Seoul 50 Plus Foundation and Korean Policy Studies Association Discuss 'Issues and Policy Tasks in Middle-aged and Older Adults' Retirement Preparation'

Presentation of Research Results on Retirement Preparation for Middle-aged and Older Adults... Expert Discussion and Exploration of Practical Policy Measures for Middle-aged Adults

[Asia Economy Reporter Lim Cheol-young] The retirement preparation index for middle-aged and older adults in Seoul is 55.67 points (out of 100), slightly higher than the national average of 54.62 points, but still indicates insufficient retirement preparation. The expected retirement age is 67.61 years on average, 0.94 years higher than the national average of 66.67 years. Regarding preparation for retirement living expenses, 50.7% of Seoul’s middle-aged and older adults responded that they have prepared, but among freelancers and temporary/daily wage workers, the responses indicating preparation were relatively low at 44% and 42%, respectively.

On the 23rd, the Seoul 50 Plus Foundation shared these research results related to retirement preparation for middle-aged adults and, in collaboration with the Korean Association for Policy Studies, held the ‘2022 50+ Policy Forum’ to explore practical policy measures for this demographic. This forum presented the results of research projects on retirement preparation conducted by the foundation and provided a time to discuss practical retirement preparation measures with experts from academia and related organizations. Presentations and discussions were held on key issues related to retirement preparation for middle-aged adults, including research on the current status of retirement preparation, social contribution jobs for middle-aged adults, and social networks of single-person households among the middle-aged.

The foundation will analyze and present the current status of retirement preparation among Seoul citizens by employment type, including the retirement preparation index and types. Since current retirement preparation services are mainly designed for wage workers, there is a need for more segmented services tailored to different employment types such as self-employed, small business owners, and freelancers. Accordingly, the foundation examines the status of retirement preparation by employment type and proposes corresponding preparation methods.

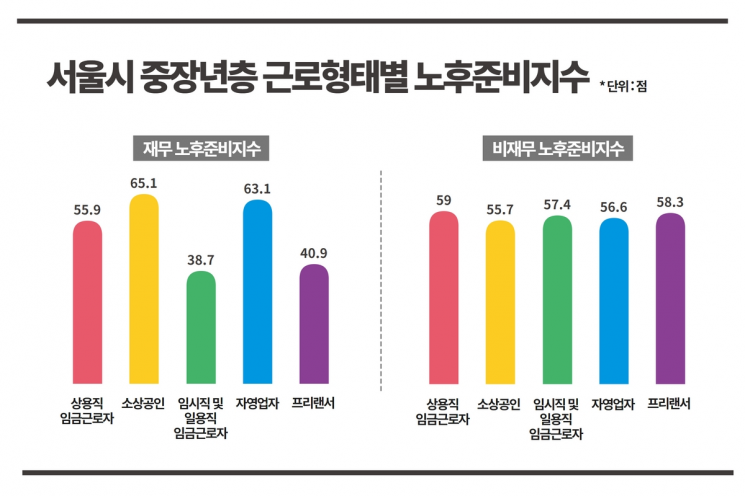

The foundation’s research results showed that retirement preparation status varies by employment type. Financial retirement preparation was highest among small business owners, while non-financial retirement preparation was best among regular wage workers. Small business owners and self-employed individuals subjectively perceived their financial retirement preparation as the highest.

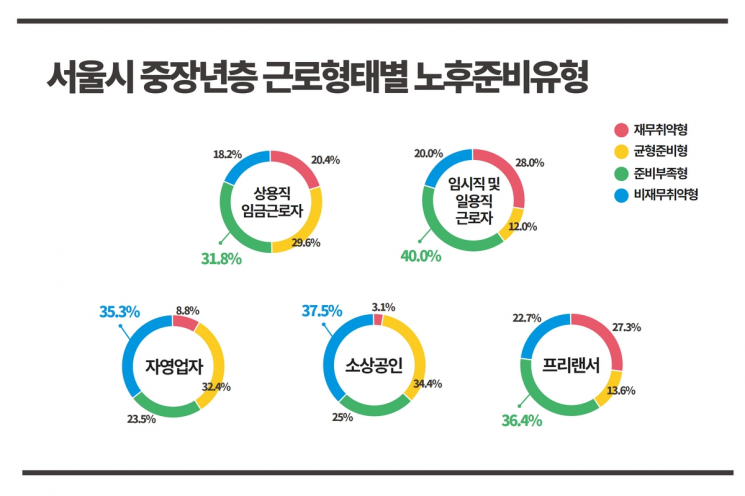

Regular wage workers had the highest estimated retirement fund at the time of retirement, amounting to 761.03 million KRW, indicating relatively good financial retirement preparation. However, by type, the underprepared group (31.8%) and balanced preparation group (29.6%) were similar in proportion, revealing polarization in retirement preparation even among regular wage workers depending on occupation.

Temporary and daily wage workers had the weakest financial retirement preparation, with an estimated preparation fund (394.94 million KRW) lower than the required retirement fund (418.04 million KRW). Their non-financial retirement preparation was also insufficient, with social relationships being the most vulnerable. Freelancers ranked second lowest in financial retirement preparation after temporary and daily wage workers. The majority were in the underprepared group (36.4%) and financially vulnerable group (27.3%), and freelancers with irregular income faced serious retirement preparation deficiencies.

Accordingly, the foundation proposes retirement preparation methods tailored to employment types. For temporary and daily wage workers who need to continue working after retirement to secure living expenses, it is advised to utilize retirement preparation support institutions to fulfill both work and social relationships simultaneously. The Seoul city government is also recommended to provide opportunities for flexible job searching and support, as well as systematic vocational training services.

Hwang Yoon-joo, head of the Policy Research Team, said, “This forum was organized to share research results on retirement preparation for middle-aged adults in Seoul and to jointly explore practical policy directions,” adding, “Based on diverse research and discussions, we will strive to further expand policies and services that middle-aged adults actually need for retirement preparation.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.