Currently a Depressed NAND Market

What Synergies Can SK Hynix Expect from Solidigm?

[Asia Economy Reporter Park Sun-mi] Solidigm (formerly Intel's NAND business unit), which was expected to become a strong supporter of SK Hynix through a successful merger and acquisition (M&A), is now in danger of becoming an ugly duckling. This is due to a surge in NAND inventory, one-time costs, and increased acquisition payment burdens caused by the strong dollar, which have delayed synergy creation with SK Hynix.

According to the semiconductor industry on the 11th, SK Hynix's market share was only 13% last year but rose to around 20% in the first half of this year, jumping to second place after Samsung Electronics. However, due to the rapidly worsening NAND market conditions since the second quarter of this year, prices have plummeted and inventory has surged, making the increase in market share itself meaningless. This is why there are reactions that SK Hynix's acquisition of Intel's NAND business unit has not produced significant effects other than increasing its global NAND market share.

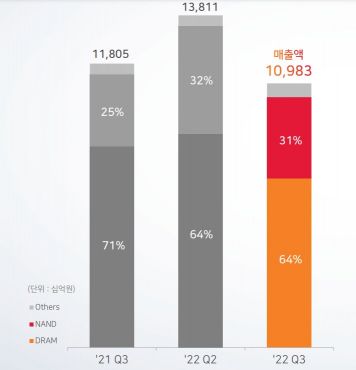

In fact, NAND prices are plummeting due to a sharp oversupply. According to market research firm DRAMeXchange, the fixed transaction price of general-purpose NAND flash products for memory cards and USBs last month was $4.14, down 3.73% from $4.30 in September. This marks five consecutive months of decline. Inventory is also surging due to Solidigm's volume, making further price drops and resulting profitability deterioration inevitable. Solidigm recorded a loss (including one-time costs) in the third quarter of this year, and there are forecasts that even SK Hynix will turn to losses in the fourth quarter. Kim Sun-woo, a researcher at Meritz Securities, predicted that the operating profit margin of SK Hynix's NAND business unit, which accounts for about 31% of SK Hynix's total sales, will fall by 21% in the third quarter of this year and turn negative. He also opened the possibility that it could drop to -49% in the fourth quarter, -55% in the first quarter of next year, -57% in the second quarter, and -60% in the third quarter.

SK Hynix President Noh Jong-won explained during the third-quarter earnings conference call regarding Solidigm's situation, "The current market conditions have become much worse than expected at the beginning of the year, and accordingly, Solidigm's performance is deteriorating," adding, "Solidigm was once a business unit of Intel but is now separated as a consolidated subsidiary of SK Hynix, and it is true that there were difficulties in actively responding to rapid market changes during this process."

The impact of the strong dollar on the acquisition funds, which have not yet been fully paid, is also a burden. Initially, SK Hynix completed payment of $7 billion out of the $9 billion acquisition price (about 10 trillion won at the time) last year, leaving $2 billion unpaid. If the strong dollar trend continues, SK Hynix will inevitably face the burden of having to pay more. Additionally, SK Hynix's acquisition of Intel's NAND business unit included taking over the Dalian NAND factory in China, which has become a risk factor due to the U.S.'s strengthened stance on China.

The breakthrough depends on how efficiently SK Hynix can integrate Solidigm, which has strengths in the enterprise SSD sector, to create synergy. SK Hynix is recently seeking a change in atmosphere by overhauling Solidigm's management. Lee Seok-hee, former SK Hynix president who led the acquisition of Intel's NAND business unit, stepped down as chairman of Solidigm's board. Robert Crook, who had served as CEO since Solidigm's launch last year, also resigned. Currently, SK Hynix Vice Chairman Park Jung-ho serves as chairman of Solidigm's board, and SK Hynix CEO Kwak No-jung is temporarily acting as Solidigm's CEO.

SK Hynix's breakthrough lies in how much synergy it can create with Solidigm in the server SSD market amid the slowdown in the memory semiconductor industry. Solidigm has market-leading capabilities, announcing plans to launch a new server SSD product with up to 61TB capacity in the first half of next year. SK Hynix believes that the acquisition effect of Solidigm, which excels at making high-performance enterprise SSDs used in data centers, will be clear in the mid to long term as the server SSD market rapidly expands. According to market research firm Omdia, the server SSD market size is expected to grow from $17.2 billion in 2020 to $20 billion this year and reach $33.6 billion by 2025.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.