Health and Social Research Institute Estimates Depletion by 2056 Even with Conservative Calculation

National Pension Service / Photo by Asia Economy DB

National Pension Service / Photo by Asia Economy DB

[Asia Economy Reporter Jo In-kyung] "A pension reform several times stronger than those of other countries is necessary. In the mid to long term, we must pursue a 'uniform pension' system that integrates and operates public pension schemes."

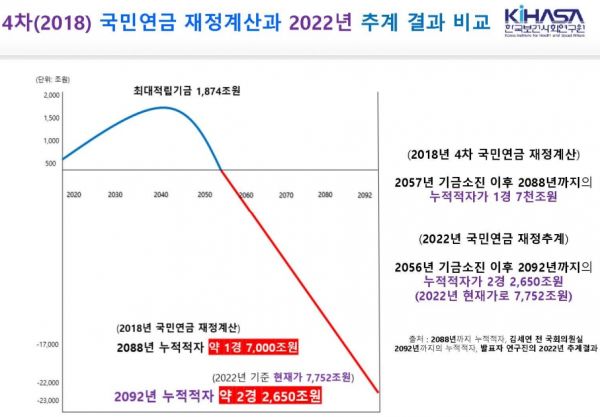

Yoon Seok-myung, a research fellow at the Korea Institute for Health and Social Affairs, stated at the 'Pension Reform for the Youth Generation' discussion among civil society, ruling party, and government held at the National Assembly on the 9th, "According to the newly projected finances of the National Pension Service as of this year, the fund will be completely depleted by 2056, and the cumulative deficit will reach 2,265 trillion won by 2092, 70 years later." This means that those born in 1990, currently 32 years old, may not receive a single penny of the National Pension starting from 2055 when they turn 65.

This result is one year earlier than the originally projected depletion year of the National Pension, which was 2057. The National Pension Service has been calculating finances every five years since 2008. In the third financial projection in 2013, the fund was expected to turn into deficit in 2044 and be depleted by 2060.

In the fourth financial projection in 2018, the deficit year and depletion year were shortened to 2042 and 2057, respectively. The cumulative deficit also increased by about 560 trillion won compared to the projected deficit of 1,700 trillion won for 70 years later (2088) based on the financial calculations at that time.

Research fellow Yoon explained, "The increase in cumulative deficit is due to the four years that have passed since the last projection and the fact that key assumptions such as fertility rate and economic variables were calculated quite conservatively to reflect recent changes." Currently, the total fertility rate is much lower than the assumptions made in 2018, and the fund's average annual return, which was expected to maintain around 4% over the next 70 years, has suffered a significant loss of -4.7% this year.

He added, "There is optimism that 950 trillion won has been accumulated in the National Pension fund since the previous government, but this is misleading information. The pension payments to be made in the future amount to 2,500 trillion won, and the cumulative deficit could reach 2,265 trillion won by 2092, which is the reality," he pointed out.

He also warned that if the current system of '9% contribution rate and 40% income replacement rate' is maintained, one young person may have to support five elderly people. Research fellow Yoon emphasized, "The birth rate in 2021 was 0.81, meaning that 260,000 future generations will have to support 700,000 to 1 million people. If pension reform is delayed, it will inevitably lead to mutual destruction."

Research fellow Yoon also presented a projection that if the Yoon Seok-yeol administration raises the basic pension from the current 300,000 won to 400,000 won per month as promised, expenditures in 2090 will reach 478 trillion won. This is 119 trillion won more than the expenditure projection of 359 trillion won if the basic pension remains at 300,000 won. The government has not disclosed expenditure estimates related to the basic pension increase.

As a direction for pension reform, he suggested extending the mandatory pension contribution period from the current age 59 to 64 for those with income to strengthen retirement income. He also stated that the National Pension, a contribution-based pension system, should gradually transition to an income-proportional pension, and the basic pension funded by government finances should be operated selectively and paid differentially according to the level of retirement income. Research fellow Yoon proposed, "Support insurance premiums for vulnerable groups to minimize blind spots," and "In the mid to short term, we should pursue a 'uniform pension' system that integrates and operates public pension schemes."

The discussion was hosted by Ahn Cheol-soo, a member of the People Power Party, and included experts such as Yoon Seok-myung, Yang Jae-jin, professor of public administration at Yonsei University, Cho Gyu-hong, first vice minister of the Ministry of Health and Welfare, Kim Mi-ae, member of the People Power Party, and Oh Geon-ho, policy committee chairman of the Welfare State We Make. Ahn said, "Pension reform should have started during the Moon Jae-in administration, but the proposals at that time were discarded due to populist thinking, which is the problem. The burden has increased for this government. Solving these issues is a historic task and mission for the Yoon Seok-yeol administration."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)