International Oil Prices Expected to Reach $100

S-Oil Stock Rises 10% in One Week

[Asia Economy Reporter Minji Lee] Amid growing concerns over an energy crisis due to the sharp rise in European natural gas prices, forecasts that international oil prices will surpass $100 again are gaining traction. The stocks of refining companies, which were beneficiaries of the oil price increase earlier this year, are also fluctuating.

According to the Korea Exchange on the 23rd, as of 9:40 a.m., S-Oil's stock price was 98,700 KRW, up 1.23% from the previous trading day. On the 16th, S-Oil's stock traded around 89,600 KRW, marking an increase of over 10% in just one week. Other refining-related stocks are also showing upward trends at this time. Jungang Enervis rose 7%, Hyundai Electric 3.34%, and Heungkuk Oil 1.8%. The rebound in international oil prices, which had sharply declined since last month, has caused related stocks to respond.

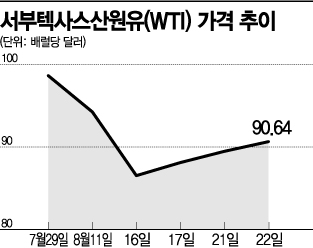

According to the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) crude oil stood at $90.64 per barrel as of the previous day. While oil prices, which exceeded $100 per barrel in early July, sharply dropped to $85 this month, they have been rising again since mid-month. Early this month, concerns over demand slowdown due to China's weak real economy indicators pulled oil prices down, but the low crude oil inventory levels and expectations that oil will replace heating demand this winter are pushing prices back up.

Saudi Arabia, the largest oil producer, mentioning the possibility of production cuts to control imperfect supply and demand is also supporting the floor for oil prices. Saudi Energy Minister Abdulaziz bin Salman stated, "To prevent extreme volatility and disruption in the oil market, OPEC+ member countries will sign a new agreement based on their past successful experiences." Recent oil price levels are close to Saudi Arabia's fiscal breakeven point of around $80 per barrel.

In the market, it is said that in the short term, oil prices may fall whenever the stalled Iran nuclear deal restoration issue is highlighted. However, in the mid-to-long term, oil consumption for winter heating is expected to increase, making it likely that prices will comfortably exceed the $100 mark. The ongoing Russia-Ukraine war, which has driven up European natural gas prices, remains uncertain and could further push up international oil prices.

Hwang Byung-jin, a researcher at NH Investment & Securities, said, "Due to the U.S. LNG export disruptions, natural gas and coal markets have surged mainly in Europe and Asia, and even if this situation eases, the possibility of Russian provocations remains," adding, "Regardless of Iran's resumption of oil exports, demand for oil as a substitute for gas and coal will increase in winter." Shim Soo-bin, a researcher at Kiwoom Securities, also said, "Russia announced a three-day gas supply cut to Europe at the end of this month, raising expectations for oil demand as a substitute for natural gas," and added, "If U.S. weekly crude oil and gasoline inventories continue to decline, the fall in oil prices will be limited."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)