Jusan Research 'August Apartment Sales Outlook Index'

Down 9.1 Points from Previous Month to 61.3

Incheon, Gyeonggi, and Daegu Remain in the 40s

"Affected by Economic Downturn and Interest Rate Hikes"

[Asia Economy Reporter Hwang Seoyul] The nationwide apartment pre-sale outlook index has shown a decline for three consecutive months, indicating a still gloomy outlook for the pre-sale market. In particular, Incheon, Gyeonggi, and Daegu are predicted to have very negative prospects.

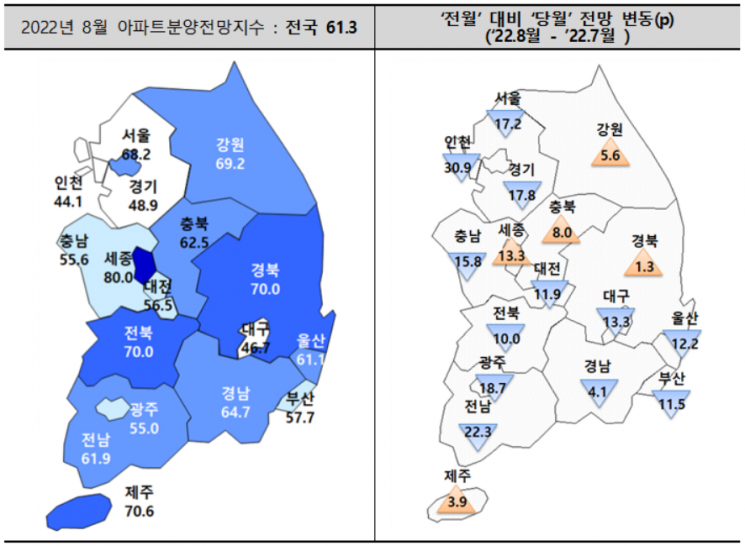

According to the Korea Housing Industry Research Institute (hereinafter referred to as KHIRI) on the 16th, the apartment pre-sale outlook index for August is expected to worsen by 9.1 points from the previous month to 61.3. The index has been declining for three consecutive months since May (87.9). The apartment pre-sale outlook index is a measure that supports the management of the pre-sale market through situation assessment and risk diagnosis, surveyed among members of the Korea Housing Association and the Korea Housing Builders Association.

Specifically, the metropolitan area is forecasted at 53.7, down 22 points from last month (75.7). Seoul recorded 68.2, down 17.2 points from the previous month (85.4), while Incheon (44.1) and Gyeonggi (48.9) fell by 31.1 points and 17.8 points respectively compared to the previous month, remaining in the 40-point range, indicating very negative market outlooks.

All provincial metropolitan cities showed a downward outlook, dropping about 9 points from 68.6 last month to 59.5. Busan (57.7) decreased by 11.5 points, Daejeon (56.5) by 11.9 points, and Gwangju (55.0) by 18.7 points. Daegu (46.7) fell into the 40-point range, decreasing by 13.3 points from 60.0 last month.

On the other hand, Gangwon (63.6→69.2), Gyeongbuk (68.8→70.0), and Jeju (66.7→70.6) saw slight increases of around 5 points in their outlook indices, and Sejong showed the largest increase among all cities and provinces nationwide, rising 13.3 points from 66.7 to 80.0 this month.

KHIRI analyzed, "Concerns over economic recession and rapid interest rate hikes have increased buyers' burdens, along with growing worries about falling housing prices, which appear to have deepened the transaction freeze." They added, "With the easing of private supply regulations such as the reconstruction excess profit recovery system and safety inspections expected, it is necessary to observe the impact of expectations for revitalizing private redevelopment projects on the pre-sale outlook."

Meanwhile, the nationwide average pre-sale price index for August is expected to fall by 4.8 points from the previous month to 106.9, and the pre-sale volume index is forecasted to decrease by 0.5 points to 89.2. The unsold housing index is predicted to increase by 8.9 points to 124.3.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)