25.9% Increase from Last Year-End to 52 Trillion

Impact of Soaring Raw Material Costs and Demand Decline

[Asia Economy Reporter Moon Chae-seok] Samsung Electronics' inventory assets have exceeded 50 trillion won for the first time. The reason for the inventory buildup in the first half is attributed to concerns about economic recession, rising prices, and uncertainties related to the COVID-19 endemic. Companies are managing the crisis by lowering production operating rates. Finished product (set) companies such as home appliances are cautiously looking forward to recovery in the second half, while semiconductor companies are presenting conservative forecasts.

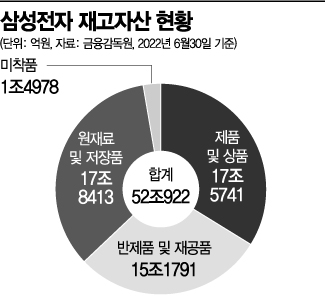

According to the half-year reports submitted by each company to the Financial Supervisory Service on the 18th, Samsung Electronics' total inventory assets as of the end of June amounted to 52.0922 trillion won, an increase of 10.7078 trillion won (25.9%) compared to the end of last year. This marks the first time it has surpassed 50 trillion won. The increase rates by division were 30.7% for the DS (semiconductor) division, 21.3% for the DX (Device Experience) division, and 21.8% for the Display division. The proportion of inventory assets in Samsung Electronics' total assets rose by 1.9 percentage points from last year to 11.6%.

Not only Samsung but also major companies overall have shown an increase in inventory. SK Hynix, which operates in the memory semiconductor business, saw its inventory assets grow by 33.2% to 11.8787 trillion won during the same period compared to the end of last year. LG Display, engaged in the TV panel business, also increased its inventory assets by 41% to 4.7225 trillion won during this period. LG Electronics recorded an increase in inventory assets as of the end of June compared to the end of last year in its home appliance division producing washing machines and refrigerators, TV division, and automotive parts division.

The industry diagnosis is that external adverse factors in the first half had a significant impact on the inventory increase. Supply chain disruptions caused by the Russia-Ukraine war led to a sharp rise in raw material costs, while consumer demand decreased, resulting in inventory accumulation across sets and semiconductors alike. Production costs rose, but buyers were scarce, rendering all efforts ineffective.

Companies are accelerating inventory normalization by lowering production line operating rates. Samsung Electronics reduced the operating rate of its mobile phone production line from 81.0% in the first quarter to 70.2% in the second quarter. LG Electronics also lowered the second-quarter operating rates compared to the previous quarter for refrigerators (127%→119%), washing machines (99%→81%), and air conditioners (129%→108%). LG Display's Gumi plant reduced its operating rate from 100% to 97% during the same period. SK Hynix stated that it is reviewing its facility investments. It was reported last month that the board of directors postponed the resolution plan for expanding the Cheongju plant in Chungcheongbuk-do as of the end of June. SK Hynix also lowered its memory semiconductor demand forecast for the second half during its Q2 conference call at the end of last month. This indicates that the company intends to maintain a conservative management stance in consideration of the inventory increase.

Set companies aim to normalize inventory in the second half. Semiconductor companies believe recovery will not be easy in the second half either. A set industry official said, "Actively utilizing demand-increasing factors such as the World Cup and Black Friday in the second half will be a task for set companies to reduce inventory assets." An SK Hynix official said, "The semiconductor market outlook for the second half does not look very bright, and with customers (set companies, etc.) also holding high inventory, we will pursue a management strategy that avoids excessive sales."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)