KHNP Virtually Secures Eldaba Nuclear Power Plant Contract... Contract Signing Likely by Month-End

'$30 Billion' Mega Project... Construction of Four 1200MW-Class Nuclear Reactors

Challenges Due to Ukraine Crisis... Success in Order Using 'Desert Nuclear Power Plant' Expertise

President Yoon Accelerates Vision for 'Nuclear Power Superpower'... Increased Possibility of Saudi Nuclear Power Plant Order

Korea's first exported nuclear power plant, Barakah Unit 1 in the United Arab Emirates (UAE). [Image source=Yonhap News]

Korea's first exported nuclear power plant, Barakah Unit 1 in the United Arab Emirates (UAE). [Image source=Yonhap News]

[Asia Economy Sejong=Reporter Lee Jun-hyung] "It was not easy due to unexpected sudden variables."

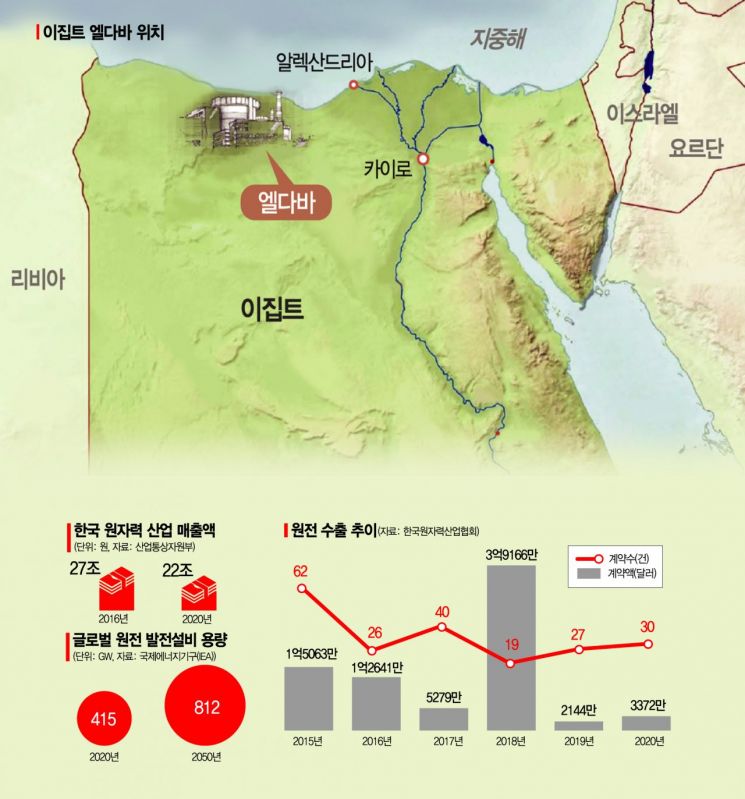

This is the evaluation of an internal official at Korea Hydro & Nuclear Power (KHNP) regarding the contract for the El-Dabaa nuclear power plant project in Egypt. KHNP was selected as the sole negotiation partner at the end of last year and expected the formal contract to be signed by the end of April this year. However, negotiations became complicated due to the outbreak of the Ukraine crisis during the final stages of contract signing. This was because the main contractor for the El-Dabaa nuclear power plant was JSC ASE, a subsidiary of the Russian state-owned nuclear company Rosatom. The fact that major countries such as the United States strengthened financial sanctions against Russia, just before a large-scale nuclear power project requiring massive funding, also became an obstacle. Consequently, there were negative views that it would not be easy for JSC ASE, a Russian state-owned company, to sign a multi-trillion won contract with KHNP.

US and France Also Participate... A ‘Rainfall’ for Korea’s Nuclear Industry

However, from Russia’s perspective, it was difficult to find a nuclear partner as good as Korea. Korea had accumulated desert nuclear power plant experience through the Barakah nuclear power plant in the United Arab Emirates (UAE). Korea has been sequentially operating Barakah Units 1 and 2, its first exported nuclear power plants, since last year, successfully proving its capability in desert nuclear power plant construction and operation. Since the El-Dabaa nuclear power plant is also being built in the desert, the know-how Korea gained in the UAE served as a strong competitive advantage.

The participation of Western companies in the construction of the El-Dabaa nuclear power plant was also a background factor that allowed KHNP to safely secure the project. Major Western companies such as General Electric (GE) from the United States and Assystem from France are also significantly involved in the El-Dabaa project. Jeong Jae-hoon, president of KHNP, recently explained on social media that "Many allied country companies, including those from the US, are participating in the (El-Dabaa) project."

Domestic nuclear power companies, which were on the brink of collapse due to the Moon Jae-in administration’s ‘nuclear phase-out’ policy, have received a much-needed boost from this export. The second phase of the El-Dabaa nuclear power plant construction, won by KHNP, accounts for 5 to 10% of the total project scale (USD 30 billion). Considering that KHNP’s share alone exceeds 2 trillion won and that many domestic companies supply parts, the ‘trickle-down effect’ on the nuclear industry is expected to be significant. Immediately, the construction of the El-Dabaa nuclear power plant is planned to be undertaken by Doosan Enerbility, a leading domestic nuclear company. This means that more than 200 Doosan Enerbility partner companies are likely to see an increase in work orders.

Proving K-Nuclear Competitiveness... "Urgent Need to Restore Supply Chains"

The government’s goal of winning nuclear power plant contracts worth 60 trillion won is also gaining momentum. The government has already thrown its hat into the ring for the Czech Dukovany nuclear power plant project, worth 8 trillion won. The new nuclear power plant construction project worth 40 trillion won, promoted by Poland, is also one of the projects the government is targeting. This is why Minister of Trade, Industry and Energy Lee Chang-yang visited the Czech Republic and Poland as his first overseas business trip in June to conduct ‘nuclear power sales.’ Thanks to these sales efforts, the Czech government is reportedly evaluating the Korean-type nuclear power plant (APR-1400) positively.

The possibility of winning the Saudi Arabia nuclear power plant project has also increased. Earlier, Saudi Arabia sent a request for bid participation to four countries?Korea, France, China, and Russia?in May, indicating its intention to build nuclear power plants worth 12 trillion won. The Saudi government is promoting a project to build two nuclear power plants with a capacity of 1,400 MW by 2030. The nuclear industry expects the Saudi nuclear power plant bidding to be narrowed down to a two-way competition between Korea and Russia. France’s construction costs are relatively high, and China has no experience with desert nuclear power plants.

Experts also point out that restoring the domestic supply chain is urgent to accelerate the nuclear power plant contract race. Domestic nuclear industry sales decreased by 5 trillion won from 27 trillion won in 2016 to 22 trillion won in 2020. During the same period, the number of nuclear sector partner companies of Doosan Enerbility dropped by nearly 100, from 320 to 227. Experts diagnose that under the current situation, even if overseas nuclear power projects are won, the domestic supply chain cannot adequately support them. Accordingly, the government plans to issue emergency work orders worth 130.6 billion won to the nuclear industry within this year to help restore the ecosystem.

President Yoon Visits Cladding Material Storage for Shin Hanul Units 3 and 4 (Changwon=Yonhap News) Photo by Seomyeonggon Seo = On the morning of June 22, President Yoon Seok-yeol visited Doosan Enerbility in Changwon, Gyeongnam, where he received an explanation about the Korean nuclear power plant APR1400 at the cladding material storage for the Shin Hanul Units 3 and 4 reactor and steam generator. 2022.6.22 seephoto@yna.co.kr (End)

President Yoon Visits Cladding Material Storage for Shin Hanul Units 3 and 4 (Changwon=Yonhap News) Photo by Seomyeonggon Seo = On the morning of June 22, President Yoon Seok-yeol visited Doosan Enerbility in Changwon, Gyeongnam, where he received an explanation about the Korean nuclear power plant APR1400 at the cladding material storage for the Shin Hanul Units 3 and 4 reactor and steam generator. 2022.6.22 seephoto@yna.co.kr (End) There is also an opinion that the government’s dedicated personnel for nuclear power exports should be reinforced. The Ministry of Trade, Industry and Energy, the competent authority, has only one ‘division’ with eight staff members dedicated to nuclear power export tasks. Having only one division-level organization makes it inevitably difficult to realize the government’s ambitious plan to export 10 nuclear power plants by 2030.

Concerns are also growing as the establishment of a ‘Nuclear Power Export Bureau’ has lost momentum. During the presidential transition committee period, the current government pursued a plan to expand the ‘Nuclear Power Export Promotion Division’ into a bureau-level organization. The idea was to establish a bureau-level organization within this year and assign it the practical overall control of the government’s nuclear power export control tower. However, the government finalized the national agenda implementation plan at the end of last month, excluding the plan to establish the Nuclear Power Export Bureau. This was judged to be inconsistent with the government’s policy of ‘streamlining’ government organizations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)