Stock Prices of This Year's Listed Companies All Below IPO Price

AlpBio Achieves Successful Subscription with 1518:1 Competition Rate

Sunbio Falls Significantly Short of Initial IPO Expectations

Shaperon and Plasmap to Hold General Subscriptions in Early and Mid Next Month Respectively

[Asia Economy Reporter Lee Chun-hee] Despite the difficulties faced by domestic bio venture companies listed this year, showing stock prices below their initial public offering (IPO) prices amid frozen investor sentiment, various bio companies are still knocking on the door of IPOs. As companies that have succeeded in attracting strong interest emerge, expectations are rising again, and attention is growing toward companies that can pass investors' rigorous selection.

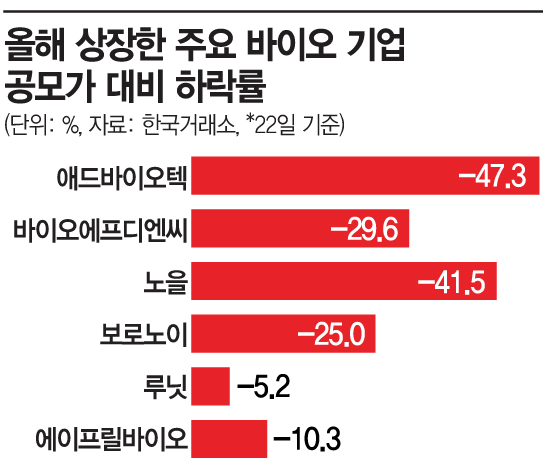

According to the Korea Exchange on the 23rd, the recent stock prices of major bio companies that went public this year are all below their IPO prices. Lunit had maintained a stock price higher than the IPO price of 30,000 KRW until last week, but its closing price yesterday fell 5.2% to 28,450 KRW compared to the IPO price. Some companies have nearly halved in value. Adbiotech dropped 47.3% to 3,690 KRW from the IPO price of 7,000 KRW, and Noeul also fell 41.5% to 5,850 KRW. Other companies that went public this year, including BioFDNC (-29.6%), Voronoi (-25.0%), and AprilBio (-10.3%), are all trading below their IPO prices.

AlpBio’s Successful IPO... Can It Continue?

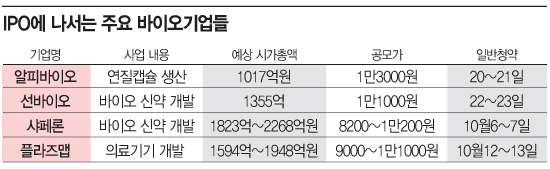

Despite this situation, AlpBio, SunBio, Shaperon, and Plasmap are proceeding with their IPOs, drawing attention to whether they will succeed. Leading the way, softgel capsule manufacturer AlpBio overcame concerns and led a successful IPO. It recorded a demand forecast competition rate of 1,556 to 1, setting the IPO price at the top of the expected band at 13,000 KRW. Furthermore, during the general public subscription held on the 20th and 21st, it achieved a competition rate of 1,518 to 1 and subscription deposits of about 3 trillion KRW.

AlpBio’s sales in the first half of this year reached 68.1 billion KRW, a 24% increase compared to the same period last year, and operating profit also rose 146% to 6.7 billion KRW. The average annual sales growth rate over the past five years is 14%. With a strong market competitiveness, holding a 51.5% share of the domestic softgel capsule market for over-the-counter drugs, continuous growth is expected. However, since AlpBio’s business area differs from typical bio companies focused on new drug development, many believe it is premature to say it will bring a positive wind to the bio IPO market.

The next company to go public, SunBio, aims to transfer its listing from KONEX to KOSDAQ. It possesses ‘pegylation’ technology, which combines polyethylene glycol (PEG) with pharmaceuticals. This technology is said to extend the drug’s retention time or suppress immune responses, thereby enhancing drug efficacy. However, with an IPO price of 11,000 KRW, significantly below the initial expected band of 14,000 to 16,000 KRW, and a low number of applicants for the general subscription starting on the 22nd, a red light has been lit on its success prospects.

New drug development company Shaperon is pursuing a technology-special listing. Its main pipelines include ‘Nugel’ for atopic dermatitis treatment, ‘Nuserin’ for Alzheimer’s dementia treatment, and ‘Nusepin’ for idiopathic pulmonary fibrosis and COVID-19 treatment. It also possesses nanobody technology that lightens existing antibody therapeutics. The expected IPO price band is 8,200 to 10,200 KRW, with demand forecasting scheduled for the 29th and 30th and subscription on the 6th and 7th of next month.

Medical device developer Plasmap, specializing in low-temperature sterilization solutions for surgical instruments and implant revitalization solutions, has postponed its originally planned schedule this month. It will conduct demand forecasting on the 5th and 6th of next month, followed by general subscription on the 12th and 13th. Its medical sterilizer received U.S. Food and Drug Administration (FDA) approval last year.

An industry insider said, "The overall market is unstable and investor sentiment is deeply frozen, making IPO progress difficult rather than the bio industry itself." However, "since AlpBio succeeded in attracting strong interest, it confirms that investor sentiment still exists for capable companies, so a turnaround is worth hoping for."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.