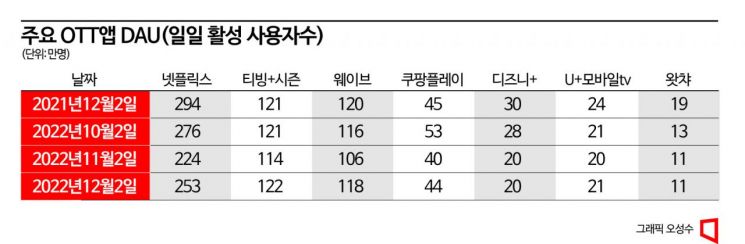

Daily Active Users Reach 1.22 Million After KT Season Merger, Up by 10,000

Gap with No. 2 OTT Wave Widens to 40,000 Users

Still Half the Size of Netflix's Domestic User Base

Challenges Remain in Profitability Enhancement and Overseas Expansion Including Ad Plans

[Asia Economy Reporter Minyoung Cha] TVING, which absorbed and merged KT-affiliated online video service (OTT) Season, has increased its number of users and surpassed Wave, the previous number one, becoming the top OTT operator in South Korea. TVING, aiming to attract 8 million subscribers, plans to improve profitability and expand overseas next year based on economies of scale.

KT's 'Season' Merger Had an Effect... TVING Widens Gap with 2nd Place 'Wave' to Become No. 1

According to big data platform company IGAWorks Mobile Index on the 7th, as of the 2nd, the combined daily active users (DAU) of TVING and Season reached 1.22 million, an increase of 10,000 compared to the same period last year. Considering that the OTT industry was relatively sluggish this year compared to last year’s COVID-19 special effect, this is regarded as a decent achievement. It also showed a gap of 40,000 users compared to Wave, the second largest domestic OTT. However, compared to Netflix, the number one OTT in the market with 2.53 million users, TVING’s user base is still only about half, indicating there is a long way to go.

TVING plans to sequentially offer about 700 key contents from Season. Season originals such as the military drama "Shinbyeong" and the comic office drama "Gaus Electronics" are representative. Popular overseas titles like the "Spider-Man," "Ghostbusters," and "Resident Evil" series will also be added. Season, which is being absorbed and merged, will end service on the 31st of this month. Season’s paid subscribers can transfer their accounts to TVING or receive refunds for fees already paid. Owned video-on-demand (VOD) and Genie TV’s continue-watching features that were available on Season will be provided through new services starting January next year.

The merged company will also hold joint events to prevent existing Season customers from leaving. Since the user interface (UI) and other aspects are changing, some users have expressed inconvenience. The two companies will give CU mobile gift certificates on a first-come, first-served basis to 70,000 subscribers who registered their accounts on TVING from among Season users who used KT mobile plans and additional services. To commemorate the launch of TVING original "Drunk City Women 2," 1,500 customers who activated their TVING accounts among "TVING/Genie Choice" plan subscribers will be selected to receive "Y Artist Project" merchandise.

Holding the Title of No. 1 Domestic OTT... But Many Challenges Remain

TVING, which succeeded in OTT integration, faces several challenges. The biggest issue is deteriorating profitability due to competition in content investment. Last year, the three domestic OTT companies recorded a total loss of 157 billion KRW. TVING posted the highest operating loss of 76.2 billion KRW (pre-merger basis), followed by Wave with 55.8 billion KRW and Watcha with 24.8 billion KRW. TVING plans to improve profitability by increasing subscribers through the merger with Season. Yang Ji-eul, CEO of TVING, stated at the Q3 earnings conference call, "We will expand the business aiming for meaningful profit and loss improvement next year." They also plan to raise the number of subscribers to around 8 million.

TVING is actively considering introducing an ad-supported subscription plan, which Netflix ignited. Netflix introduced an "ad-supported basic" plan on the 4th of last month in Korea, the US, the UK, Japan, and other countries. This plan offers content with ads at 5,500 KRW per month, which is 4,000 KRW cheaper than the existing basic plan (9,500 KRW per month). Netflix Korea also ran advertisements on social networking services (SNS) such as Instagram to recruit subscribers. Reed Hastings, CEO of Netflix, recently mentioned at the DealBook conference hosted by The New York Times, "It was my mistake not to push the ad-supported plan strategy sooner," referring to Hulu’s success case.

Domestic OTT industry, including TVING, is paying close attention to the revenue increase from Netflix’s ad-supported plan. Major conglomerates and luxury brands have started advertising on Netflix, and there is analysis that the introduction of a low-cost plan is increasing Netflix subscriptions again. An OTT industry insider said, "I understand that the volume of ads has increased," adding, "It needs to be confirmed whether this has actually led to an increase in subscribers."

TVING’s goal of global expansion within this year is expected to be difficult to realize. CEO Yang Ji-eul stated at a joint press conference with global OTT Paramount+ in June, "We aim for global expansion within this year." However, due to recent global economic tightening, internal speed adjustments are expected. According to foreign media such as The Wall Street Journal (WSJ), major media companies like Warner Bros. Discovery and Paramount have also started cost-cutting and layoffs due to concerns over advertising market stagnation and economic slowdown. TVING launched a dedicated brand zone for Paramount+ and has jointly invested in original content. They expressed their intention to actively expand from key markets such as the US and Japan to Southeast Asia, but the first country for expansion has not yet been decided.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)