Export Controls on Four Key Technologies

Production of Semiconductor Chips Above 3nm

EDA Software Blocked

Limited Impact on Domestic Companies like Samsung

Chinese Clients' Contract Manufacturing, etc.

Long-term Risk Management Needed

[Asia Economy Reporter Moon Chae-seok] As the United States imposes export restrictions on semiconductor design software for 3nm (nanometer; 1nm is one billionth of a meter) and above to China, South Korean semiconductor companies such as Samsung Electronics' foundry (semiconductor contract manufacturing) are closely monitoring the situation. Since advanced processes are mainly carried out domestically, the short-term impact is not significant, but because major customers of U.S. chip design software companies are Chinese firms, this could pose a risk to semiconductor contract manufacturing for Chinese clients in the future.

According to the semiconductor industry and foreign media on the 17th, export restrictions related to four technologies for advanced semiconductors and turbine production have come into effect in the United States. Although China was not directly named, the phrase "to prevent nefarious military and commercial use" was used to justify the restrictions, which strongly supports the interpretation that this is effectively a "China-targeted law." One of the four restrictions is on electronic design automation (EDA) software for semiconductor chip production of 3nm and above.

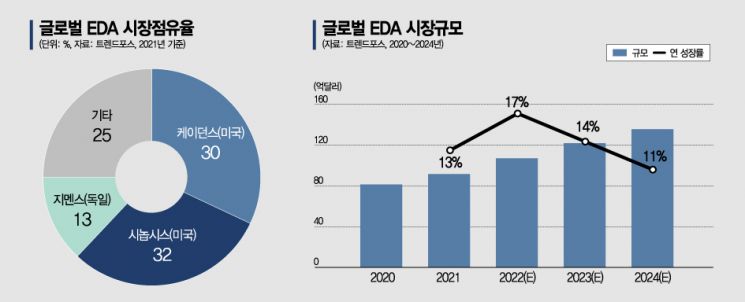

EDA is essential software for design, testing, and verification that enhances the productivity of advanced semiconductors used in fields such as artificial intelligence (AI), machine learning (ML), and autonomous driving. It operates closely within the foundry's key supply chain alongside design assets (IP), design houses, and OSAT (post-processing). According to Taiwanese market research firm TrendForce, the EDA market share is held by Synopsys (32%), Cadence (30%), and including Germany's Siemens (13%), these are called the "world's top three EDA companies." The EDA market is expected to grow from $8.1 billion (approximately 10.6 trillion KRW) in 2020 to $13.6 billion (approximately 17.8 trillion KRW) by 2024.

Since U.S. companies virtually dominate the EDA market, industry insiders view the U.S. government's regulations as highly binding. TrendForce analyzed that the U.S. restrictions will significantly impact Chinese fabless (design-specialized) companies. TrendForce stated, "Without U.S. companies' EDA tools, Chinese IC (integrated circuit) design will face difficulties throughout the development process, from initial chip design to backend (post-processing) system design."

Summarizing the domestic industry's response, it is "the short-term impact on Samsung Foundry is limited, but long-term risk assessment is necessary." It is reported that major semiconductor companies such as Samsung Electronics and SK Hynix have not yet taken company-wide measures in response to the Chinese EDA regulations. An industry official said, "Since this is not a direct check targeting Samsung Foundry, the immediate impact is limited."

Samsung Electronics has been diversifying its supply chain and managing risks by collaborating with Synopsys, Cadence, and Siemens. In November last year, Samsung Electronics held the 'SAFE Forum' in the U.S. and announced that it had secured more than 80 EDA tools and technologies, including AI-based EDA optimized for the 3nm GAA (Gate-All-Around) process structure, systematically managing and analyzing design infrastructure and data.

There is also an opinion that the difficulty in utilizing the most advanced 3nm process when receiving system semiconductor contract manufacturing orders from Chinese clients could pose a considerable risk in the long term. An industry official said, "(The U.S. China EDA regulation) is a management variable that must be observed over the long term," adding, "It is so important that it is said there is virtually no case where design can be done without using (U.S. companies') EDA tools."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)