Slight Year-on-Year Market Share Increase for Top 3 Domestic Companies

CATL Surpasses Panasonic to Take 2nd Place

[Asia Economy Reporter Jeong Dong-hoon] Excluding China, where the domestic electric vehicle (EV) market is rapidly growing, the combined market share of the three major Korean battery companies reached 56% in the global market. Chinese company CATL also made significant advances globally, surpassing Panasonic to take second place.

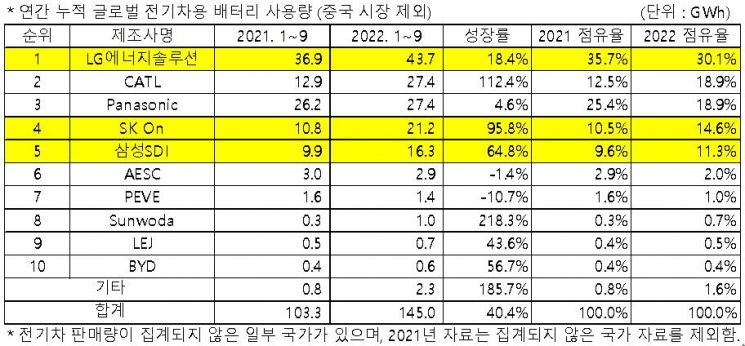

According to market research firm SNE Research on the 7th, in the ranking of battery usage in electric vehicles sold globally from January to September this year, excluding the Chinese market, LG Energy Solution (30.1%) maintained its first-place position. SK On (14.6%) and Samsung SDI (11.3%) ranked fourth and fifth respectively. The combined market share of the three Korean companies slightly increased to 56.0% compared to 55.8% during the same period last year.

The total battery energy capacity of electric vehicles registered worldwide, excluding China, reached 145.0 GWh, marking a 40.4% increase compared to the same period last year. By company, LG Energy Solution maintained its top position with 43.7 GWh, growing 18.4%. Chinese company CATL recorded a remarkable growth rate of 112.4% even outside China. SK On grew by 95.8% to 21.2 GWh, increasing its market share by 4.1 percentage points. Samsung SDI ranked fifth with 16.3 GWh, a 64.8% increase compared to last year.

The growth of the three Korean companies is mainly driven by strong sales of models equipped with their batteries. LG Energy Solution’s growth continued due to steady sales of models such as Volkswagen ID.4, Tesla Model 3/Y, and Ford Mustang Mach-E. SK On showed high growth driven by the popularity of Hyundai Ioniq 5 and Kia EV6, and recently expanded its growth with the launch of new models like the Ioniq 6. Samsung SDI’s growth was supported by strong sales of the Audi e-tron lineup, BMW i lineup, Fiat 500, and Jeep Wrangler PHEV.

In contrast, Japanese companies showed relatively sluggish growth. The market shares of Japanese companies such as Panasonic, PEVE, and LEJ declined compared to last year.

Chinese companies including CATL demonstrated explosive growth with triple-digit growth rates. In particular, CATL nearly doubled its size, rising to second place, driven by increased sales of pure electric vehicles such as Tesla Model 3 (China-made exports to Europe, North America, and Asia), Mercedes-Benz EQS, BMW iX3, and Mini Cooper. Sunwoda ranked eighth due to increased sales of Renault Group’s Dacia 'Spring Electric' in Europe.

SNE Research stated, "Following last year, LG Energy Solution maintained its first-place position in the non-China market from January to September 2022, but the explosive growth of Chinese companies like CATL and Sunwoda is intensifying competition with the three Korean companies." They added, "The recent implementation of the U.S. Inflation Reduction Act (IRA) and the resulting trend to reduce dependence on China, known as 'de-Chinaization,' is expected to have a significant impact on the global market excluding China."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.