Analysis of Cumulative Short Selling Transactions

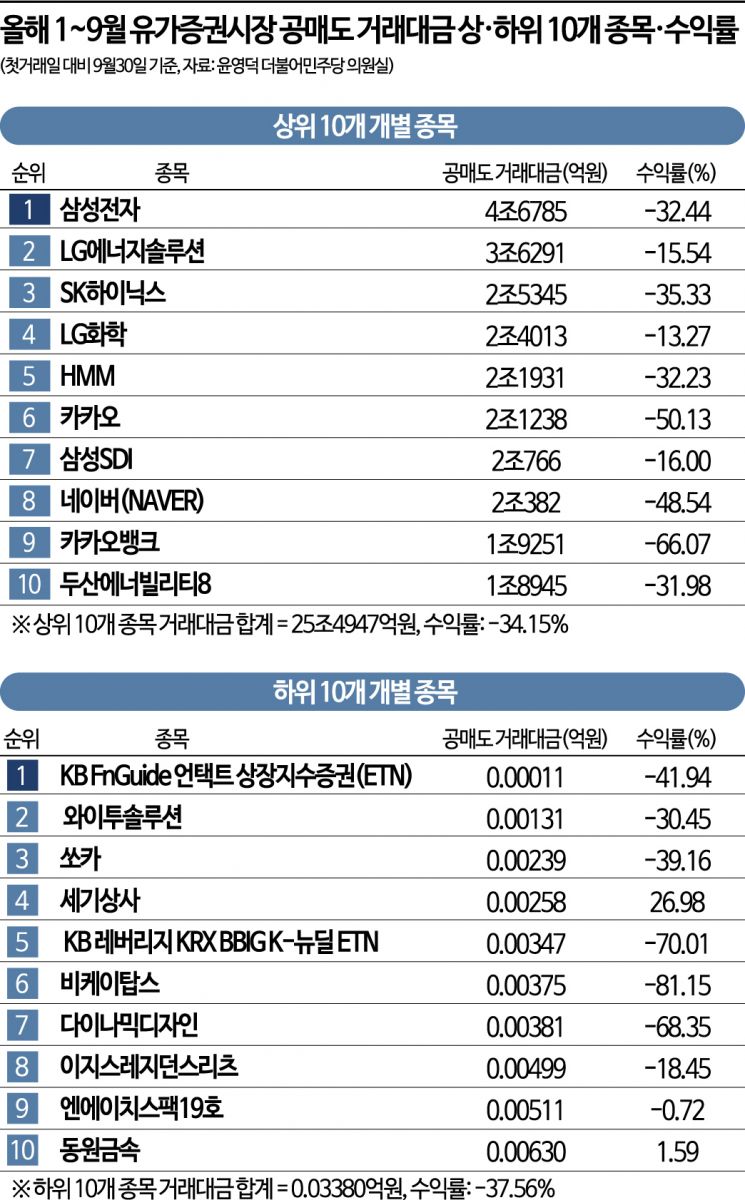

Samsung Electronics' Short Selling Hits 4.6 Trillion Won This Year... Stock Price Down 32%

KakaoBank's Stock Price Falls 66% Despite Less Short Selling Than Samsung Electronics

Short Selling Does Not Necessarily Lead to Stock Price Decline

Short Selling Fuels Stock Price Drop in Negative News Stocks

In the KOSDAQ market, EcoPro BM (2.694 trillion KRW) had the largest short selling transaction amount, falling 24.95% compared to the beginning of the year, while Wemade (850 billion KRW), which had less short selling, dropped by 75.10%.

The poorer stock returns of stocks facing adverse factors are interpreted as the cause. Among the top short selling stocks, KakaoBank, which had the worst returns, soared to the 10th largest market capitalization on the KOSPI right after its listing last year, but doubts about its growth followed. KakaoBank's net profit in Q2 this year was 57 billion KRW, down 14.3% from the previous quarter. Additionally, controversies over stock option sell-offs by executives and employees earlier this year and concerns about overhang due to a block deal with Kookmin Bank became negative factors.

Among the top short selling stocks in KOSDAQ, Wemade, which experienced the largest stock price drop (-74.26%), also appears to have seen its stock price plunge exacerbated by short selling due to adverse factors. Wemade showed high growth by reflecting revenue related to its issued cryptocurrency WEMIX in its earnings, but faced public criticism for undisclosed sales of 108 million WEMIX tokens (approximately 227.1 billion KRW).

Professor Seo Ji-yong of the Department of Business Administration at Sangmyung University explained, "When there are adverse factors for a particular stock, if institutions or foreigners with relatively more information engage in short selling, individual investors tend to benchmark their investment patterns on them, which can cause the stock price to fall further. Since short selling is meaningful data, it certainly influences investment behavior."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)