①China Already Dominates the Battery Value Chain... 7 Years to Build Mines and Refining Plants

②Domestic and European Markets Open and Nearly as Large as North America

③Korean Batteries Partner with Top 3 US Automakers... 90% of Raw Materials Imported from China

[Asia Economy Reporter Jeong Dong-hoon] The Inflation Reduction Act (IRA) promoted by the United States embodies a determination to thoroughly exclude countries competing for hegemony in industrial and security sectors, such as China and Russia. In particular, in the next-generation advanced industry of batteries, there is a strategic intention to tighten and isolate China’s global supply chain, but insiders and outsiders in the industry highly predict that this strategy is likely to fail.

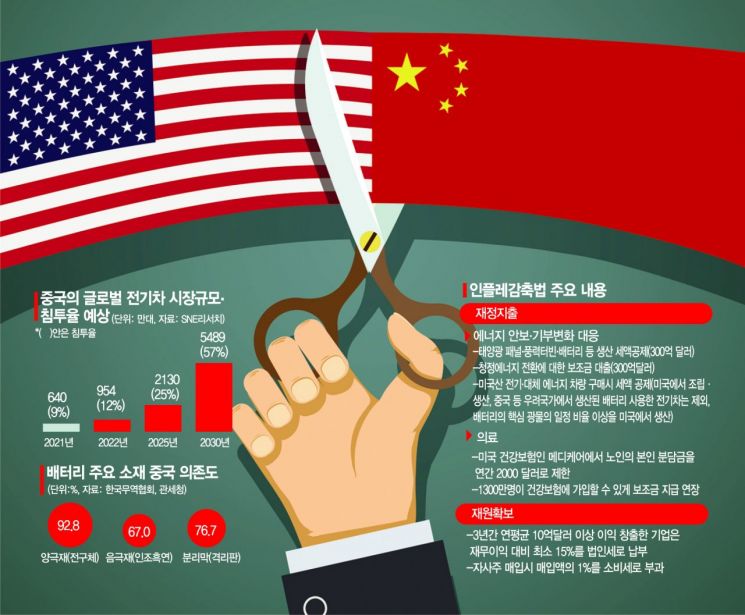

Signed by U.S. President Joe Biden on the 17th, the IRA includes provisions that completely exclude tax credit benefits if electric vehicle battery minerals or components from "concerned countries" are included. The IRA specifies that battery minerals such as aluminum, graphite, lithium, and nickel must be mined and processed in countries that have free trade agreements (FTA) with the U.S. or recycled in the North American region to receive up to half of the maximum subsidy ($3,750, approximately 4.91 million KRW). The required ratio to qualify for the subsidy starts at 40% next year and must increase to 80% by 2027.

Once this law is enforced, major battery components such as cathode materials, anode materials, and electrolytes must be manufactured or assembled in the North American region to receive half of the subsidy. The domestic manufacturing ratio must increase from 50% in 2023 to 60% in 2024-2025, 70% in 2026, 80% in 2027, 90% in 2028, and eventually reach 100% thereafter.

However, industry insiders evaluate that the impact of the U.S. strategy to isolate Chinese batteries will be localized and limited to North America, as China already dominates most of the battery value chain. This is also why Korean companies have no choice but to continue battery cooperation with China.

China Dominates Battery Value Chain... It Takes 7 Years Just to Build a Refinery

The first reason why the U.S. battery isolation strategy is difficult to succeed is that China has absorbed most of the global market in mining, refining, and processing minerals used in batteries. Except for graphite, China does not mine battery minerals domestically but has secured mining rights in major overseas mines in Africa and South America. These minerals are then brought to domestic factories to be produced into battery material compounds. The global market share in processing and refining reaches 50-70% depending on the material. Neither the U.S. government nor companies can simply build mining and refining plants in North or South America overnight. According to battery information company Benchmark Mineral Intelligence, it takes about seven years to build mines and refining plants producing battery material minerals and 2-3 years to build battery factories. This means it will take considerable time for the U.S. to secure the battery supply chain from mining to refining, yet the IRA imposes stringent standards starting next year.

The second reason is that China has a large electric vehicle battery market comparable to North America. Even if China is thoroughly excluded from the North American market, the growth of Chinese electric vehicle companies and the size of the domestic market surpass North America. It is forecasted that by 2030, the Chinese electric vehicle market will account for about 57% of the global market. According to SNE Research, last year China’s electric vehicle market grew 167% year-on-year, raising the electric vehicle penetration rate in China to 9%. It is expected to rise to 12% this year and reach 54.89 million vehicles with a penetration rate of 57% by 2030.

U.S. Electric Vehicles Cannot Run Without Korean Batteries... Korea’s Dependence on Chinese Raw Materials Exceeds 90%

The third reason is that Korean battery companies, which have partnered with all three major U.S. automakers, cannot be excluded. U.S. automakers such as GM, Ford, and Stellantis continue trillion-won scale investments locally in North America with domestic complete battery cell companies like LG Energy Solution, SK On, Samsung SDI, as well as material companies such as POSCO Chemical and EcoPro BM. However, most Korean battery companies import raw materials from China. Although they diversify import sources to South America, Africa, and Southeast Asia, their dependence on China is so high that they cannot manufacture batteries without completely excluding China. According to the Korea International Trade Association, last year the import value of raw materials such as tungsten oxide, calcium hydroxide, and manganese hydroxide used in precursors for cathode materials was $1.99512 billion (approximately 2.35 trillion KRW). Of this, 92.8%, or $1.85081 billion (approximately 2.18 trillion KRW), was imported from China. The dependence on China for other cathode materials like cobalt oxide and anode core materials like artificial graphite was 63.9% and 67.0%, respectively. The dependence on China for separator raw materials, one of the three major battery materials, also reached 60.8%.

Moreover, battery manufacturing companies continue alliances and collaborations with Chinese companies in research and production fields. China is also evaluated to have well-established research infrastructure, including numerous institutions and universities related to the battery sector. Regarding parts in the IRA, since finished product manufacturing plants are built locally, there is no major difficulty. In the mineral sector, depending on the detailed criteria set for mining, refining, and processing countries, the China isolation strategy may take different paths, but the probability of it ending as a "flash in the pan" is increasing. Professor Park Jung-wan of the Department of Automotive Engineering at Seojeong University said, "The U.S. battery sector’s China 'isolation strategy' is highly likely to fail," adding, "From Korea’s standpoint, which has high dependence on Chinese raw materials, it is necessary to exert diplomatic efforts to favorably influence detailed regulations or obtain exceptions from the U.S."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.