5-Year Nationwide Housing Prices Rise 23%

High-Intensity Regulations Paralyze Market Functions and Cause Sharp Housing Price Surge

[Asia Economy Reporter Park Sun-mi] Over the past five years, housing prices have risen by an average of more than 4.6% annually, leading to an analysis that the housing price bubble has reached an excessive level.

On the 22nd, the Korea Economic Research Institute stated in its report "Controversy and Evaluation of Housing Price Bubbles" that housing prices nationwide have increased by 23% over the past five years, marking the steepest rise since the founding of the nation.

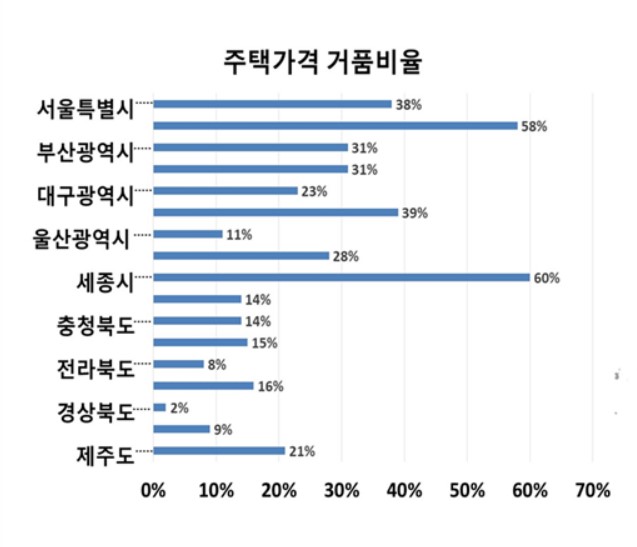

In particular, it was analyzed that prices are overvalued by more than 38% in Seoul, over 58% in Gyeonggi Province, and over 19% in other regions, indicating an excessive housing price bubble.

By region, it was found that there is a price bubble of about 37% in the Gangbuk area of Seoul and about 38% in the Gangnam area, with the bubble level in the affluent Gangnam-Dongnam area exceeding 40%. Especially, Seocho-gu's price bubble was analyzed to exceed 50%, the highest in Seoul.

The housing price bubble in the Gyeonggi area was about 58%, the second highest nationwide after Sejong City (60%). This price bubble phenomenon has intensified particularly since 2019, with interpretations suggesting that the balloon effect caused by the strengthening of high-intensity regulations in major areas of Seoul played a major role.

Researcher Lee Seung-seok of the Korea Economic Research Institute pointed out, “Given Korea’s conditions of high population density relative to land, it is true that an average bubble of about 10-15% has existed in housing market prices, but a housing price bubble approaching 40% is excessive,” adding, “The occurrence of extreme bubble phenomena, with some areas exceeding 60%, can only be seen as a result of housing policy failures such as the balloon effect caused by pinpoint regulations.”

The Korea Economic Research Institute expects confusion in the housing and rental markets to continue this year. As the transition from jeonse (long-term deposit lease) to monthly rent progresses rapidly, the burden on non-homeowners is increasing, but due to the market contraction caused by the rapid interest rate hikes, there is not enough supply on the market to satisfy real demand.

Researcher Lee emphasized, “It is necessary to clearly signal housing supply to demanders,” and added, “At the same time, it is urgent to boldly abolish or ease the extreme housing regulations that have caused confusion and distortion in the housing market to quickly restore the market’s function.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)