Commercial Banks Lowered Loan Rates by 0.5%p Last Week but Ineffective

Loan Rates Likely to Rise Starting This Week

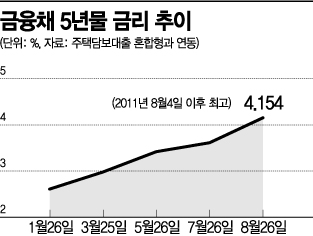

Bank Funding Rates on Financial Bonds Begin Rapid Increase

1-Year and 5-Year Financial Bond Rates Reach Highest in 11 Years

Savings Deposit Rate Hikes Also Push Loan Rates Up

US Rate Hike Signals Also Impact

Rates Expected to Reach 7% Soon

As the U.S. central bank, the Federal Reserve (Fed), hinted at additional interest rate hikes, attention is increasing on whether the Bank of Korea's Monetary Policy Committee will raise rates at its meeting scheduled for the 25th. The photo shows a counter at a commercial bank in downtown Seoul on the 19th. Photo by Hyunmin Kim kimhyun81@

As the U.S. central bank, the Federal Reserve (Fed), hinted at additional interest rate hikes, attention is increasing on whether the Bank of Korea's Monetary Policy Committee will raise rates at its meeting scheduled for the 25th. The photo shows a counter at a commercial bank in downtown Seoul on the 19th. Photo by Hyunmin Kim kimhyun81@

Office worker Seo Hee-su (43, pseudonym) had been weighing the timing to take out a 50 million KRW unsecured loan for a month before visiting the bank last week. Seo said, "In this period of rising interest rates, borrowing money when the rate is even 0.1 percentage point lower feels like avoiding a loss," adding, "As soon as I saw an article that banks would lower loan interest rates after disclosing the loan-deposit interest rate spread, I rushed to get a loan the next day, on the 25th."

Last week, commercial banks collectively lowered loan interest rates by at least 0.1 percentage points and up to 0.5 percentage points by product, prompting financial consumers like Seo to act quickly. However, it is premature to predict that this measure will calm the upward trend in loan interest rates. The dominant view in the financial sector is that loan interest rates will rise again starting this week.

Banks issue financial bonds to secure loan funds, and the interest rate on these bonds recently hit an 11-year high. The financial bond rate is known as the bank's 'funding cost,' which directly affects the loan interest rates offered to customers. A representative from a commercial bank said, "Loans from commercial banks, which reflect the funding cost level daily, will start to see interest rate increases this week," adding, "This will affect all areas, including unsecured loans and mortgage loans."

According to the Bond Information Center of the Korea Financial Investment Association on the 29th, the 5-year financial bond rate linked to fixed (hybrid) mortgage loan rates recorded 4.154% as of the 26th. This is the highest point in 11 years since 4.21% on August 4, 2011. The 1-year financial bond rate, which serves as the benchmark for unsecured loans, was 3.699% on the 26th. On the 25th, it reached 3.709%, also the highest since 3.70% on November 1, 2011. This reflects the immediate impact of the Bank of Korea's base rate hike.

Rising deposit interest rates at commercial banks and the U.S.'s intention for further rate hikes are also fueling the increase in loan interest rates. Last week, commercial banks raised deposit interest rates by up to 0.5 percentage points in addition to lowering loan rates after disclosing the loan-deposit interest rate spread. While rising deposit rates are welcome news for financial consumers, this move inevitably pushes up the COFIX, which serves as the benchmark for next month's variable mortgage loan rates, making it a case of 'a change in appearance but not in substance' from the borrower's perspective.

A financial sector official said, "Since even the Governor of the Bank of Korea hinted that Korea will continue to raise its base rate until the U.S. stops hiking rates, loan interest rates will keep rising for the time being," adding, "Banks lowering loan spread rates slightly is insufficient to reverse the trend during a rate hike period, so loan interest rates could rise to 7% by the end of the year." As of the 29th, the five major banks' rates are 4.30?6.309% for variable-rate mortgages, 4.17?6.303% for hybrid mortgages, and 4.86?6.13% for unsecured loans.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)