Low Volatility Amid Memory Market Conditions

Increasing Demand Across Various Sectors

Top Pick Among Post-Processing Related Stocks

[Asia Economy Reporter Kwon Jae-hee] Amid the semiconductor industry's downturn casting a shadow over the entire industrial outlook, the test socket industry is gaining attention like a ray of light. Even though the outlook for the upstream semiconductor industry is uncertain, socket companies have secured downside resilience in earnings as sample sockets account for more than half of their sales. The increasing demand in various fields such as automotive semiconductors, artificial intelligence (AI), Internet of Things (IoT), and autonomous driving chips is also cited as a remarkable reason.

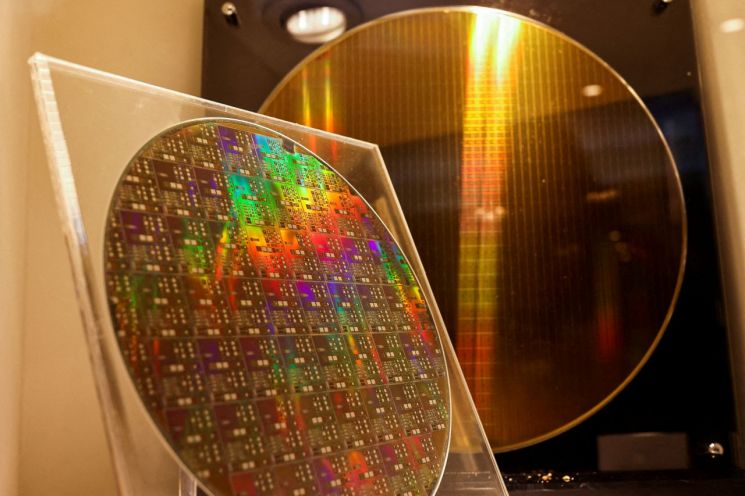

According to the financial investment industry on the 23rd, recently, securities firms have identified socket-related stocks as the top picks among semiconductor backend inspection-related stocks. Semiconductor test sockets are consumable components used to determine defects in semiconductors after the final packaging process. Among semiconductor backend inspection-related stocks, there are major categories such as sockets, consumables, and equipment, with sockets showing relatively less volatility depending on the memory market conditions.

The outlook is also bright. Demand growth in multiple industrial sectors such as HPC (High Performance Computing), automotive semiconductors, AI, IoT, and autonomous driving is expected to accelerate growth. The semiconductor test socket market recorded single-digit growth from 2011 to 2016. Since 2017, it has seen a 23.9% increase driven by the semiconductor boom triggered by data centers, followed by double-digit growth such as 18.7% in 2019 due to the initial effects of the introduction of 5th generation mobile communication (5G).

The minimal impact from the semiconductor industry's downturn, which is the upstream industry, is also attractive. Socket companies' sales of sample sockets for new chip development account for 40-60% of total test socket sales. Even if mass production test socket sales decline, the overall sales impact is minimal, enabling stable profit generation. In fact, the semiconductor market in 2019 decreased by 11.3% compared to the previous year due to the base effect of the semiconductor market boom in 2017 and 2018, but the test socket market increased by 18.7% as chip R&D and mass production in new fields such as 5G, AI, and IoT increased.

Representative semiconductor test socket companies include Rino Industrial, ISC, and TSE. ISC is a global leader in this field, supplying to over 400 global semiconductor companies such as Samsung Electronics, SK Hynix, Intel, and Qualcomm.

Park Sung-hong, a researcher at Korea Investment & Securities, said, "ISC's non-memory sales account for 66%, so performance changes due to memory market fluctuations are not significant, and with the increase in server CPU sales, which was unprecedented in the past, non-memory socket sales are expected to increase by 158% year-on-year this year." He added, "Rino Industrial is also seeing an increase in socket shipments as the proportion of socket sales in high value-added industrial sectors beyond mobile is growing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)