Hana Securities Report

[Asia Economy Reporter Lee Myunghwan] An analysis from the securities industry suggests that the Japanese cosmetics market could present new opportunities for domestic brands.

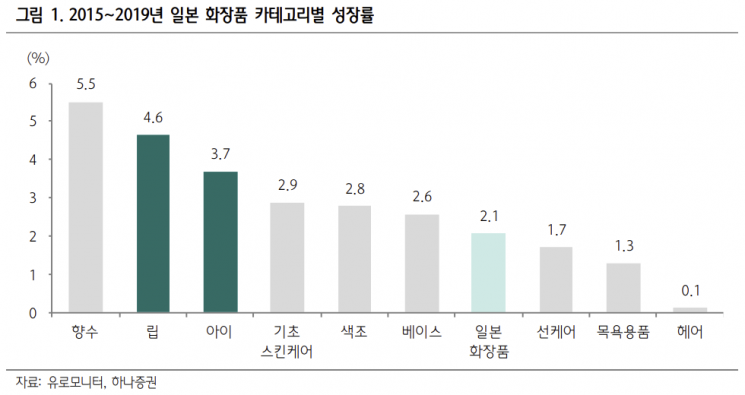

Hana Securities stated on the 16th, "Japan's mid-range and color cosmetics are typical niche markets," providing this analysis.

According to Hana Securities, Japan's cosmetics market ranks as the third largest globally, following the United States and China. As of 2019, the size of Japan's cosmetics market was $35.7 billion (approximately 51.49 trillion KRW), accounting for nearly 9% of the global cosmetics market, which is about three times the size of the domestic cosmetics market.

Hana Securities evaluated that major Japanese cosmetics companies have focused on expanding in advanced markets, neglecting mid-range and color portfolios within Japan. Due to the declining purchasing power of the MZ generation in Japan, investment attractiveness was limited, and the online penetration rate of cosmetics was only about 13%, making the entry environment unfavorable for venture brands. As a result, Hana Securities assessed that the mid-range cosmetics market in Japan has effectively been preempted by domestic beauty companies.

Hana Securities also pointed out that the distribution channel structure of Japan's cosmetics market has remained almost unchanged over the past decade. In Japan, drugstores account for a much larger share of sales than online channels. The excessively aging population structure and an unfavorable parcel delivery industry structure also played a role, according to Hana Securities' analysis. Drugstore operators are actively introducing Korean brands due to their rapid production speed and excellent product quality. The Korean Wave (Hallyu) has also influenced this, with the Korean cosmetics industry's capabilities combining with K-culture to create a synergistic effect.

Products from Korean cosmetics brands accounted for 34% of Japan's cosmetics imports in the first half of 2022, ranking first, and K-beauty has established itself as a distinct category in Japan, according to Hana Securities. Japanese products lack brand power, China lacks the backing of C-culture, and Thailand has weak brand power and a limited base for Original Design Manufacturing (ODM), the analysis noted.

Jongdae Park, a researcher at Hana Securities, stated, "Although the Japanese cosmetics market is stagnant, it is becoming an opportunity for Korean brand companies. Especially since 2022, many domestic cosmetics companies have experienced poor performance due to lockdowns in China and economic downturns, but high growth in the Japanese market has partially offset this and provided hope."

Researcher Park added, "K-beauty brands are gradually strengthening their market position and expanding into basic skincare categories. Among companies with a high sales proportion in Japan, it is advisable to prioritize investment in those with strong domestic brand power and diverse brand lineups and categories."

Hana Securities identified Clio as the leading domestic cosmetics company in the Japanese market. iFamilySC was noted for its brand and category diversity, while Able C&C and VT were highlighted as needing to enhance domestic brand recognition.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)