[Asia Economy Reporter Minji Lee] Coupang is expected to raise its stock price level through expanding its share in the online market.

On the 9th, Coupang's stock price was at $19.56. Over the past week, the stock price rose by 16.22%, which is analyzed to have attracted investor sentiment due to expectations of improved earnings.

The restructuring of South Korea's online market is gaining momentum. The online penetration rate, which was 36.1% last year, is expected to increase to 37.6% this year and 38.9% next year, rising by 1.5 percentage points and 1.3 percentage points year-on-year, respectively. The online penetration rate refers to the proportion of online transactions within the total consumer market. As the penetration rate increases, growth potential inevitably decreases. Accordingly, the domestic online market growth rate is expected to record 8.2%, down 2.4 percentage points from the previous year.

Myungjoo Kim, a researcher at Korea Investment & Securities, said, “With the market growth rate slowing and interest rates rising, some e-commerce companies are facing difficulties in raising additional funds, accelerating market restructuring. Although Coupang is a deficit company, its commerce division's EBITDA turned positive in the first half of the year, and with improvements in commerce profitability, the overall company deficit is expected to shrink in the future.”

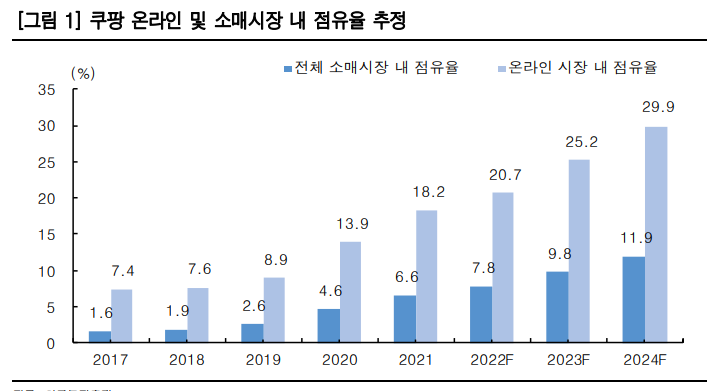

Currently, Coupang's market share in the online market is estimated at 20.7% last year and 25.2% next year. The larger increase in market share next year is due to Coupang’s strengthened fulfillment competitiveness, which will sustain healthy growth in open market transaction volume. Coupang’s sales are estimated to grow by 32.6% this year and 27.2% next year compared to the previous year. Researcher Kim explained, “Among Coupang’s major subsidiaries related to the commerce division and producing private brand (PB) products, CPLP, Coupang Pay, and Coupang Fulfillment Services recorded profits as of last year.”

Coupang is also strengthening its share in the retail market. Coupang’s share in the retail market is expected to grow by 1.2 percentage points to 7.8% this year and by 2 percentage points to 9.8% next year. Researcher Kim analyzed, “Coupang will first strengthen advertising, fulfillment, and loan services that help improve profitability. With rapid market share expansion in the Korean online market, valuation justification and increase are expected, so a positive approach is recommended when stock prices adjust.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)