SPC Group Chairman Heo Young-in is leaving the press conference room after delivering a public apology regarding the recent employee death incident at the affiliate SPL, held at the SPC headquarters in Seocho-gu, Seoul, on the 21st. Photo by Kang Jin-hyung aymsdream@

SPC Group Chairman Heo Young-in is leaving the press conference room after delivering a public apology regarding the recent employee death incident at the affiliate SPL, held at the SPC headquarters in Seocho-gu, Seoul, on the 21st. Photo by Kang Jin-hyung aymsdream@

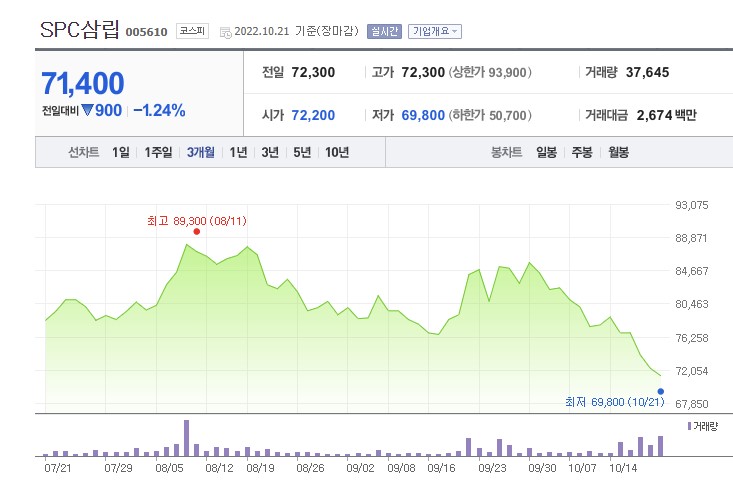

[Asia Economy Reporter Lee Seon-ae] SPC Samlip's stock price has fallen. The stock price was affected as uncomfortable public opinion spread, including a boycott movement related to the death of a worker at the SPC Group-affiliated bakery factory (SPL) located in Pyeongtaek, Gyeonggi Province. The delayed apology also became controversial. Chairman Heo Young-in issued a public apology seven days after the accident, but it was insufficient to quell the cold public sentiment.

According to the Korea Exchange on the 22nd, SPC Samlip's stock price opened at 72,200 won the previous day and dropped to 69,800 won during the session, falling below 70,000 won. This is the first time in over four months since June 24 (closing price 69,900 won) that SPC Samlip's stock price fell below 70,000 won. It closed at 71,400 won, down 1.24% from the previous trading day. Compared to the trading day just before the accident on the 14th (77,600 won), it dropped by about 8%. Since the trading day after the accident on the 17th, the stock price has continued to decline for five consecutive trading days.

On the 15th, a worker in his 20s died after getting caught in a sauce mixer at the SPC Group-affiliated SPL bakery factory in Pyeongtaek, Gyeonggi Province. Controversy arose as it was revealed later that SPL resumed operations at the factory the day after the accident and that a similar 'body entrapment' accident had occurred a week earlier. As a result, a boycott movement began to emerge mainly on online communities, intensifying the backlash.

Although Chairman Heo issued a belated public apology the day before, it was insufficient to change public opinion. On the 21st at 11 a.m., Heo held a press conference related to the SPL bakery factory death accident at the SPC headquarters auditorium on the 2nd floor in Seocho-gu, Seoul, saying, "I deeply feel responsible," and bowed his head, expressing "Once again, I offer my deep condolences and apologies to the deceased and their family regarding the accident that occurred at the workplace, and I sincerely apologize for causing concern." Subsequently, Hwang Jae-bok, SPC’s CEO, announced a recurrence prevention plan, pledging to invest a total of 100 billion won over three years to strengthen safety management.

Although SPC Samlip's stock price is collapsing, securities firms see no problem with the company's business competitiveness. SK Securities maintained a target price of 127,000 won and a 'buy' rating for SPC Samlip, forecasting that consolidated sales for the third quarter of this year will increase by 10.3% year-on-year to 826.6 billion won, and operating profit will surge 77.9% to 24.7 billion won.

Park Chan-sol, a researcher at SK Securities, said, "Since the release of Pok?mon bread in the first quarter of this year, the consumer age group has expanded, and demand remains solid. Pok?mon bread appears to be maintaining a monthly sales trend of about 13 billion won in the third quarter of this year."

He added, "For 2023, we expect ▲ continuous growth in the bakery business ▲ expansion of channels in the food division and margin improvement due to a rebound in the rest area business ▲ business development focused on operating profit margin in the distribution division. If the current short-term uncertainty in demand for mass-produced bread is overcome, we see a high possibility of entering a company-wide operating profit margin in the 3% range from the second quarter of next year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)