[Asia Economy Reporter Changhwan Lee] Amid rapidly aging population and worsening elderly poverty, sales of pension products (pension insurance + pension savings), which are part of retirement income, continue to decline, raising calls for measures to revitalize pension insurance.

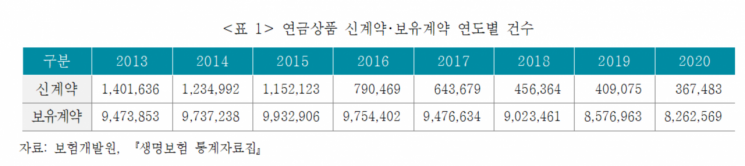

According to the Korea Insurance Research Institute on the 13th, the number of new contracts for domestic pension products reached 1,401,636 in 2013 but dropped to only 367,483 in 2020, decreasing every year.

Seokyoung Kim, Senior Research Fellow at the Korea Insurance Research Institute, analyzed, "The sluggish sales of pension products are due to dissatisfaction among sellers caused by expense regulations and dissatisfaction among consumers due to reduced pension amounts."

He pointed out that the impact was especially significant after the expense regulations on savings insurance, which reduced incentives for agents to sell pension insurance.

The supervisory regulations require insurance companies to ensure that the refund rate reaches 100% at the payment completion point (7 years for policies with 7 years or more payment period) for savings-type insurance including general pensions, resulting in lower commissions for agents.

Although the expense restrictions through refund regulations aimed to provide more savings insurance benefits to policyholders, the reduction in sales commissions for pension insurance led to decreased preference among agents to sell pension insurance, causing the unintended effect of pension products not being sold.

As part of efforts to overcome sluggish pension insurance sales, low- or no-surrender-value pension products that can improve consumer satisfaction by providing higher pension amounts were sold, but concerns about consumer harm such as excessive competition on refund rates led financial authorities to impose some regulations.

The revised surrender value regulations by financial authorities limited refund rate competition to prevent consumer harm, but it also had the side effect of restricting the development of low- or no-surrender-value pension products that pay higher pension amounts to enhance consumer satisfaction.

Reducing surrender values and increasing pension amounts to provide incentives to maintain pension products can contribute to the essential purpose of pensions, which is providing retirement income.

Therefore, as one of the measures to revitalize pension products for retirement income preparation, Senior Research Fellow Kim argued that it is necessary to consider easing regulations on surrender values to allow the development of various pension products such as low- or no-surrender-value pension products that address consumer dissatisfaction.

Senior Research Fellow Kim stated, "Instead of restricting product development through surrender value regulations, restrictions on unsound sales practices are needed," and added, "Insurance companies need to develop and sell pension products with a long-term strategy and strengthen their own efforts to cleanse sales practices that deviate from the essence."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)