Surge in Electric Vehicle Battery Demand

Prices Triple in One Year

Upward Trend Expected Until 2030

[Asia Economy Reporter Oh Hyung-gil] Lithium prices, known as "white petroleum," are soaring to unprecedented heights. The explosive increase in demand for this key battery raw material is further driving up prices.

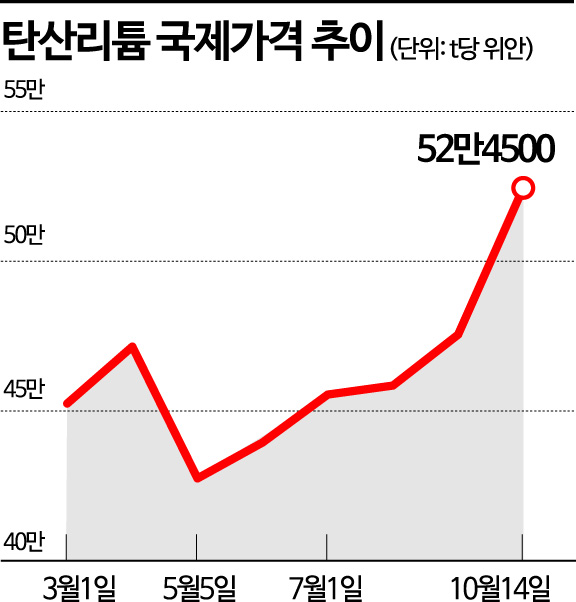

According to the Korea Resource Information Service on the 17th, as of the 14th, the price of lithium carbonate (99.5% grade) per ton is 524,500 yuan, approaching 104.84 million KRW. Although lithium carbonate prices did not exceed 500,000 yuan even in March when the Russia-Ukraine war broke out, they surpassed 500,000 yuan for the first time ever on the 10th and have continued to rise for four consecutive trading days.

Considering that lithium carbonate prices were 170,000 yuan per ton during the same period last year, prices have more than tripled in just one year.

This trend contrasts with nickel, another key battery material, which surged due to supply chain shocks from Russia but has stabilized since the third quarter. Nickel prices have been declining this year and are expected to fall below $20,000 per ton starting next year.

On the other hand, lithium prices are expected to continue rising for the time being. The International Energy Agency (IEA) forecasts that lithium demand will increase by a staggering 42 times by 2030 compared to 2020.

Lim Ji-hoon of the Korea International Trade Association’s Institute for International Trade and Commerce said, "Lithium is a mineral with high price volatility due to supply-demand imbalances. Although supply instability is expected to ease and price surges will subside for the time being, prices are likely to gradually rise after 2025 and form a high price range around 2030 due to global demand expansion."

Lithium is the lightest metal on the periodic table and conducts electricity easily, making it widely used in batteries. Australia and Chile hold 67% of the world's lithium reserves, and these countries along with China account for 90% of total production.

Since China became South Korea’s top lithium import source in 2020, dependence on Chinese imports has increased. From January to July this year, the share of imports from China reached 64%.

Moreover, with the enactment of the U.S. Inflation Reduction Act (IRA), a new challenge has emerged to reduce dependence on Chinese lithium. In response, domestic battery and material companies are accelerating investments and expanding cooperation with overseas lithium producers.

POSCO Group is investing in facilities to produce lithium hydroxide from lithium brine at the Hombre Muerto salt flat in Argentina. After starting construction of the first phase in March, the second phase will begin within this year. The investment schedule has been advanced by more than half a year compared to the original plan. Once the first and second phase investments are completed in 2025, POSCO Group is expected to produce 50,000 tons of lithium hydroxide annually (enough for 1.2 million electric vehicles).

SK On has invested 10% equity in Australia’s Lake Resources and signed a long-term contract to supply a total of 230,000 tons of high-purity lithium. Lake Resources owns and is developing four lithium salt flat assets and one lithium mine in Argentina. SK On has also signed a memorandum of understanding (MOU) with Global Lithium for stable lithium supply. LG Energy Solution has strengthened its supply chain by signing agreements with three Canadian mineral companies for cobalt and lithium supply.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)