9th 'Financial Market Stability Meeting between Financial Services Commission Chairman and Bank CEOs'

Additional Measures to Supply Liquidity to Banks

Financial Services Commission Chairman Kim Ju-hyun is speaking at the Bank Presidents' Meeting held at the Bankers' Hall in Jung-gu, Seoul on the 9th. Photo by Kim Hyun-min kimhyun81@

Financial Services Commission Chairman Kim Ju-hyun is speaking at the Bank Presidents' Meeting held at the Bankers' Hall in Jung-gu, Seoul on the 9th. Photo by Kim Hyun-min kimhyun81@

[Asia Economy Reporter Sim Nayoung] Financial authorities have decided to lower the risk weight applied to banks' contributions to the Securities Stabilization Fund from 250% to 100%. This measure responds to the demand for funding solutions from commercial banks that need to supply liquidity to the bond market.

At the 'Financial Market Stability Financial Services Commission Chairman-Bank CEOs Meeting' held on the 9th at the Korea Federation of Banks in Myeongdong, Seoul, financial authorities announced that following the normalization of the Liquidity Coverage Ratio (LCR) regulation and the easing of the loan-to-deposit ratio regulation, the risk weight applied to contributions to the Securities Stabilization Fund will also be lowered, as was done during the COVID-19 period.

The Securities Stabilization Fund is being raised to about 10 trillion won, with policy banks including the Korea Development Bank contributing 2 trillion won, major financial groups such as KB, Shinhan, Hana, and Woori each contributing 1 trillion won, and the insurance sector contributing 800 billion won, among about 20 financial companies. The issue is that when banks invest funds in the Securities Stabilization Fund, their Risk-Weighted Assets (RWA) increase, which worsens their LCR ratio.

The contribution to the Securities Stabilization Fund has been subject to a 250% risk weight when calculating RWA, imposing a heavy burden on banks, but this will be eased. Financial authorities took this measure in 2020 during the COVID-19 period to supply liquidity.

Kim Joo-hyun, Chairman of the Financial Services Commission, said, "Although difficult economic conditions persist due to the recent rapid interest rate hikes, it is difficult to respond with interest rate cuts and fiscal spending expansions as was done during the 2008 financial crisis and the 2020 COVID-19 crisis. Now is the time for the financial sector and the government to join forces and efficiently utilize all the capabilities of our economy to overcome difficulties."

He also said, "The banking sector should take a more proactive role in market stabilization by looking beyond the banking industry to the entire financial system. If the government's market stabilization measures and the banks' efforts combine to open the flow of funds, it will greatly help support funding for companies and small business owners and stabilize the bond and short-term money markets."

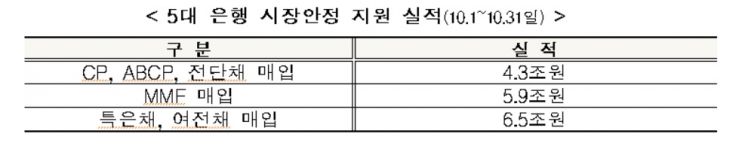

At the meeting, Kim Kwang-soo, Chairman of the Korea Federation of Banks, and bank CEOs stated, "Since the Emergency Macroeconomic and Financial Meeting, the banking sector has minimized bank bond issuance to stabilize the funding market and continues to supply liquidity to the funding market through corporate commercial paper (CP), asset-backed commercial paper (ABCP), purchase of promissory notes, repurchase agreement (RP) purchases, and maintaining the scale of money market fund (MMF) operations."

They also announced that out of the 95 trillion won support plan by the five major financial groups, about 90 trillion won (market liquidity supply of 72.8 trillion won, bond stabilization fund and securities stabilization fund of 11 trillion won, and affiliate support of 6 trillion won) will be executed through banks.

Regarding concerns that the concentration of funds in the banking sector could cause liquidity shortages in other sectors such as the secondary financial sector, they stated, "Banks will cooperate as much as possible to ensure that the creditworthiness of the secondary financial sector is maintained without difficulty."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.