wattpad last year, Naver has been competing to secure a global platform. In the Japanese market, Naver acquired the e-book service company 'eBook Initiative Japan,' building a platform that encompasses both webtoons and web comics. As of August this year, the combined transaction amount of the two companies surpassed 10 billion yen (approximately 97.2 billion KRW), the highest ever.

Kakao acquired the North American webtoon platform 'Tapas' and web novel platforms 'Radish' and 'Usia World' last year. In May this year, Kakao merged Tapas Media and Radish to launch Tapas Entertainment. Kakao aims to achieve 500 billion KRW in sales in the North American region by 2025 by operating the Tapas-Radish-Usia World triangular alliance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)