Semiconductor Production Index Declines in Q3, Inventory Index Increases

Samsung Electronics and SK Hynix Q3 Operating Profit Shrinks

October Semiconductor Exports Down 17.4%... Price Decline Ongoing

K-Chips Act Discussions for Strengthening Semiconductor Competitiveness Stalled

Partial interior view of Line 1 at Samsung Electronics Pyeongtaek Campus / Provided by Samsung Electronics

Partial interior view of Line 1 at Samsung Electronics Pyeongtaek Campus / Provided by Samsung Electronics

[Asia Economy Reporter Kim Pyeonghwa] The semiconductor industry, which has been the backbone of the Korean economy, showed red flags in various figures for the third quarter as expected. The market is flooded with concerns that the semiconductor winter will be harsher than anticipated. With the sluggish market conditions centered on memory semiconductors expected to continue into the fourth quarter, a decline is inevitable not only in the performance of related industries but also in exports.

Long-term risks arising from intensified global hegemony competition are also emerging, but discussions in the National Assembly on the related legislation, the 'K-Chips Act,' remain stalled without progress. Criticism is mounting that the semiconductor industry, the flagship of Korean exports, will fall behind in competition due to political irresponsibility, as it is pointed out that the 'golden time' has already passed.

According to the National Statistical Office's National Statistical Portal (KOSIS) on the 2nd, the semiconductor production index (seasonally adjusted) for the third quarter of this year recorded 320.6 (2015=100), down 11% from the previous quarter. This is the largest decline since the fourth quarter of 2008 (-23.6%). The semiconductor operating rate for the third quarter also decreased by 16.3% based on the same criteria. Conversely, the semiconductor inventory index (seasonally adjusted) for the third quarter was 237.1 (2015=100), up 17.4% from the previous quarter. This is a result of the domestic semiconductor industry being hit as the global semiconductor market froze due to worsening macroeconomic conditions.

These statistics had already been foreshadowed in the third-quarter earnings of major domestic semiconductor companies such as Samsung Electronics and SK Hynix. Both companies experienced a chain reaction of effects such as price declines due to increased inventory as front-end demand continued to weaken amid external environmental deteriorations like inflation, interest rate hikes, and the Russia-Ukraine war, leading to worsened earnings. Samsung Electronics announced on the 27th of last month that its third-quarter semiconductor (DS division) operating profit shrank by 49.16% year-on-year to 5.12 trillion won. SK Hynix's third-quarter operating profit, announced the day before, also plunged 60% year-on-year to 1.6556 trillion won. Their third-quarter inventory assets stood at 57.32 trillion won and 14.67 trillion won, respectively, surging 51.6% and 122.3% year-on-year.

The problem is that there are growing forecasts that this situation could worsen in the fourth quarter. The Ministry of Trade, Industry and Energy announced that the provisional export amount last month was $52.48 billion, down 5.7% from the same month last year, with a significant decrease in semiconductors, the largest export item. Semiconductor exports last month were $9.23 billion, down 17.4% year-on-year. In particular, exports of memory semiconductors, which are the main focus of the domestic semiconductor industry, decreased by as much as 35.7%. Minister of Trade, Industry and Energy Lee Chang-yang said at the 3rd Export Situation Review Meeting held on the 1st, "With the expansion of downside risks to the global economy, it is not easy to reverse our exports in the short term," adding, "We are taking the recent situation very seriously."

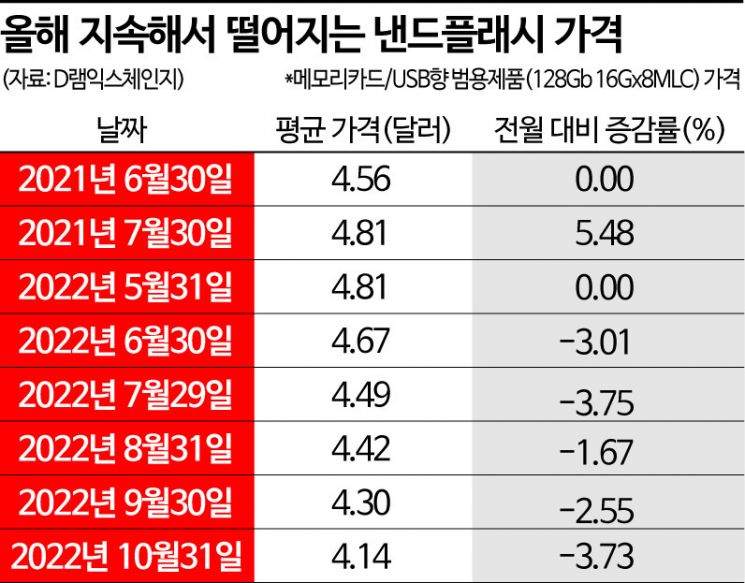

Price declines, which can directly affect the semiconductor industry's performance, are also expected to continue. According to market research firm DRAMeXchange, as of the end of October, the fixed transaction price for general-purpose PC DRAM products (DDR4 8Gb) was $2.21, a sharp drop of 22.46% from the previous month. The fixed transaction price for general-purpose NAND products (128Gb) for memory and USB also decreased by 3.73% over the same period. Market research firm TrendForce forecasted that prices for major memory items, DRAM and NAND flash, could fall by up to 18% and 20%, respectively, in the fourth quarter compared to the previous quarter, projecting a larger decline than in the third quarter. Due to these impacts, the earnings forecasts for Samsung Electronics and SK Hynix for the fourth quarter are also trending downward. Some securities firms even predict that SK Hynix could record an operating loss in the fourth quarter.

The domestic semiconductor industry is adopting different strategies to overcome this situation. Samsung Electronics is focusing on long-term investment and expanding production capacity, expecting the semiconductor market downturn to improve. SK Hynix has announced plans to reduce investment and production to balance market supply and demand. The market expects the semiconductor market to gradually recover starting in the second half of next year, with the various difficulties faced by the industry this year expected to improve gradually.

However, long-term risks due to intensified global semiconductor hegemony competition are expected to persist. As competing countries such as the United States, China, and Taiwan pour out various support measures to foster their domestic semiconductor industries, the lack of domestic support measures could lead to a weakening of Korea's semiconductor competitiveness. This could also negatively affect the Korean economy, which is highly dependent on semiconductors. To make matters worse, the K-Chips Act (Amendment to the Act on National Advanced Strategic Industries and the Restriction of Special Taxation Act), proposed in the National Assembly last August to strengthen the competitiveness of the domestic semiconductor industry, is expected to see little progress in discussions this month as well.

A National Assembly official said, "The amendment to the Act on National Advanced Strategic Industries could be reviewed if the subcommittee of the Industry, Trade, and Small and Medium Venture Business Committee is held this month, but nothing has been decided yet," adding, "The amendment to the Restriction of Special Taxation Act also needs to go through the subcommittee of the Planning and Finance Committee, but since the subcommittee has not yet been formed, discussions on the bill have not progressed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)