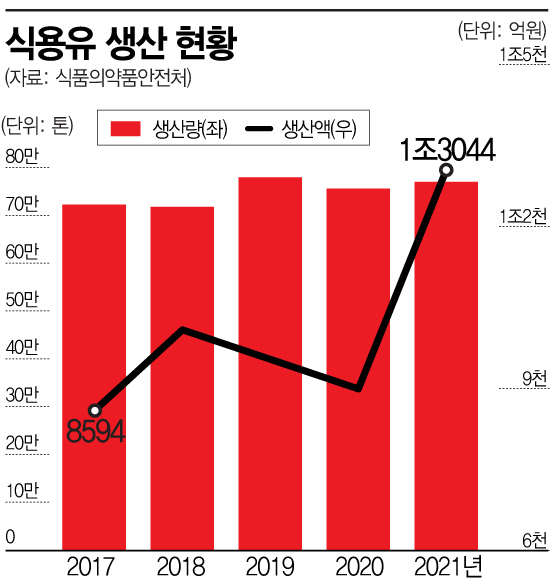

Domestic Edible Oil Production Value Reaches 1.3044 Trillion KRW Last Year, Up 52% in 4 Years

Impact of Rising Raw Material and Logistics Costs

Affordable Soybean Oil Tops at 58%

Following Health-Conscious Trends

Consumer Demand Diversifies and Upgrades

Usage Expands to Salad Dressings, etc.

Olive and Grape Seed Oils Expected to Grow

[Asia Economy Reporter Eunmo Koo] As the use of cooking oil expands from frying to salad dressings and sauces, the related market is expected to continue growing centered on healthy cooking oils such as olive oil.

According to the Ministry of Food and Drug Safety on the 13th, domestic cooking oil production last year was 770,298 tons, an 8.3% increase compared to 722,789 tons in 2017. During the same period, production value rose from 859.4 billion KRW to 1.3044 trillion KRW, a 51.8% increase, showing a larger growth rate in production value than in production volume. This is attributed to the sharp rise in international soybean prices, which surged over 60% in one year as of 2021 due to increases in raw material and logistics costs, leading to price hikes for both household and commercial cooking oils.

By oil type, soybean oil (Daeduyu) accounted for the largest share of total production value at 58.0%, followed by canola oil (13.2%), palm oil types (10.7%), and corn oil (5.9%). Soybean oil contains abundant essential fatty acids such as linoleic acid and is inexpensive, making it widely used not only in households but also in commercial establishments, thus holding the largest share of total production value. Last year, the production value of soybean oil was 765.1 billion KRW, a 38.6% increase from 545.7 billion KRW in 2017.

As cooking oil prices continue to rise, price was found to be the most important factor consumers consider when purchasing cooking oil products. According to the Korea Agro-Fisheries & Food Trade Corporation, consumers prioritize price-related factors such as low price (15.6%) and in-store promotional events (13.0%) when buying cooking oil. The recent widespread increase in food prices appears to have heightened the importance of price considerations. Other factors ranked were raw material quality (12.2%), brand (8.4%), and product quality (8.2%).

Meanwhile, the domestic cooking oil market is shifting its focus from traditional soybean oil to oils perceived as healthier, such as olive oil, following food industry trends emphasizing health. With growing health awareness, cooking methods that use less oil even for frying are being considered, changing the role and preference for cooking oils.

As consumer demands become more segmented and premiumized, the market for premium oils mainly used in salads and pasta, such as olive oil, is growing. Usage is expanding to dressings and other applications in line with the trend toward health-oriented diets that emphasize taste, aroma, and health. In a consumer survey conducted by aT in June, olive oil and grape seed oil were identified as items expected to grow in the future market, while soybean oil and canola oil were seen as items with potential market contraction.

This trend is also reflected in consumer expectations for cooking oils. When asked about desired improvements for cooking oils (multiple responses allowed), 62.8% answered "health-conscious cooking oil," the highest share, followed by "good raw materials" (53.4%) and "hygienic manufacturing" (37.4%). Since concerns about health and safety issues such as cholesterol, trans fats, and genetically modified organisms (GMO) have existed for cooking oils, consumers are expected to seek products that can alleviate these concerns.

Meanwhile, in the domestic household cooking oil market, CJ CheilJedang held an overwhelming market share of 39.9% last year, followed by Sajo Haepyo (20.9%) and Daesang (10.9%) with double-digit shares, and Ottogi (8.4%) and Dongwon F&B (6.1%) trailing behind.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)