Data from Hong Seong-guk, Member of the Democratic Party of Korea's Office

The Bank of Korea raised the base interest rate by 0.5 percentage points, and the real estate transaction market is expected to experience a prolonged winter. On the 13th, a red light was on at a traffic signal near an apartment in downtown Seoul.

The Bank of Korea raised the base interest rate by 0.5 percentage points, and the real estate transaction market is expected to experience a prolonged winter. On the 13th, a red light was on at a traffic signal near an apartment in downtown Seoul.

[Asia Economy Sejong=Reporter Kwon Haeyoung] In so-called 'gap investment,' where buyers purchase homes with jeonse deposits aiming for capital gains rather than residential purposes, high-risk transactions with a loan-to-value ratio (LTV) exceeding 70% account for two out of every three transactions.

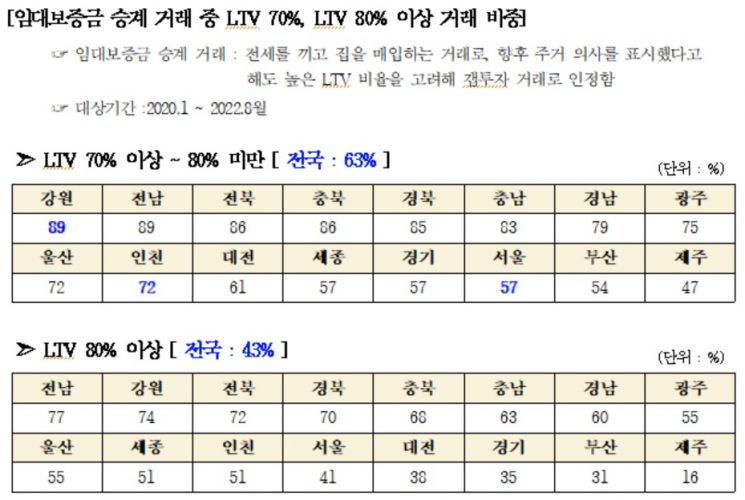

According to data submitted by the Korea Real Estate Board to Hong Seong-guk, a member of the National Assembly's Planning and Finance Committee from the Democratic Party of Korea, from January 2020 to August this year, about 63% of gap investment transactions nationwide had an LTV of 70% or higher, and 43% had an LTV of 80% or higher over the past three years.

The proportion of gap investments was recorded at 50% in Seoul and over 30% nationwide. In particular, gap investments were prevalent in multi-family housing in Seoul, Incheon, and Gyeonggi, and in apartments in Gangwon, Gyeongnam, and Jeonbuk. Transactions with an LTV of 70% or higher were 57% in Seoul, 72% in Incheon, and a staggering 89% in Gangwon.

The proportion of debt in total housing transactions was 48%. Among these, mortgage loans accounted for 38%, about one-third, while the remainder consisted of rental deposits, unsecured loans, and contract loans. This indicates that rental deposits and other means outside financial regulatory oversight were mainly utilized.

When looking at the borrowing ratio in total housing transactions, it was 40% for those in their 40s and 50s, while it rose to about 60% for those aged 30 and below.

Until now, leverage investment was possible due to the continuous rise in jeonse prices, but if real estate prices fall causing reverse jeonse or "empty jeonse" situations, losses for highly leveraged investors are inevitable. Especially, real estate prices in areas with many gap investments are likely to decline more sharply.

Assemblyman Hong Seong-guk stated, "There needs to be a change in the government's approach, which has so far managed the real estate market focusing on mortgage loan regulations such as LTV and debt service ratio (DSR). First, the actual conditions of gap investments must be accurately identified, and the government should strive to protect tenants."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)