refutes through analysis on the 9th

"Tax base of 200M~500M KRW for SMEs and mid-sized firms

Only 10% applied, 10%P lower than the existing 20%"

"Tax base of 200M~500M KRW for SMEs and mid-sized firms

Only 10% applied, 10%P lower than the existing 20%"

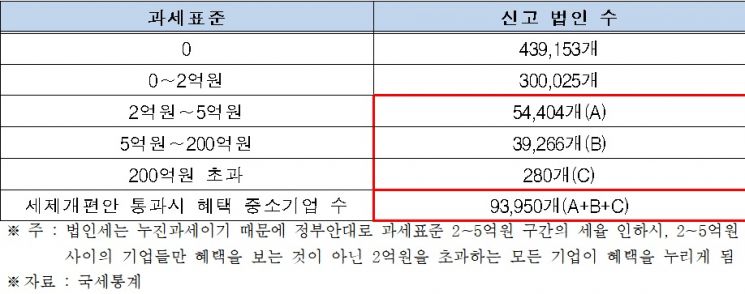

[Asia Economy Reporter Moon Chaeseok] The business community has rebutted the opposition party's claim that the government's corporate tax reform plan under discussion in the National Assembly is a "tax cut for the rich benefiting only 0.01% of large corporations." They argue that the plan is not a policy benefiting only large corporations, as it includes tax reduction benefits of up to 10 percentage points for about 93,000 small and medium-sized enterprises (SMEs).

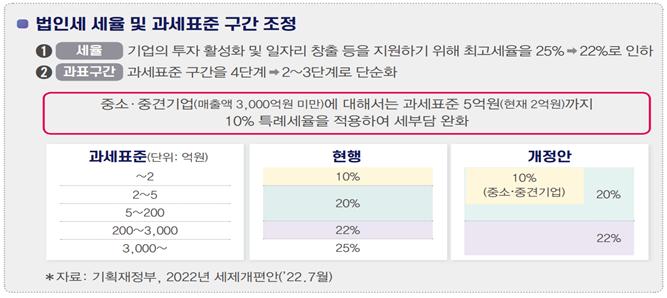

On the 9th, the Federation of Korean Industries (FKI) stated that the government's reform plan does not only include a reduction of the top tax rate from 25% to 22%, a 3 percentage point cut. They also noted that it includes benefits from the application of special tax rates for small and medium-sized enterprises and mid-sized companies.

The reform plan includes lowering the tax rate for the taxable income bracket exceeding 300 billion KRW, which is subject to the highest corporate tax rate, from 25% to 22%. Additionally, it contains provisions to reduce the tax rate for SMEs and mid-sized companies in the taxable income bracket of 200 million to 500 million KRW from 20% to 10%, a 10 percentage point cut.

The FKI emphasized that an analysis of the National Tax Service's 2021 data shows that if the reform plan passes, 93,950 SMEs with taxable income exceeding 200 million KRW will benefit from tax reductions.

However, it is true that if the top tax rate is lowered to 22%, only 103 companies will benefit, as claimed by Rep. Jin Sun-mi of the Democratic Party on the 7th. Among the 906,325 corporations subject to corporate tax in 2021, 93,950 SMEs will also benefit, but this part was omitted in the "tax cut for the rich" argument.

Chu Kwang-ho, head of the FKI's Economic Headquarters, pointed out, "It is unreasonable to claim that the reform plan is a 'tax cut for the rich' benefiting only a small number of large corporations by focusing solely on the reduction of the top tax rate, when many SMEs and mid-sized companies can benefit from the application of special tax rates."

Number of corporations filing tax returns by taxable income scale of small and medium-sized enterprises as of 2021. (Source: Federation of Korean Industries)

Number of corporations filing tax returns by taxable income scale of small and medium-sized enterprises as of 2021. (Source: Federation of Korean Industries)

According to government analysis, the reduction rate of tax burden for SMEs after the tax reform is nearly twice as high as that for large corporations. According to the Ministry of Economy and Finance's analysis of tax revenue effects by corporate size estimated last October, the tax burden reduction rate for SMEs and mid-sized companies under the reform plan is 9.6%, which is 1.7 times that of large corporations at 5.7%.

On the contrary, the FKI reminded that large corporations subject to the top tax rate will have to pay 20 million KRW more in taxes. The government's reform plan includes simplifying the current four-tier tax rate system (10-25%) into two tiers (20-22%). Because of this, the tax rate for the taxable income bracket below 200 million KRW will increase from the existing 10% to 20%. As a result, large corporations with taxable income below 300 billion KRW will not receive the special tax rate benefits like SMEs and mid-sized companies and will have to pay 20 million KRW more in taxes than before.

Head Chu emphasized, "Given the economic crisis situation, it is necessary to promptly pass the reform plan to help companies overcome management crises regardless of their size."

Changes in corporate tax rates by taxable income brackets for large corporations upon passage of the corporate tax reform plan. (Data provided by the Federation of Korean Industries)

Changes in corporate tax rates by taxable income brackets for large corporations upon passage of the corporate tax reform plan. (Data provided by the Federation of Korean Industries)

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)