[Asia Economy Reporter Lee Seon-ae] There is a significant divergence in the securities industry's views on Samsung Electronics, the leading stock in the domestic market, leaving 6 million small shareholders uncertain about their investment strategies. Some firms are raising their target prices, while others are lowering them. The discrepancy in operating profit forecasts for next year reaches a staggering 15 trillion won. As a result, dissatisfaction is emerging over the inability to trust the consensus from securities firms.

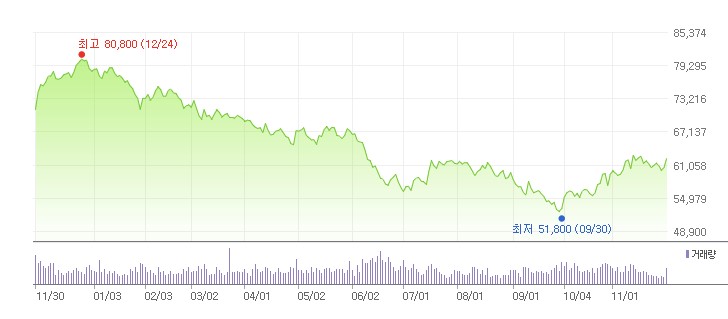

According to the Korea Exchange on the 1st, Samsung Electronics recently showed unstable stock price movements, falling back to the '50,000 won electronics' range during trading hours. Investment sentiment cooled due to the semiconductor industry's downturn and political instability in China. After slipping into the 50,000 won range on the 28th of last month and dropping to as low as 59,800 won during trading the following day, the stock barely recovered to the 60,000 won range. It rose to around 62,000 won the day before, but concerns about future stock price prospects remain high.

With the resurgence of COVID-19 leading to stricter lockdown policies in China, worries about weak semiconductor demand are growing, alongside expectations of expanded global supply chain instability. In this context, some securities firms are raising their target prices while others are lowering them, causing confusion among investors.

The recently announced target prices for Samsung Electronics by securities firms range from 83,000 won (DB Financial Investment) to 72,000 won (NH Investment & Securities), at least 10,000 won higher than the current stock price. Most firms, including Korea Investment & Securities (83,000 won) and Mirae Asset Securities (80,000 won), have maintained their targets, but Hi Investment & Securities (80,000 won) and Hanwha Investment & Securities (82,000 won) have raised theirs to the 80,000 won level. Conversely, Samsung Securities lowered its target from 90,000 won to 80,000 won, an 11.1% decrease.

Hwang Min-sung, a researcher at Samsung Securities, said, "Samsung Securities' 2023 operating profit estimate is about half of this year's 50 trillion won, down 18% from previous estimates. Given this, many risks are considered, so we maintain a buy rating but adjust the target price downward." He added, "More proactive production adjustments are necessary," reflecting the view that semiconductor inventory issues will persist into next year. While most semiconductor companies like Micron in the U.S. have decided to cut production, Samsung Electronics has yet to announce any production cut plans.

There is also a wide divergence in securities firms' consensus on Samsung Electronics' operating profit for next year. Before Samsung Securities released its forecast, the gap between the highest (41.943 trillion won by BNK Investment & Securities) and lowest (27.426 trillion won by IBK Investment & Securities) operating profit forecasts was 14.517 trillion won. However, Samsung Securities announced an even lower forecast of 26.5 trillion won on the 29th of last month. As a result, the gap in operating profit forecasts exceeds 15 trillion won. Due to this large discrepancy, individual investors are frustrated about which forecast to rely on.

Nonetheless, a common view is that buying at low points and in installments remains a valid strategy. With DRAM inventory expected to peak in the second quarter of next year, and considering Samsung Electronics' strong cash flow and expansion of its foundry business in the U.S. (in 2024), there is considerable analysis anticipating a stable upward trend.

DB Financial Investment researcher Eo Gyu-jin highlighted Samsung Electronics' investment plan amounting to 54 trillion won (47.7 trillion won in semiconductors). Samsung Electronics, holding net cash of 116 trillion won, has demonstrated profitability and financial strength to withstand the current downturn. Eo said, "With limited supply increases due to reduced new investments and production cuts, a memory market rebound is expected after the third quarter of next year. Samsung Electronics' large-scale investments are expected to translate into increased market share during the memory rebound, making Samsung the protagonist in the next memory cycle."

Hyundai Motor Securities also maintained a target price of 78,000 won, stating, "Considering Samsung Electronics' valuation appeal and the potential of its advanced foundry processes, a low-point buying strategy is effective." Researcher Noh Geun-chang of Hyundai Motor Securities said, "Samsung Electronics plans to increase capital expenditures (CAPEX) this year compared to last year, based on differentiated financial soundness, and its memory semiconductor market share is expected to rise again. Although DRAM market share, which was 45.8% in 2017, is expected to fall to 42.4% this year, it is projected to rise again to 45.7% in 2024. NAND market share, which has dropped to 33.8%, is also expected to recover to 35.7% in 2024."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.