Deposit Interest Rates Fell 4-5 Times in a Month

Deposit Rate Increase Pace Hits 6-Month Low

"Refrain from Raising Rates" Authority Message

Regulatory Easing Also Eased Deposit Supply

[Asia Economy Reporter Song Seung-seop] Savings banks are lowering deposit and savings interest rates contrary to the trend of base rate hikes. This is due to the financial authorities' use of a "carrot and stick" approach, sending messages to restrain interest rate increases while easing liquidity regulations. Some analysts also suggest that savings banks, which had excessively raised interest rates for marketing purposes, have now entered a period of self-restraint.

According to the industry on the 1st, OK Savings Bank has cut deposit interest rates four consecutive times in the past month. On October 31, the interest rates for 'OK Jeonggi Savings' and 'OK e-Jeonggi Savings' dropped by up to 1 percentage point (for 3 months), and 'OK Anshim Jeonggi Savings' decreased by 0.8 percentage points. On November 3, 'Jungdohaeji OK Jeonggi Savings 369' and 'OK Corporate Daebak Account' fell by 0.7 and 1 percentage points, respectively. The next day, various deposit products were lowered by up to 0.30 percentage points.

Daol Savings Bank also implemented six deposit interest rate cuts starting from October 20. The 'Fi Jeonggi Savings' interest rate was reduced by 0.10 to 1.40 percentage points depending on the subscription period. The 'Fi Revolving Jeonggi Savings' and 'Fi Alpha Revolving Jeonggi Savings' rates also dropped by up to 1.25 percentage points. On the 3rd of last month, the 'Fi Free Withdrawal Jeonggi Savings' rate was cut by 0.30 percentage points, and on the 21st by 0.20 percentage points. With another rate cut two days prior, the 12 to 24-month interest rate for Fi Jeonggi Savings fell from 6.15% to 4.45% within a month.

In the case of Sangsangin Savings Bank, it announced on November 15 that it would raise the face-to-face subscription interest rates for revolving and fixed deposits by 0.4 percentage points. However, just a week later on the 22nd, it declared it would lower the rates again by 0.1 percentage points.

Did the Financial Authorities' 'Carrot and Stick' Approach Work?

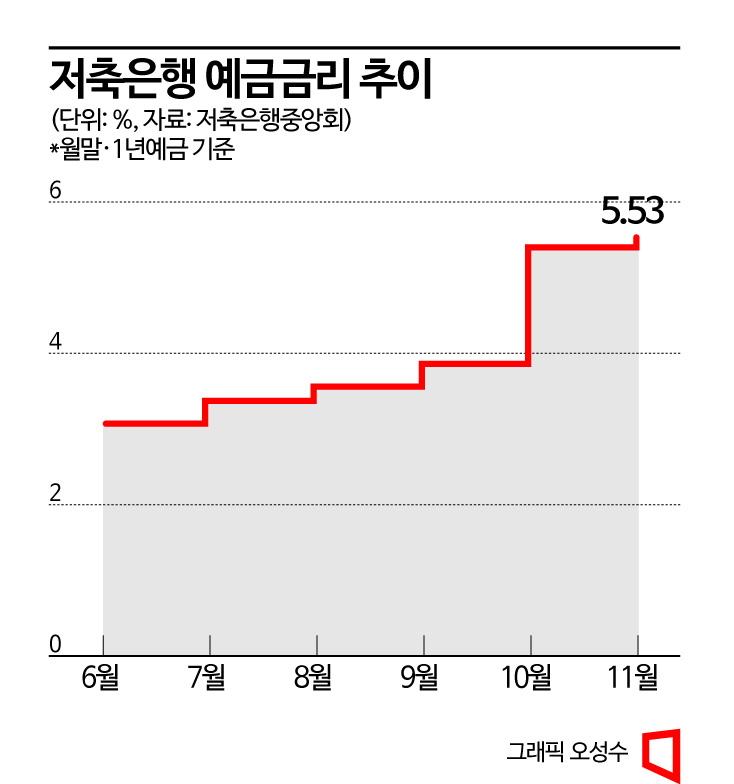

This movement is contrary to the current situation where the base rate continues to rise. The Bank of Korea decided on November 24 to raise the base rate by 0.25 percentage points to an annual 3.25%. This marks the sixth consecutive increase following those in April, May, July, August, and October. According to the Korea Federation of Savings Banks, the deposit interest rate in November rose by only 0.13 percentage points to 5.53% compared to the previous month. This is the slowest pace of increase in the past six months.

The reason savings banks' interest rates are not rising is due to financial authorities' policies. On November 27, the Financial Supervisory Service issued market stabilization measures, warning to "refrain from excessive deposit competition." Savings banks inevitably feel pressured by the FSS when considering raising deposit interest rates. At the same time, the loan-to-deposit ratio regulation was relaxed from 100% to 110% for six months. This means savings banks no longer need to aggressively gather funds to meet regulatory ratios.

There are also criticisms that the savings bank industry engaged in excessive interest rate competition. It is interpreted that the excessively raised deposit interest rates are now being adjusted. Last month, savings banks boldly raised rates and engaged in competitive promotions. On November 14, Daol Savings Bank launched a special 5.2% product, and on the 18th, Sangsangin Savings Bank introduced a 6% deposit product. On the 19th, Welcome Savings Bank and OK Savings Bank released products with interest rates of 5.35% and 5.5%, respectively.

The savings bank industry complains that it is difficult to balance deposit amounts due to the unique regulatory environment. Savings banks can practically only cover the funds needed for loans through deposits and savings. A savings bank official explained, "In a situation where the base rate keeps rising, it is practically impossible to gather the desired amount of deposits," adding, "If adjustments are not made after gathering more funds than needed, it could lead to negative margins." Another savings bank official said, "As commercial banks aggressively raised interest rates to attract funds, the policy change has somewhat eased the pressure on funding."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.