No Solution for Chronic Negative Margin Structure

USD 800 Million Overseas Bonds Issued in June and October

Bond Issuance Inevitable to Cover Operating Costs

Deficit Expected to Continue in 2024

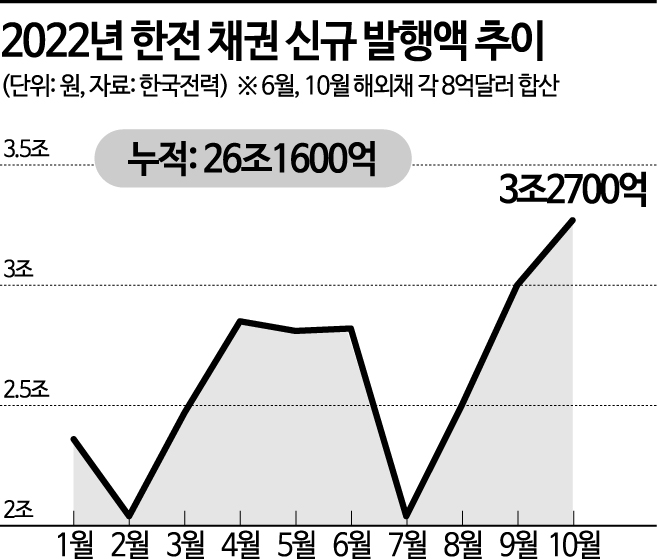

Korea Electric Power Corporation (KEPCO) has issued more than 26 trillion won in KEPCO bonds, identified as the fundamental cause of the bond market tightening, from the beginning of this year through October. This amount is 2.5 times the total issuance of about 10.43 trillion won for the entire previous year. Due to the deficit structure of buying electricity at high prices and selling it cheaply, KEPCO has increased bond issuance to secure long-term operating funds. Although the government and financial sectors are increasingly demanding a reduction in KEPCO bond issuance, KEPCO's concern over 'funding tightness' is growing as it needs to raise 2 to 2.5 trillion won in new operating funds this month.

According to the energy industry on the 2nd, the total bonds issued by KEPCO from the beginning of this year until the end of last month amounted to approximately 26.16 trillion won. This includes 23.9 trillion won in corporate bonds and 1.6 billion dollars (about 2.26 trillion won) in overseas bonds. KEPCO issued overseas bonds twice, each time 800 million dollars, in June and last month. This means KEPCO issued bonds averaging 2.6 trillion won per month for operating funds. If this trend continues, the total bond issuance for this year is expected to reach around 30 trillion won. The cumulative bonds KEPCO must repay amount to 62.78 trillion won.

The reason why the massive issuance of KEPCO bonds is disrupting the funding market is clear. The corporate bonds issued by KEPCO in the first half of this year accounted for 38% of the total corporate bond issuance. The average interest rate on KEPCO corporate bonds more than doubled from 2.71% in January this year to 5.73% last month. The demand contraction in the bond market caused by the ultra-high-grade KEPCO bonds eventually led to a vicious cycle of rising interest rates.

The problem is that unless a fundamental solution to eliminate KEPCO's chronic negative margin structure is found, the company cannot reduce its corporate bond issuance. Currently, KEPCO is considering various alternatives such as bank loans and overseas bond issuance to secure operating funds, but it is judged that it will be difficult to raise the 2 trillion won level of operating funds needed this month without issuing corporate bonds.

Regarding the plan to expand bank loans, some in the financial sector criticize it as "taking a stone from below to support the one above." Professor Sung Tae-yoon of Yonsei University's Department of Economics said, "While bank loans can relieve pressure on the bond market, they ultimately restrict the supply side of financial institutions, which also shrinks liquidity."

Another alternative, increasing the scale of overseas bond issuance, is also not easy. This is because the possibility of exposure to foreign exchange risk cannot be completely ruled out, and concerns about a global economic downturn have pushed short-term overseas bond interest rates into the 5% range, increasing interest burdens. Earlier, KEPCO issued 3-year overseas bonds with a dollar coupon rate of 3.675% and 5-year bonds at 4.0% in June, but last month, it raised the average rate by 1.5 percentage points to 5.375% for 3.5-year bonds and 5.5% for 5.5-year bonds.

The outlook for next year is also not bright. The prolonged Russia-Ukraine war is causing international energy prices such as crude oil to continue rising, and if the KEPCO bond issuance limit is raised from the current double to five times, the phenomenon of market funds concentrating on KEPCO bonds could intensify. The financial industry expects KEPCO's deficit status to continue until 2024. According to financial information provider FnGuide, KEPCO's cumulative deficit for this year is projected at 30.125 trillion won, 14.85 trillion won in 2023, and 1.71 trillion won in 2024.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)