[Asia Economy Reporter Song Hwajeong] The Financial Services Commission (FSC) stated that the disclosure of banks' loan-to-deposit interest rate spreads will expand consumer choice and promote market-driven competition, thereby enhancing the transparency and rationality of interest rate management.

On the 23rd, the FSC announced that it will actively strive to ensure the successful establishment of the loan-to-deposit interest rate spread disclosure.

The FSC explained, "The strengthening of disclosure on banks' loan-to-deposit interest rate spreads and loan and deposit interest rates was implemented to expand consumer choice and promote market-driven competition, thereby improving the transparency and rationality of interest rate management," adding, "We expect these effects to materialize in the future."

The Korea Federation of Banks publicly compared banks' loan-to-deposit interest rate spreads for the first time yesterday and also strengthened the disclosure of existing loan and deposit interest rates. However, some voices express concerns that despite the strengthened disclosure, the effect may not be significant and there could be side effects such as a contraction in loans to middle- and low-credit borrowers.

Regarding opinions that the disclosure of loan-to-deposit interest rate spreads is causing deposit interest rates to rise → COFIX (Cost of Funds Index) to increase → loan interest rates to rise, the FSC stated, "Since both deposit and loan interest rates use market interest rates as reference rates, it is necessary to consider that they rise in tandem with market interest rate increases," adding, "However, deposit and loan interest rates are not determined solely by market interest rates but are also influenced by various bank interest rate policies (such as additional interest rates and branch-level decision rates). Therefore, if the disclosure of loan-to-deposit interest rate spreads promotes banks' autonomous competition, it will improve financial consumers' benefits."

Regarding concerns that the expansion of loan-to-deposit interest rate spreads may lead to avoidance of loans to middle- and low-credit borrowers who generally face higher loan interest rates, the FSC acknowledged, "It is true that some regional banks and internet banks, which have a high proportion of loans to middle- and low-credit borrowers, may show higher average loan-to-deposit interest rate spreads," and added, "To sufficiently explain these bank-specific characteristics, disclosures also include loan-to-deposit interest rate spreads by credit score and average credit scores."

In response to opinions that financial authorities may impose disadvantages on banks with high or expanding loan-to-deposit interest rate spreads in the future, the FSC emphasized that deposit and loan interest rates are autonomously determined in the market and that financial authorities cannot directly intervene in the levels of deposit and loan interest rates. The FSC plans to ensure the smooth progress of improvements to the interest rate calculation system, which is being carried out together with the banking sector, as interest rate calculation must be conducted through reasonable and transparent procedures.

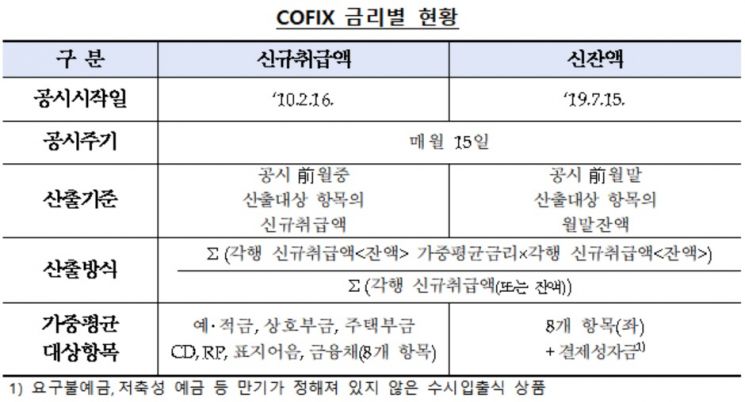

Additionally, the FSC plans to promote new balance COFIX loans, which have a slower rate increase during periods of rising interest rates, in the third quarter to alleviate consumers' interest rate burdens. New balance COFIX includes low-cost deposits such as demand deposits in its interest rate calculation, resulting in relatively lower and less volatile rates. COFIX refers to the Cost of Funds Index calculated as the weighted average funding cost of eight major banks (Kookmin, Shinhan, Woori, Hana, SC, Citi, Nonghyup, and Industrial Bank of Korea). It is disclosed on the Korea Federation of Banks' website, categorized by new loan amount, balance, and new balance.

An FSC official said, "The financial authorities will continue to make every effort in supervisory duties to alleviate financial consumers' interest rate burdens during periods of rising interest rates by promoting banks' autonomous interest rate competition," adding, "While expanding consumer choice through the activation of new balance COFIX loans, we will continuously improve the disclosure system of loan-to-deposit interest rate spreads and the operation performance disclosure system of the right to request interest rate reductions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)