New Hot-Rolled and Cold-Rolled Steel Specialization

Discovering Growth Engines at the Control Tower

On the Same Day, Chairman Jang Se-joo's Eldest Son, Executive Director Jang Seon-ik, Promoted

[Asia Economy Reporter Choi Seoyoon] Dongkuk Steel is splitting into two steel companies specializing in hot-rolled and cold-rolled steel, respectively, and a control tower for the first time in its 68 years since establishment. The company plans to discover future growth engines through this spin-off.

On the 9th, Dongkuk Steel held a board meeting and approved the plan for the spin-off and the convening of an extraordinary general meeting of shareholders.

Following the spin-off, shareholders will maintain their shareholding ratios in the split companies. The approval general meeting for the spin-off is scheduled for May 17 next year, and if passed, the spin-off date will be June 1.

Surviving Corporation 'Dongkuk Holdings'... New Corporations 'Dongkuk Steel' and 'Dongkuk CM'

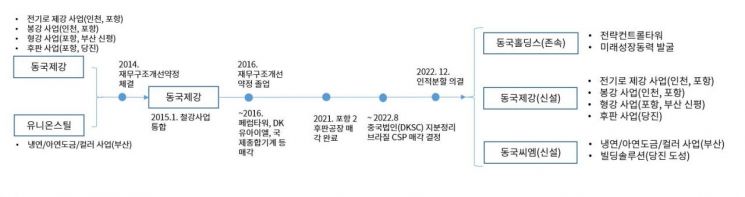

Through this spin-off, Dongkuk Steel will separate into the surviving corporation 'Dongkuk Holdings' (tentative name) and two newly established companies specializing in steel business: 'Dongkuk Steel' (tentative name) focusing on hot-rolled steel and 'Dongkuk CM' (tentative name) focusing on cold-rolled steel. The split ratio is Dongkuk Holdings (tentative name) 16.7%, Dongkuk Steel (tentative name) 52.0%, and Dongkuk CM (tentative name) 31.3%.

Accordingly, as of the board resolution date, the surviving company Dongkuk Holdings (tentative name) will have assets of 599.7 billion KRW (debt ratio 18.8%). The newly established Dongkuk Steel (tentative name) will have assets of 3.4968 trillion KRW (debt ratio 119.0%), and Dongkuk CM (tentative name) will have assets of 1.7677 trillion KRW (debt ratio 83.7%).

The surviving corporation 'Dongkuk Holdings' (tentative name) will serve as the group's strategic control tower, focusing its capabilities on discovering long-term growth engines and strategic investments. It will promote new business discovery and management efficiency through organizations such as strategy, finance, and human resources, and enhance governance and management transparency to improve shareholder value. After the spin-off is completed, Dongkuk Holdings plans to convert into a holding company through a public tender offer and paid-in capital increase by in-kind contribution.

The newly established company 'Dongkuk Steel' (tentative name) will engage in electric furnace steelmaking and hot-rolled steel businesses such as rebar, structural steel, and thick plates. Dongkuk Steel’s plants in Incheon, Pohang, Dangjin, and Sinpyeong are included. In particular, it aims for sustainable growth in the electric furnace steelmaking sector, which recycles steel scrap and has emerged as an alternative to blast furnace steelmaking. Dongkuk Steel has adopted 'Steel for Green' as its growth strategy, specializing in the most competitive electric furnace steelmaking business in Korea and eco-friendly steel products.

The newly established company 'Dongkuk CM' (tentative name) will operate in the cold-rolled steel business, starting from cold rolling to galvanized steel sheets and color-coated steel sheets. This includes the Busan plant, the world's largest color-coated steel production base, and the Building Solution Center in Doseong, Chungnam. Dongkuk CM (tentative name) aims to specialize in the world's most competitive color-coated steel business.

In particular, under the 'Color Vision 2030' strategy, which aims to achieve 2 trillion KRW in color-coated steel sales and establish a global 1 million ton system by 2030, Dongkuk CM aspires to become the world's most competitive color-coated steel company. It will lead the global galvanized and color-coated steel market by focusing on three directions: 'Global,' 'Sustainable Growth,' and 'Marketing,' through global expansion, marketing innovation, and development of eco-friendly products and processes.

Completion of 8-Year Business Restructuring... Building a Profitability-Centered Portfolio

This spin-off decision particularly signifies that Dongkuk Steel has completed its 8-year business restructuring and is pursuing new growth.

Due to deteriorating financial soundness, Dongkuk Steel Group signed a financial structure improvement agreement with the Korea Development Bank in 2014, and in 2015, it had to integrate steel businesses, including Dongkuk Steel, which operated the hot-rolled business, and Union Steel, which operated the cold-rolled business. Through intensive restructuring, Dongkuk Steel graduated from the financial structure improvement agreement just two years after signing it, in 2016. Until recently, Dongkuk Steel has continued to pursue business restructuring and building a profitability-centered portfolio, and this year minimized uncertainties and potential threats by divesting shares in its Chinese subsidiary (DKSC) and selling its stake in Brazil's CSP.

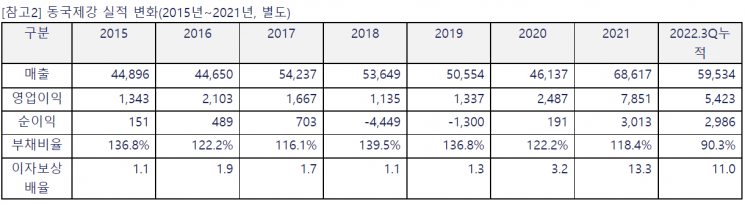

The business restructuring led to improved management performance and financial structure. As of the end of Q3 this year, Dongkuk Steel’s debt ratio on a separate basis was 90.3%, entering the double-digit range. This is a 46.4 percentage point improvement from 136.7% in 2015. The interest coverage ratio (operating profit/financial expenses) transformed from about 1.1 times in 2015 to 11.0 times as of the end of Q3 2022, turning into a high-quality company.

Dongkuk Steel’s creditworthiness also improved. Although its credit rating fell to speculative grade (BB) in 2016, continuous financial structure improvements led the three major domestic credit rating agencies to upgrade Dongkuk Steel’s credit rating to BBB+ (stable) in November 2022.

Meanwhile, Dongkuk Steel promoted Jang Seon-ik, Executive Director and eldest son of Chairman Jang Se-ju, to Managing Director after two years, along with a total of 13 executive appointments. Jang, the fourth-generation owner who had been in charge of production at the Incheon plant since December 2020, will now return to headquarters to oversee purchasing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.