National Assembly Legislative Research Office Report: As Important as the 'Right to Request Interest Rate Reduction' During Interest Rate Hikes

Active Use of 'Free Personal Credit Score Viewing Right' and 'Right to Object to Personal Credit Evaluation Results' Needed

[Asia Economy Reporter Sim Nayoung] It has been revealed that although citizens can directly check their credit scores, which have the greatest impact when obtaining loans from banks, and request corrections or re-evaluations, many are unable to utilize these rights simply because they are unaware such systems exist.

According to the report titled "Current Status and Future Tasks of Exercising Rights Related to Personal Credit Evaluation for Financial Users" by the National Assembly Legislative Research Office on the 28th, during the current period of rising interest rates, the "right to request a reduction in interest rates" for existing loan interest is as useful as the "right to free access to personal credit scores" and the "right to request explanations and raise objections regarding personal credit evaluation results," which allow individuals to directly check and request re-evaluation of their credit scores. However, it was found that the vast majority of citizens have never used these rights.

Personal credit scores can be checked up to three times a year at credit evaluation companies. Over the past five years, the year with the highest combined number of personal credit score inquiries from Korea's credit evaluation companies A and B was 2020, with 1,157,608 cases. The report stated, "Assuming simply that each individual accessed their score once, this suggests that only about 2.7% of the adult population exercised their free access rights," adding, "Considering duplicate cases, the proportion of citizens utilizing the free access right is likely even smaller."

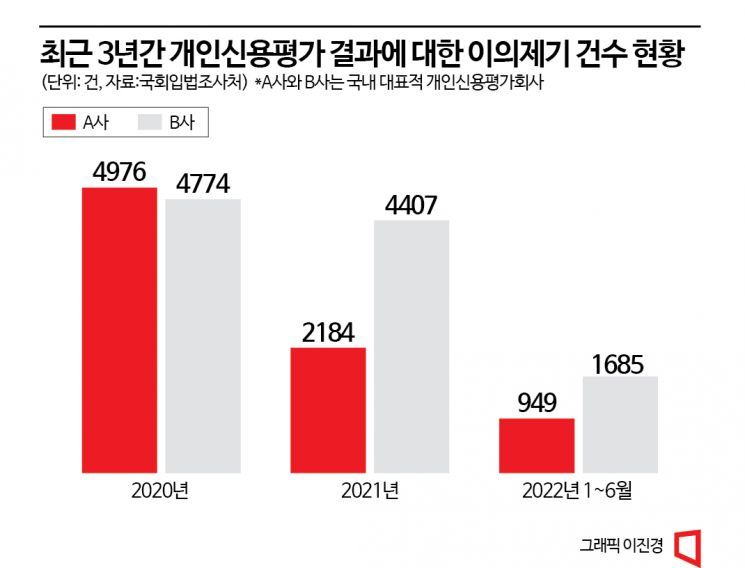

Since the number of credit score inquiries relative to the total adult population is quite low, the number of requests for explanations and objections regarding credit evaluation results was also minimal. Both company A (4,976 cases in 2020 → 2,184 in 2021 → 949 in the first half of 2022) and company B (4,774 cases in 2020 → 4,407 in 2021 → 1,685 in the first half of 2022) showed a decreasing trend in the number of explanation requests and objections last year and this year.

The report stated, "Although there are useful systems for managing personal credit, which forms the basis of financial life, they are not being properly utilized," and urged, "Financial authorities, personal credit evaluation companies, and banks should develop improvement measures so that citizens can be made aware of these systems."

It continued, "For example, the right to request a reduction in interest rates is communicated to financial consumers through financial companies’ websites as required by supervisory regulations in each sector and is also informed at the time of loan contracts," emphasizing, "Similar measures should be implemented for systems related to personal credit evaluation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.