All 25 Districts See

Simultaneous Increase in Jeonse Listings

Demand Fails to Keep Up,

Leading to Six Consecutive Months of Price Decline

[Asia Economy Reporter Kim Min-young] As the autumn moving season, typically considered a peak period, approaches, the number of jeonse (long-term lease) listings is increasing, but demand is not keeping pace, resulting in a continued slump in the jeonse market. Due to interest rate hikes and loan regulation measures, it is becoming increasingly difficult to find tenants willing to pay jeonse prices at market rates despite the autumn moving season. Recently, with jeonse prices weakening and demand decreasing simultaneously, concerns about the spread of reverse jeonse difficulties are growing.

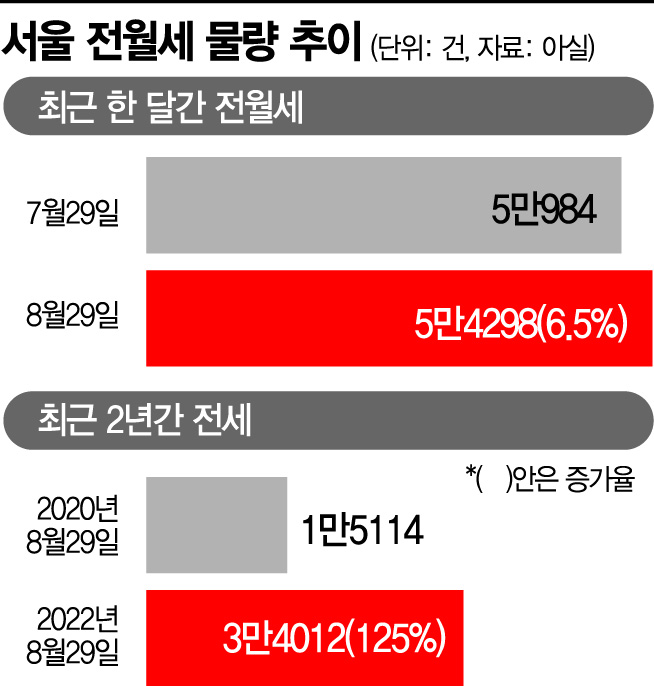

According to real estate big data company Asil on the 29th, as of that date, the total number of apartment jeonse and monthly rent listings in Seoul was 54,298, a 6.5% increase compared to a month earlier. This increase is the fourth largest nationwide following Jeju (19.6%), Gwangju Metropolitan City (8.7%), and Gyeonggi Province (6.7%). Listings in major metropolitan areas such as Busan (5.6%), Incheon (4.3%), and Daegu (4.0%) also rose compared to the previous month. Contrary to some expectations that a jeonse crisis would occur in the second year of the implementation of the Lease Protection Act (Imdaecha 2-beop), the number of listings has returned to levels seen before August 2020. Pure jeonse listings increased by 125%, from 15,114 two years ago to 34,012.

During the same period, monthly rent listings rose by 53.2%, from 13,241 to 20,286, meaning the increase in jeonse listings is more than double that of monthly rent. Even in the past month alone, Mapo-gu saw jeonse listings rise 18.7% to 1,178, with Gwangjin-gu (18.2%), Gwanak-gu (14.8%), Seongbuk-gu (14.8%), and Guro-gu (14.3%) also experiencing double-digit increases. All 25 districts in Seoul saw jeonse listings rise simultaneously over the past month. The only district where jeonse and monthly rent listings decreased was Gangbuk-gu (471 listings, -3.9%).

With listings increasing but demand failing to keep up, jeonse prices are showing weakness. According to the Korea Real Estate Board, Seoul apartment jeonse prices, which rose 6.48% last year, have fallen 0.46% through July this year. This marks six consecutive months of decline since February. The increased interest burden from rate hikes and loan regulation measures appear to be influencing this trend. Due to the interest rate hikes, the upper limit on jeonse loan interest rates at the four major commercial banks has risen to 5.95%, causing the jeonse-to-monthly rent conversion rate to invert when converting jeonse deposits to monthly rent. This has led to increased demand for semi-jeonse (ban-jeonse), where tenants pay monthly rent instead of raising the deposit. In June, the jeonse-to-monthly rent conversion rate for Seoul apartments was 4.2%.

In some areas, due to a lack of new demand, landlords are unable to find tenants even when lowering jeonse prices by 100 million to 200 million KRW below market rates, raising concerns about reverse jeonse difficulties where landlords cannot return deposits after lease expiration. In Sadang-dong, it is currently possible to find jeonse listings with larger floor areas for the same deposit. A real estate agent in Dongjak-gu said, "In Sadang-dong’s Geukdong Apartments, you can find a 30-pyeong jeonse for the price of a 20-pyeong," adding, "Due to recent factors such as flooding, jeonse price offers in the Sadang-dong area have dropped by about 20 million KRW."

Seo Jin-hyung, co-representative of the Fair Housing Forum and professor at Gyeongin Women's University, said, "Due to changes in real estate policies such as interest rate hikes and supply expansion, reverse jeonse difficulties are occurring in some areas," adding, "If sales prices stabilize, it will be difficult to raise jeonse prices, so concerns about reverse jeonse difficulties are expected to continue for the time being."

If reverse jeonse difficulties persist, conflicts between tenants and landlords may increase, and tenants’ freedom to move may be restricted. Professor Seo explained, "If landlords cannot find new tenants and thus cannot return deposits, conflicts between landlords and tenants may intensify," adding, "From the tenant’s perspective, reverse jeonse difficulties cause anxiety about deposit returns and can affect new lease contracts and relocation plans depending on whether the deposit is returned."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)