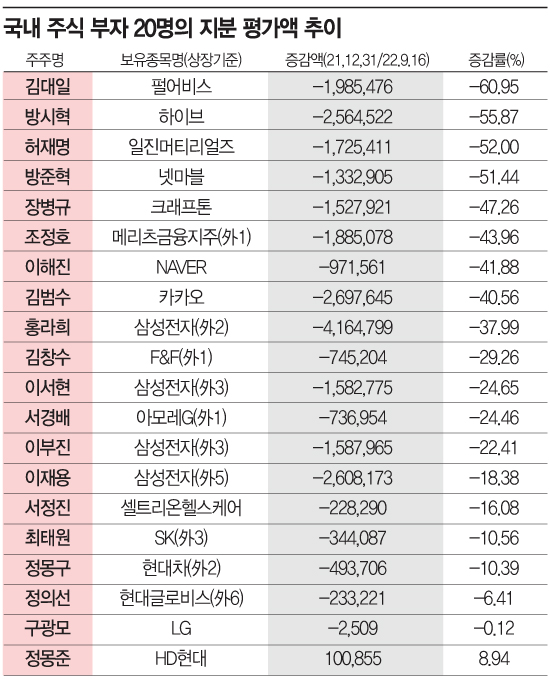

Trends in Shareholding Valuation of Top 20 Domestic Stock Millionaires

Over 27 Trillion Won Lost Compared to End of Last Year

Growth Stock Price Volatility Deepens, Lowering Valuations

Trend Expected to Continue Amid Ongoing Tightening Policy

"-27.3173 trillion KRW"

This is the amount by which the equity valuation of the top 20 domestic stock billionaires disappeared over the past year. It is also the amount lost right at the seats of the largest shareholders of major listed companies in Korea. As the tightening policies and economic recession in the US and Korea swept through the stock market, the equity valuations of the largest shareholders of each company shrank dramatically.

According to fund rating agency FN Guide on the 19th, as of the 16th, the equity valuation of the top 20 chaebols in Korea stood at 63.3742 trillion KRW, down 27.3173 trillion KRW compared to the end of last year. This means that the value of shares owned by stock billionaires, evaluated at the stock prices at each point in time, significantly decreased. Over the past year, even the heads of each company found it difficult to avoid the waves of the stock market.

Among the top 20 stock billionaires, the largest equity valuation was held by Vice Chairman Lee Jae-yong, who controls Samsung Electronics, the KOSPI leader, with 11.5817 trillion KRW. However, the decline in valuation was moderate, ranking in the mid to lower tier. Although Samsung Electronics’ valuation dropped by -28.22% compared to the previous year, Samsung Life Insurance (-0.78%) and Samsung C&T Corporation (-5.04%) performed well, resulting in an overall valuation decrease of about -18.38% compared to the previous year. In fact, Hong Ra-hee, who holds a large portion of Samsung Electronics shares (-36.88%), saw her valuation fall by -37.99%.

The largest drop in valuation was recorded by Kim Dae-il, Chairman of the Board at Pearl Abyss. His valuation decreased by 1.9854 trillion KRW (-60.95%) compared to last year, amounting to only about 39.05% of last year’s value. This was due to the stock price plummeting from 138,300 KRW per share at the end of last year to 54,000 KRW as of the 16th. While the sharp tightening policy and the plunge in growth stock prices were cited as causes, concerns over performance deterioration due to the absence of new releases failed to prevent the falling stock price from dragging down the valuation.

Besides Chairman Kim, most of those whose equity valuations dropped by more than 50% compared to last year were owners of growth stocks. These included Bang Si-hyuk, Chairman of HYBE (-55.87%), Heo Jae-myung, second son of the Iljin Group owner and Chairman of Iljin Materials (-52.00%), and Bang Jun-hyuk, Chairman of Netmarble and Coway (-51.44%).

The only one among the top 20 stock billionaires whose equity valuation increased was Chung Mong-joon, Chairman of the Asan Foundation and largest shareholder of HD Hyundai (formerly Hyundai Heavy Industries). His valuation rose by 100.855 billion KRW (8.94%) compared to the previous year. The rise in stock prices of sectors such as solar power, shipbuilding, secondary batteries, defense, and nuclear power (abbreviated as Tae.Jo.I.Bang.Won) even during the economic recession appears to have boosted Chairman Chung’s valuation.

The decline in valuation among the 20 largest shareholders was greater than the drop in the KOSPI index. During the same period, the KOSPI fell by 19.97%, while the valuations of the top 20 largest shareholders disappeared by 30.12%. This trend is expected to continue unless there are special positive factors for individual companies. For the time being, despite concerns about economic recession, countries are likely to strengthen or maintain tightening policies to curb soaring inflation. The Federal Open Market Committee (FOMC) meeting scheduled for the 20th-21st is highly expected to announce a giant step (a 0.75% increase in the benchmark interest rate). Such tightening policies are likely to drive up government bond yields and the value of the dollar, which could act as negative factors for the domestic stock market.

Lee Kyung-min, a researcher at Daishin Securities, said, "To overcome the current stock market waves, fundamental momentum is needed," adding, "It would require a change in the direction of monetary policy or a reversal to an upward trend in the downwardly revised economic and corporate earnings forecasts, but it does not seem easy at the moment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)