High Surge in Personal Services like Petroleum and Dining Out... Largest Increase in Electricity and Gas Prices in 12 Years

Even After Peaking in July, High Inflation Above 5% Expected to Persist for a While

Oil Price Variables Due to European Energy Crisis Concerns... Global Grain Price Surge Risks Also Remain

[Asia Economy Sejong=Reporter Kwon Haeyoung] Consumer prices are showing unstable trends again due to strong price increases in items that rarely fall, such as petroleum products including diesel and kerosene, and personal services like dining out. Electricity, gas, and water charges, which rose the most in 12 years since statistics began, also pushed the inflation rate back up after a brief decline. As prices that rarely drop continue to soar, the core consumer price index, which reflects the fundamental trend of inflation, jumped to its highest level since the global financial crisis.

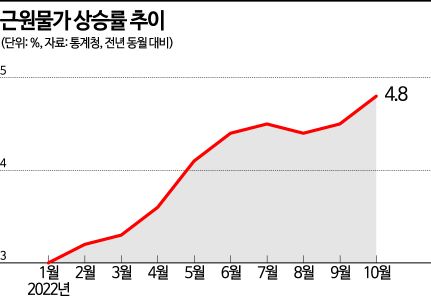

◆Core Consumer Price Index Rises Most in 13 Years and 8 Months=According to the 'October Consumer Price Trends' released by Statistics Korea on the 2nd, the core consumer price index (excluding agricultural products and petroleum products) recorded 107.47, rising 4.8% compared to the same month last year. The increase rate expanded from the previous month (4.5%) and marked the highest level in 13 years and 8 months since February 2009 (5.2%). The core consumer price index excludes items affected by seasonal factors and temporary shocks, such as agricultural products and petroleum products, and is interpreted as an indicator showing the long-term trend of inflation. The food and energy excluding index, one of the core consumer price indices, also rose 4.2% year-on-year, marking the largest increase in 13 years and 10 months since December 2008 (4.5%).

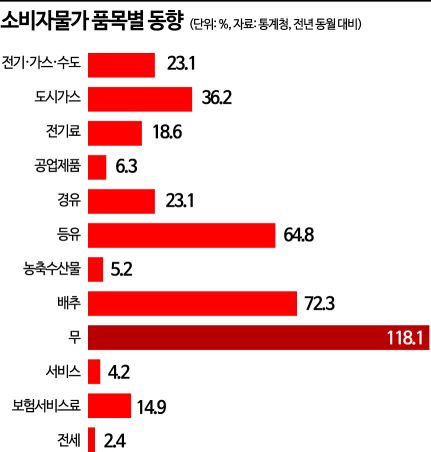

By item, electricity, gas, and water charges surged 23.1% last month, the largest increase since statistics began in January 2010. City gas prices jumped 36.2%, while electricity and district heating fees rose 18.6% and 34.0%, respectively. This was due to the electricity rate increase of 7.4 KRW per kWh and the city gas rate increase of 2.7 KRW per MJ for general residential use starting last month. As a result, electricity, gas, and water charges contributed 0.77 percentage points to the 5.7% inflation rate last month.

Industrial products and personal services are also soaring. Industrial products rose 6.3%, with petroleum products up 10.7% and processed foods up 9.5%. Although gasoline fell by 2.0%, diesel (23.1%) and kerosene (64.8%) recorded high increases. Although the rise in international oil prices has slowed, they remain at high levels compared to a year ago. For personal services, dining out rose 8.9% and insurance service fees jumped 14.9%, resulting in a 6.4% increase. Although the dining out increase rate was lower than the previous month (9.0%), it continued to rise mainly due to fish sashimi (9.2%) and chicken (10.3%). The contribution to last month's inflation rate was 2.20 percentage points for industrial products and 2.23 percentage points for services.

Agricultural, livestock, and fishery products rose 5.2% compared to the previous month, slowing from the previous month's 6.2%. Among them, agricultural products rose 7.3%, livestock products 1.8%, both lower than the previous month (8.7% and 3.2%, respectively), while fishery products rose 6.5%, increasing more than the previous month (4.5%). Among agricultural products, vegetables rose 21.6%, continuing their high increase.

◆High Inflation in the 5% Range Expected to Continue=With inflation rates expanding again after two consecutive months of decline, concerns are growing that high inflation in the 5% range will persist for some time. Although there is growing speculation that the inflation peak occurred in July, more than three months earlier than the government's initial forecast of October, the high inflation rate in the 5% range is expected to continue for the time being. The rise in import prices due to the US's aggressive tightening and sharp exchange rate increases is also fueling inflation concerns. The expected inflation rate, which reflects economic agents' outlook on inflation over the next year, turned upward after three months. According to the Bank of Korea, the expected inflation rate recorded 4.3% last month, up 0.1 percentage points from 4.2% the previous month. It had fallen after hitting a record high of 4.7% in July but rose again after three months. The rise in import prices due to the US's aggressive tightening and sharp exchange rate increases is also fueling inflation concerns.

Oh Woonseon, Director of Economic Trend Statistics at Statistics Korea, said, "While the increase rates of supply-side factors such as agricultural, livestock, fishery products, and petroleum are decreasing, demand-side factors such as personal services are likely to continue rising," adding, "Although the inflation rate will not rise to the 6% range, it is expected to remain in the 5% range for the time being, so the serious situation has not changed significantly."

On the supply side, concerns remain about a sharp rise in petroleum and grain prices. There is particular concern that petroleum prices could surge again if an energy crisis occurs in Europe during winter. Additionally, the possibility of global grain prices fluctuating again is a variable. For example, Russia has indicated its intention to suspend the implementation of the agreement not to attack Ukrainian grain export ships passing through the Black Sea, meaning it could use the 'food weaponization' card at any time. Although the urgent situation was eased as grain exports through the Black Sea resumed after Russia's announcement to suspend participation in the agreement, concerns remain that global grain prices could surge at any time.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)