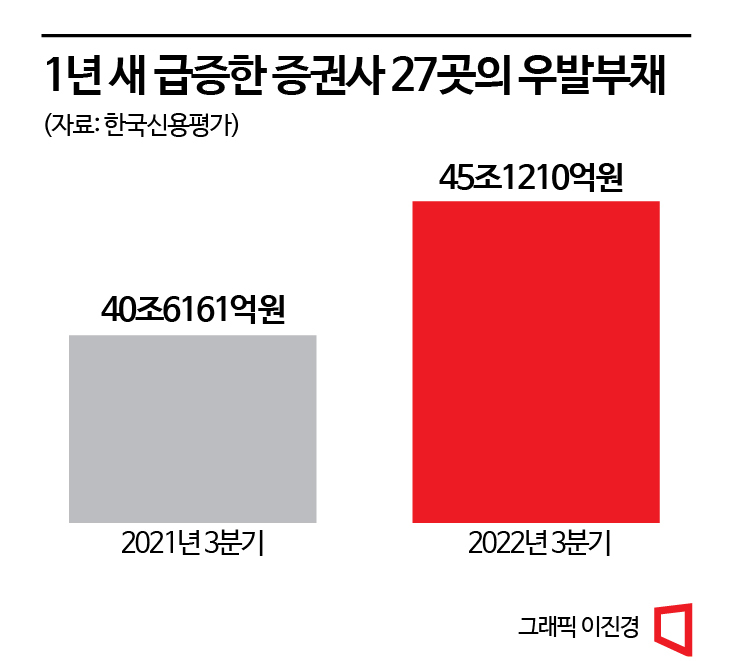

Contingent Liabilities of 27 Securities Firms Reach 45 Trillion KRW in Q3, Up 11.09% YoY

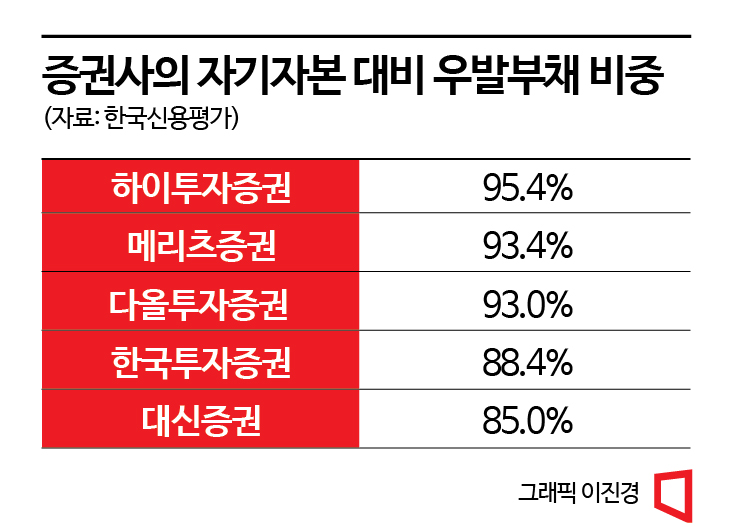

Proportion to Equity Capital Increases... High Burden on Hi, Meritz, Daol, and Hantoo

[Asia Economy Reporter Lee Seon-ae] The contingent liabilities related to real estate project financing (PF) managed by securities firms have surged to 45 trillion won, raising concerns in the financial market. If refinancing issuance fails, securities firms may have to bear the burden, meaning these 'contingent liabilities' can easily turn into 'debt.' Both small and medium-sized securities firms as well as large firms have contingent liabilities amounting to 80% to 90% of their equity capital, posing a risk to asset soundness.

According to Korea Credit Rating on the 15th, the contingent liabilities of 27 securities firms as of the third quarter totaled 45.121 trillion won, an 11.09% increase compared to the same period last year (40.6161 trillion won). The contingent liabilities of securities firms are mainly related to real estate PF. Typically, when real estate PF debt guarantees, which constitute a large portion of securities firms' corporate finance (IB) revenue, increase, contingent liabilities also rise. Contingent liabilities are debts that are not yet confirmed. However, if refinancing issuance fails or similar events occur, these liabilities become confirmed debts that securities firms must repay.

Considering the outlook of the real estate market and other cautionary factors, experts believe that securities firms' contingent liabilities will pose a burden on asset soundness in the mid to long term. Gong Moon-joo, a researcher at Yuanta Securities, explained, "Securities firms and construction companies that provide credit enhancement are exposed to various risks depending on the PF project stage. The recently emerging risk is the refinancing risk due to the long project duration but short-term financing." He added, "Securities firms showed some deterioration in capital adequacy and liquidity indicators during the expansion of credit provision for real estate PF, with the decline being more pronounced among small and medium-sized securities firms that have smaller capital and higher IB dependency." He particularly pointed out, "73.5% of PF-asset-backed commercial paper (ABCP) for which securities firms have provided credit or liquidity will mature within this year. If refinancing is not smoothly executed, it could become a burden."

Im Jae-gyun, a researcher at KB Securities, said, "The current market concern is the real estate PF market. For real estate PF to be repaid or refinanced without issues, the real estate market is crucial. However, with interest rate hikes leading to reduced transactions and falling prices, concerns about a downturn are growing, raising worries about whether real estate PF refinancing will proceed smoothly."

Another worrying aspect is the increasing ratio of contingent liabilities to equity capital among large securities firms. Korea Investment & Securities' contingent liabilities ratio rose from 59.4% in the third quarter last year to 88.4% in one year. During the same period, the contingent liabilities amount increased from 3.6494 trillion won to 5.5381 trillion won. For KB Securities, the ratio increased from 76.4% to 81.4%, with contingent liabilities rising from 4.1246 trillion won to 4.8303 trillion won. The industry leader Mirae Asset Securities recorded a ratio of 26.6%, which is also higher than last year's 18.1%. Among small and medium-sized firms, Cape Securities showed a notable increase, surging from 10 billion won in the third quarter last year to 90 billion won this year. Its contingent liabilities ratio to equity capital jumped significantly from 4.1% to 34.8% during the same period.

Among securities firms, those with high contingent liabilities ratios relative to equity capital are mostly small and medium-sized firms. The highest is Hi Investment & Securities, with 95.4% (1.3577 trillion won) as of the third quarter. Following are Meritz Securities (93.4%, 5.0243 trillion won), Daol Investment & Securities (93.0%, 646 billion won), Korea Investment & Securities (88.4%, 5.5381 trillion won), and Daishin Securities (85.0%, 1.7372 trillion won).

No Jae-woong, head of Financial and Structured Evaluation Division 2 at Korea Credit Rating, pointed out, "The increase in contingent liabilities at some securities firms is expected to expand volatility in asset soundness." He emphasized that the concern is particularly high for securities firms rated A2+ or below, where actual asset soundness deterioration is evident. Financial authorities are closely monitoring securities firms with large proportions of real estate PF-ABCP, as some firms are believed to have excessively handled real estate PF.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)