[Asia Economy Reporter Ryu Tae-min] The decline in the court auction market, considered a 'leading indicator of housing prices,' is intensifying. Even high-priced homes and reconstruction complexes in the Gangnam area of Seoul, which previously attracted bidders, are being overlooked, resulting in continuous auction failures. This is due to increased financial burdens from rising base interest rates and tightened loan regulations, coupled with growing negative outlooks on the housing market, causing buyers to be cautious in bidding.

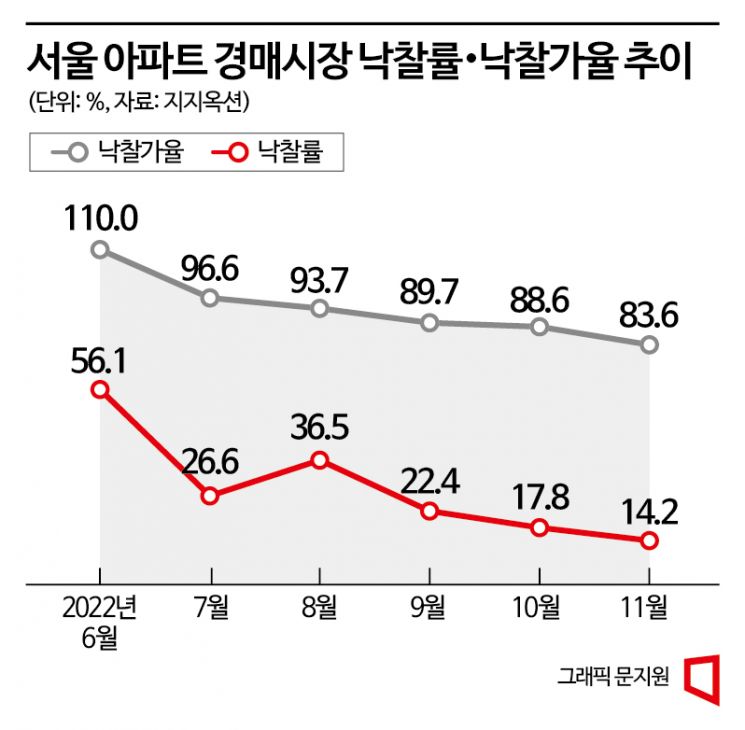

According to Gigi Auction, a court auction specialist company, the average successful bid rate for Seoul apartments last month was 14.2%. This is the lowest figure since statistics began in May 2001, dropping 3.6 percentage points from the previous month’s record low of 17.8%. The successful bid rate refers to the ratio of items with confirmed buyers among those put up for auction. For example, about 1.4 out of every 10 auctioned properties found new owners.

The successful bid rate for Seoul apartments soared to a record high of 80% in February last year, meaning 8 out of 10 auctioned properties found new owners. However, the downward trend has continued, falling to less than a quarter of that rate. Notably, last month saw a total of 162 auctions, the highest number since June 2019, but only 23 properties were sold.

The bid-to-appraisal ratio, which indicates the ratio of the winning bid price to the appraised value, also declined again. Last month, the average bid-to-appraisal ratio for Seoul apartment auctions dropped 5.0 percentage points from the previous month to 83.6%. From the first half of last year, Seoul apartment bid-to-appraisal ratios exceeded 110% for seven consecutive months, setting record highs five times, but have been declining since the market froze at the end of last year. Particularly, last month’s ratio was the lowest since March 2019, and excluding March 2020 when many court recess days occurred due to COVID-19, it is the lowest ever recorded. For example, a bid-to-appraisal ratio of 83.6% means an apartment appraised at 100 million KRW was sold for 83.6 million KRW.

High-priced homes in the Gangnam area, which were popular as 'smart single properties' last year, are also repeatedly failing to sell. In Dogok-dong, Gangnam-gu, Tower Palace saw a 162.6㎡ (exclusive area) property fail to sell on the 22nd of last month, followed by two properties of 174.6㎡ and 162.6㎡ offered as fractional sales on the 30th, both failing to find new owners. This marks the fourth auction failure within the Tower Palace complex this year.

Properties in reconstruction complexes are also less popular than before. On the 10th of last month, an 84㎡ unit in the representative Gangnam reconstruction complex, Eunma Apartment, was auctioned at an appraised value of 2.79 billion KRW but failed to attract any bids. In the northern area, the representative reconstruction complexes, Sangye Jugong 10 Complex (59㎡) and 11 Complex (58㎡) in Sangye-dong, Nowon-gu, each failed twice before finally finding buyers in August.

The villa market is no different. Last month, the average successful bid rate for villa auctions in Seoul dropped 2.0 percentage points from the previous month to 10.0%, the lowest since statistics began in May 2001. This means only 1 out of every 10 auctioned villas was sold. The bid-to-appraisal ratio, which rose to 97.6% in May, has continued to decline, falling to 84.9% last month.

The surge in auction failures is interpreted as a growing perception that appraised values are set higher than buyers’ expectations amid the ongoing housing price decline. Typically, appraisals for auctioned apartments are conducted 6 months to 1 year before the auction starts. Most properties currently being auctioned were appraised last year when concerns about housing prices peaking were widespread. Consequently, buyers tend to gravitate toward relatively lower-priced properties that have failed previous auctions rather than the initially expensive auction items. In fact, among the 23 Seoul apartments sold last month, 18 had failed at least once before.

Additionally, consecutive base interest rate hikes and comprehensive tightening of loan regulations have also impacted the market. Lee Joo-hyun, a senior researcher at Gigi Auction, said, “As buyers face increased financial burdens, they are becoming more cautious in bidding,” adding, “With growing negative outlooks on the apartment sales market, investment demand that was turning to the auction market is now shifting to a wait-and-see stance.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.