Gyeongdong Secures Mining Rights for Myeonsan Layer Titanium-Iron Deposit

Drilling Operations Begin to Confirm Titanium Reserves

Geological Resources Research Institute Estimated 220 Million Tons of Titanium-Iron Ore in 2015

Invisible Battle to Secure Titanium, Essential Material for the Aerospace Era

[Asia Economy Reporter Park Hyung-su] As the importance of titanium, a key material in the aerospace industry, grows, attention is also turning to titanium mines in the domestic stock market. The government has set a policy to actively pursue development to localize this rare mineral, which is entirely dependent on imports, once the exploitable reserves are confirmed. However, warnings have emerged due to the high volatility of related companies' stock prices. It is advised to be cautious when investing, as drilling operations and economic feasibility assessments can take several years.

According to the Financial Supervisory Service's electronic disclosure system on the 20th, Kyungdong Invest stated in response to an inquiry disclosure, "Kyungdong Co., Ltd. has acquired a mining right in the Myeonsan area near Taebaek-Samcheok," and "currently conducting drilling operations in the Taebaek and Samcheok regions."

They added, "The drilling work is a geological survey to confirm the presence of titanium deposits in the area," and "as of the disclosure date, information on the presence and quantity of titanium deposits has not been confirmed."

A company official said, "There is nothing additional to disclose beyond the announced information." It appears they are maintaining a cautious stance on information disclosure amid increased stock price volatility.

As of the end of the first half of the year, Kyungdong Invest holds a 98.55% stake in Kyungdong. Kyungdong Invest's stock price surged sharply from the 20th of last month. The stock price, which was below 30,000 KRW, soared to as high as 140,000 KRW during trading on the 16th. The news that a plan to mine titanium, a core material used in secondary batteries and one of the minerals entirely dependent on imports, is being pursued domestically influenced the stock price. After the inquiry disclosure response, a flood of sell orders for profit-taking occurred in after-hours trading.

Earlier, the Korea Institute of Geoscience and Mineral Resources (KIGAM) announced in March a call for mining right applicants for the titanium-iron deposits in the Myeonsan formation of the Taebaek-Samcheok-Bonghwa area. The mining right period is 10 years, and from five years after the contract signing date, an annual mining fee of 1% of production value must be paid. A mining right is the right to mine or acquire minerals designated for mining purposes in mining areas owned by other corporations or individuals. Kyungdong, a specialized mining development company, was selected based on evaluation of business execution capability, feasibility of the business plan, and willingness to commercialize. Kyungdong has successfully developed coal seams for over 40 years in complex geological structures with developed folds and thrust faults. They have secured experience and technical skills in all coal production processes, including surveying, tunneling, gangue treatment, and coal extraction, while continuing development under difficult geological conditions. They actively respond to varying geological conditions at each worksite to improve productivity.

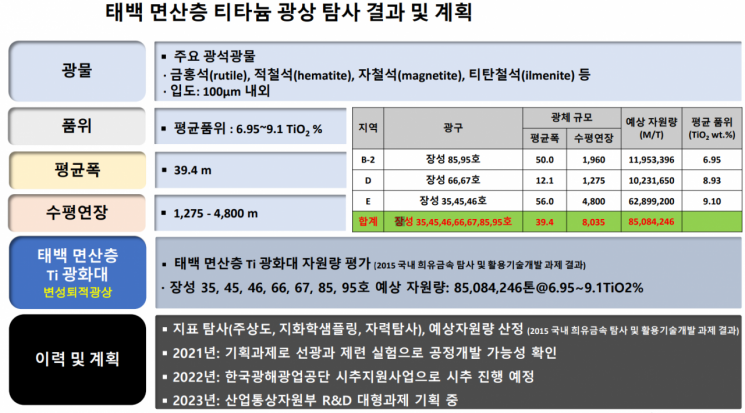

KIGAM and Kyungdong signed a joint development agreement for the titanium-iron deposit mining area in the Myeonsan formation. The estimated titanium resource in the target mining area is about 85 million tons (average grade TiO2 6.95~9.1%) or more. According to the Korea Resource Information Service, the price of titanium sponge is traded at 76,000 yuan (approximately 14.3 million KRW) per ton. Titanium ore is processed into titanium sponge, which is then made into titanium metal powder. It is compressed into titanium metal products.

It is expected to be a rich quantity that can replace a significant portion of domestic titanium ore and primary material imports. If carried out as planned, an economic feasibility evaluation is expected within 6 to 7 years. Kyungdong can independently invest in mine development and has secured the priority negotiation right for mine development after the 10-year mining right period. If the economic feasibility of the mineral deposits is guaranteed, Kyungdong can achieve stable large-scale sales over a long period.

The government sees a high possibility of titanium mining and has begun preliminary procedures. First, it actively supports research and development related to titanium. The Ministry of Trade, Industry and Energy is conducting research and development on exploration, beneficiation, and smelting technologies in preparation for titanium mine development. It is known that once reserves are confirmed, the government plans to actively pursue development for localization of rare minerals. Upon completion, titanium is expected to be used not only for mining but also as a key material in the state-led energy transition.

Taebaek City plans to make the Goteosil Industrial Complex a forward base for building a future core mineral resource supply chain. It signed a business agreement with STX, which holds shares in the Ambatovy mine, one of the world's top three nickel mines. When titanium mines are fully developed, processing ore nearby can enhance competitiveness.

The government also views the development of titanium mines positively as it can mitigate the economic impact on local communities caused by the early closure of the Taebaek Jangseong and Samcheok Dogye mining sites. Mineral value assessment work will continue until 2025, and if deemed feasible, mining, beneficiation, and smelting facilities are planned to be established by 2028, putting the titanium mine development project on track. Titanium mine development is a core pledge of Mayor Lee Sang-ho's 8th term in Taebaek City.

The government and Taebaek City judged the possibility of titanium development to be high based on basic data from KIGAM. According to Lee Cheol-gyu, a member of the National Assembly from the People Power Party, KIGAM conducted "Domestic Rare Metal Exploration and Utilization Technology Development" from 2010 to 2015. Titanium-iron deposits were confirmed in the Taebaek Myeonsan formation in the Taebaek, Samcheok, and Bonghwa areas. KIGAM reviewed economic feasibility over the past five years and concluded that the mineral has value and that extraction technology development is necessary.

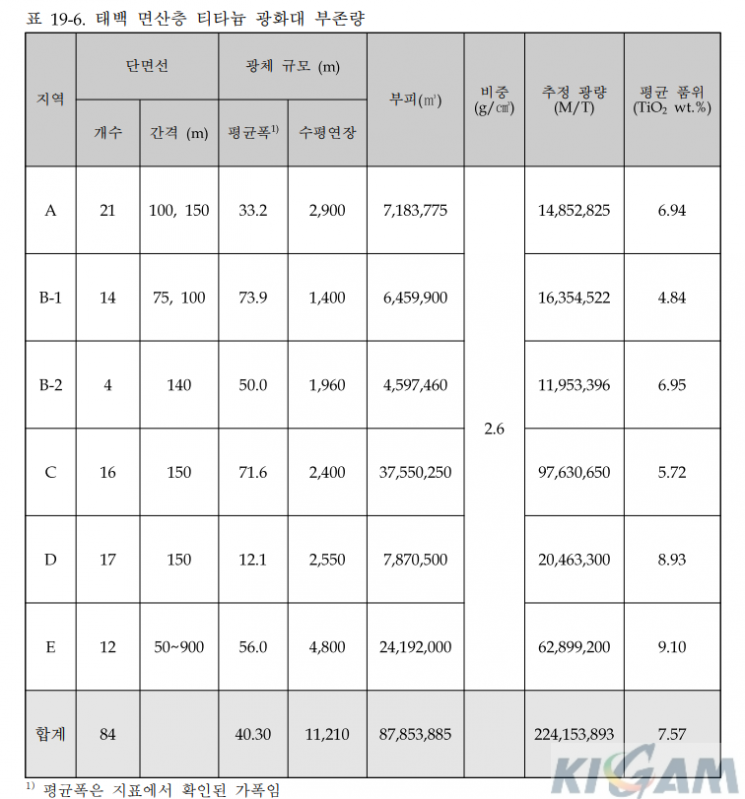

The "2015 Domestic Rare Metal Exploration and Utilization Technology Development Project Results" estimated the titanium-iron resource at about 220 million tons (average grade TiO2 7.57%). Considering last year's titanium ore imports of 70,000 tons, this is a scale that can replace about 143 years of imports. Byproduct profits such as iron are also expected to be significant. The trade deficit caused by titanium imports in Korea exceeds 700 billion KRW. A simple calculation estimates the import substitution effect to be as high as 100 trillion KRW.

Titanium is called the "dream material" because it is about 5.5 times stronger than iron but weighs about half as much, making it suitable for fields requiring strong durability such as aircraft and automobile manufacturing. It has strong corrosion resistance, does not rust, and is suitable for medical use as it does not cause toxicity or allergic reactions. It is considered a key raw material in the aerospace field.

In the electric vehicle era, titanium is regarded as a strategically essential material for the approaching aerospace era, just as lithium is for electric vehicles. As the United States, China, and the European Union (EU) actively pursue space development, competition to secure titanium is intensifying. The price of lithium surged due to increased demand from electric vehicle expansion. Ahead of the full-fledged space exploration era, the U.S. spares no effort to secure titanium.

The U.S. currently imports all titanium sponge and has no strategic stockpile for security purposes. The U.S. Department of Commerce has repeatedly warned that this poses a security threat. If China dominates the sponge titanium market and Russia restricts exports of titanium metal for aerospace use, the U.S. could fall behind in the space development race.

Development of new materials using titanium is also ongoing. The two-dimensional material "MXene," composed of titanium and carbon, is attracting attention as an anode material for next-generation lithium metal batteries. Domestic researchers have elucidated a uniform lithium deposition mechanism at the solid-state electrode-electrolyte interface using MXene. They secured more than ten times the capacity of conventional lithium-ion batteries while maintaining stability.

A financial investment industry official explained, "As lithium prices surged, related companies' stock prices soared, drawing attention to titanium as well," adding, "Resource development, like new drug development, goes through several stages before success can be determined." He advised, "The initial drilling stage can be seen as a preclinical stage, so it is too early to assess corporate value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.