[Asia Economy Reporter Seungjin Lee] The gaming industry's performance in the third quarter of this year showed a stark contrast. The success or failure of new releases in the second half and the possession of key intellectual properties (IPs) representing each company led to mixed fortunes.

Operating Profits Decline One After Another

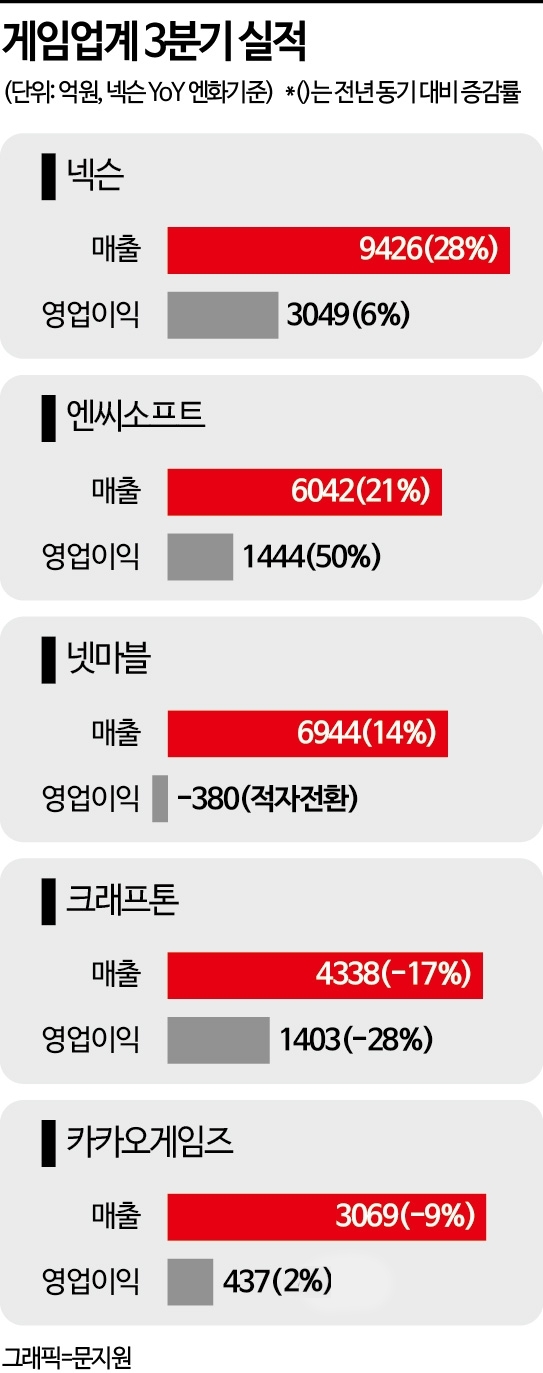

According to the gaming industry on the 12th, Netmarble recorded an operating loss of 38 billion KRW in the third quarter of this year. This marks the third consecutive quarter of operating losses following the first quarter, with the scale expanding each quarter. The operating loss in the first quarter was 11.9 billion KRW, increasing by more than 20 billion KRW in the third quarter. This reflects the impact of increased foreign currency loan translation losses due to the rising exchange rate.

In particular, the large operating loss in the third quarter was significantly influenced by the underperformance of ‘Seven Knights Revolution,’ released at the end of July. ‘Seven Knights’ is a flagship IP of Netmarble. ‘Seven Knights Revolution’ was considered a major anticipated title to lead Netmarble’s performance in the second half by succeeding the flagship IP Seven Knights.

Netmarble has been criticized for lacking proprietary IPs among all the games it services. Therefore, it plans to focus on new releases based on its own IPs in the fourth quarter to rebound its performance. Netmarble is scheduled to release ▲Modoo Marble: Meta World ▲Monster Arena Ultimate Battle ▲King of Fighters: Arena ▲Paragon: The Overprime ▲Charlotte’s Table in the fourth quarter.

Both Krafton and Kakao Games also posted weak third-quarter results.

Krafton’s third-quarter operating profit was 140.3 billion KRW, down 28% from the same period last year. The suspension of PUBG Mobile’s service in India and China’s gaming regulations appear to have led to poor performance even during the seasonal peak.

Kakao Games’ third-quarter operating profit was 43.7 billion KRW, a 2% increase from the same period last year but fell far short of market expectations. The effect of the Taiwanese launch of its flagship IP ‘Odin: Valhalla Rising’ disappeared, and the performance of ‘Uma Musume Pretty Derby,’ released in June, did not meet expectations.

The poor performance of Krafton and Kakao Games is interpreted as a result of relying heavily on specific IPs. Accordingly, both companies plan to diversify their IPs by releasing new titles across various genres in the fourth quarter and next year.

Nexon and NCSoft Soar in Q3, Fully Leveraging Their Flagship IPs

While the gaming industry overall experienced sluggish results in the third quarter, Nexon and NCSoft exceeded expectations and proved their presence. The common factor between the two companies is their solid IP portfolios. Older games continue to enjoy sustained popularity, and new titles inheriting these IPs also succeeded, driving their performance.

NCSoft’s third-quarter operating profit rose 50% year-on-year to 144.4 billion KRW. The driving force behind NCSoft’s results was its flagship IP ‘Lineage.’ The mobile game ‘Lineage W,’ released in the fourth quarter last year, has consistently ranked among the top in sales, while ‘Lineage M,’ launched over five years ago, saw sales increase for three consecutive quarters this year.

NCSoft plans to release a new title, ‘Throne and Liberty (TL),’ in the first half of next year. TL, which will be launched on PC and console multiplatforms, is expected to have a different business model (BM) from the existing Lineage IP.

The company with the best performance in the third quarter was Nexon. New titles leveraging existing popular IPs all led to successful launches. The third-quarter operating profit was 31.5 billion yen (approximately 304.9 billion KRW), the highest ever for a third quarter. ‘Hit 2,’ released in August, topped sales charts on both major app markets, and ‘Dungeon & Fighter Mobile,’ launched in March, maintained steady popularity.

Nexon also set third-quarter sales records simultaneously for three PC online steady sellers: ‘FIFA Online 4,’ which has been breaking records every quarter; ‘MapleStory,’ launched in 2003; and ‘Mabinogi,’ celebrating its 18th anniversary.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)