Detailed Negotiations for Management Rights Acquisition Underway

Potential to Secure 820,000 Users

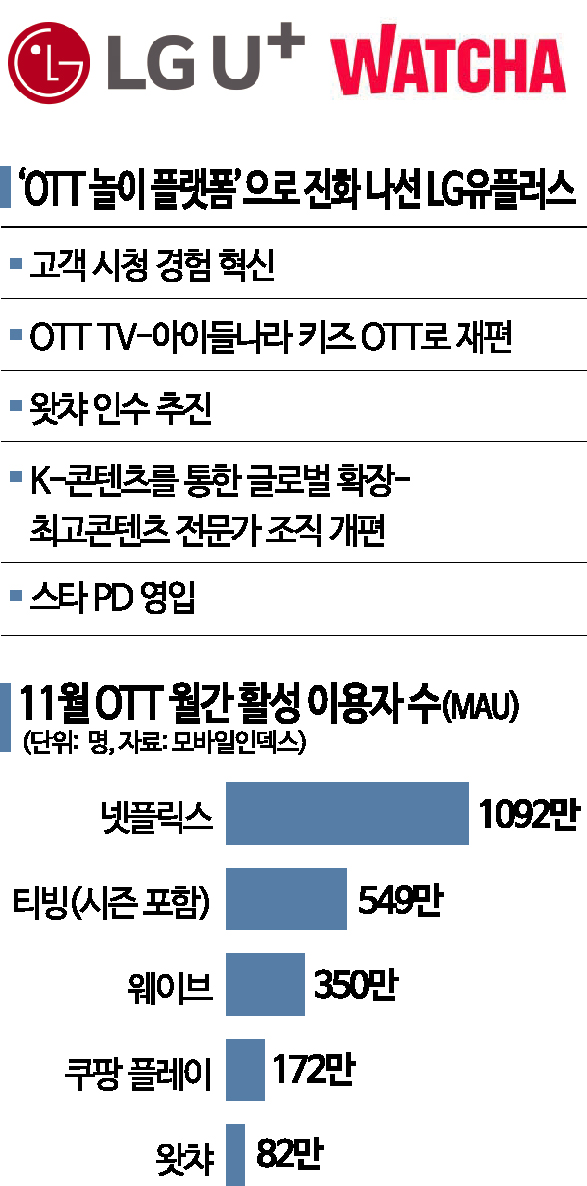

[Asia Economy Reporter Lim Hye-seon] LG Uplus has announced a long-term plan to transition its IPTV business to an online video service (OTT) and is moving to acquire the domestic OTT company 'Watcha,' which has fallen into deficit and is struggling financially. Although Tving, the number one domestic OTT provider, is also running at a loss, LG Uplus is focusing its investments on the deficit market, believing that the future of the broadcasting market lies in OTT.

LG Uplus Moves to Acquire Management Rights of Watcha

According to the telecommunications industry on the 12th, LG Uplus is finalizing key matters such as price and is conducting detailed negotiations regarding the acquisition of management rights of Watcha. LG Uplus plans to acquire new shares worth 40 billion KRW issued by Watcha to become the largest shareholder. Until early this year, Watcha's corporate value was estimated as high as 500 billion KRW, but it has dropped to the 30 billion KRW range based on pre-investment valuation. This decline is due to intensified competition in the OTT market, continued subscriber losses, and increased operating losses, which have reduced its investment attractiveness. Additionally, worsening investment conditions due to domestic and international interest rate hikes led to failure in securing follow-up investments. For LG Uplus, this is an opportunity to acquire a necessary company at an attractive price amid significantly lowered external valuation.

If negotiations proceed smoothly, LG Uplus will secure Watcha's 820,000 users (as of the end of November), establishing a foundation to assert its presence in the OTT market. It can also create synergy by providing Watcha services to LG Uplus's 19.473 million wireless subscribers as of the third quarter.

Expanding Content Platforms and Focusing on Original Content Production

LG Uplus extended a helping hand to Watcha, which was at a critical juncture, to expand its content platform. On the 8th, CEO Hwang Hyun-sik declared the era of platform-centered 'Uplus U+3.0' and is accelerating new business initiatives. CEO Hwang presented four major platforms: telecommunications-based lifestyle platform, play platform, growth care platform, and web 3.0 platform. The expansion of the OTT business corresponds to the play platform. The plan is to transform Internet TV (IPTV) into an OTT TV that allows easy and convenient viewing of multiple OTT services and to focus on producing original content.

Last month, LG Uplus launched the OTT service 'Idle Nara.' 'Idle Nara' is a kids' educational content service that has been provided to IPTV subscribers since 2017, with a cumulative user count reaching 61 million. It has been spun off as an OTT service that anyone can watch by paying a monthly subscription fee. LG Uplus aims to increase 'Idle Nara' subscribers to 1 million within five years. To enable customers to conveniently watch content, LG Uplus also exclusively launched the dongle-type set-top box ‘Chromecast with Google TV (4K)’ (hereinafter U+ Chromecast) in Korea. The U+ Chromecast is a latest device supporting 4K resolution and is an officially released product in Korea supporting the Korean language. It features a simple design without complicated wiring, convenience to watch various OTTs on one screen, and supports 4K Dolby Vision and Atmos. U+ Chromecast allows simultaneous access to about 270 live channels and 270,000 video-on-demand (VOD) titles provided by the IPTV service U+tv.

Low Profitability of OTT Services Remains a Challenge

The worsening profitability of domestic OTTs is also a challenge for LG Uplus. Watcha posted an operating loss of 24.8 billion KRW last year. Wave and Tving (before their merger) recorded losses of 55.8 billion KRW and 76.2 billion KRW, respectively. The total operating loss of the three OTTs amounts to about 150 billion KRW, a fivefold increase compared to the previous year. This is because content acquisition costs are rising annually, making it difficult to cover with subscription revenue. Watcha even introduced a service allowing unlimited webtoon viewing to retain subscribers.

LG Uplus plans to increase non-telecommunication business revenue to 40% within five years. A telecommunications industry insider said, "LG Uplus's acquisition of Watcha has entered the final countdown," adding, "As OTT providers, including market leader Netflix, are launching ad-supported subscription plans to enhance profitability, there is growing interest in how much market share LG Uplus will capture."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)