Political Turmoil, Trade Disruptions, and Soaring Prices Forecast Sharp Pound Decline

Energy Price Cap Expected to More Than Double... 10.5 Million Households Face Poverty Crisis

[Asia Economy Reporters Byunghee Park, Hyunwoo Lee] "Signs of an economic crisis typically seen in emerging countries are appearing in the United Kingdom, the world's 6th largest economy." "30% of UK households are facing poverty risk."

Bleak forecasts for the UK economy are pouring in. According to CNBC on the 9th (local time), Christopher Dembik, an analyst at Danish investment bank Saxo Bank, stated in a report released on the 8th that "the UK increasingly looks like an emerging country."

Analyst Dembik pointed out that recent political turmoil following Prime Minister Boris Johnson's resignation, trade disruptions after Brexit (the UK's withdrawal from the European Union), and soaring prices due to the energy crisis are signs typically seen when emerging countries experience economic crises.

According to Dembik, the only typical characteristic of an emerging market economic crisis not yet confirmed in the UK is a currency crisis. However, he noted, "It is unclear what will cause the pound to plummet," implying there are many negative factors that could devalue the pound.

Recently, Swiss investment bank UBS warned that the pound could fall again to $1.15 per pound in the fourth quarter of this year, the level seen in March 2020 at the start of the COVID-19 pandemic. At that time, the pound's value hit its lowest point in 40 years.

Dembik also pointed out several indicators forecasting a difficult road ahead for the UK economy, such as new car registrations last month totaling 1.528 million units, a sharp drop from 1.835 million units a year earlier. He said that current new car registrations are at their lowest level since the late 1970s, and that the UK economy's recession will be long and deep, making recovery difficult.

The central bank, the Bank of England (BOE), also predicted that the UK economy will enter its longest recession since the 2008 global financial crisis starting from the fourth quarter of this year. At last week's monetary policy meeting, the BOE forecasted that the gross domestic product (GDP) will decline for five consecutive quarters from the fourth quarter of this year through the end of next year. The BOE also warned that GDP in 2025 will be 1.75% lower than now, indicating a prolonged recovery from the recession.

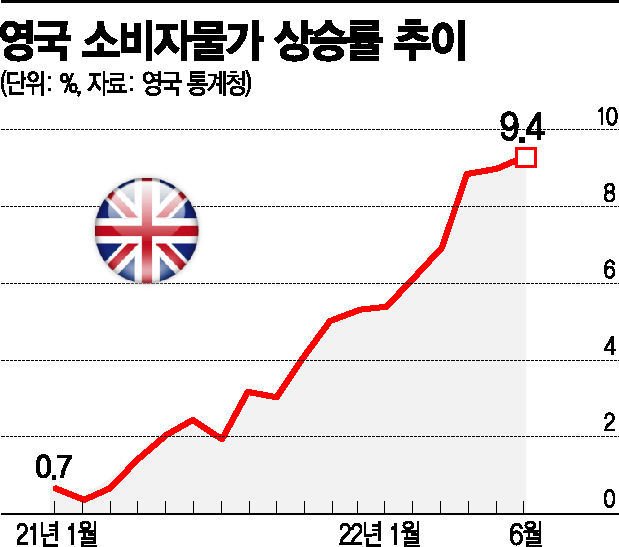

The BOE also warned of a severe inflation crisis. It stated that inflation will peak only in the fourth quarter of this year, raising the forecast for the highest inflation rate in the fourth quarter from the previous 11% to 13.3%, the highest since 1980. The BOE expects inflation to remain in double digits until mid-next year.

There are particular concerns that gas supply shortages caused by the Russia-Ukraine war will further fuel inflation. Cornwall Insight, a UK energy market research firm, reported on the 9th that the current annual energy price cap of ?1,971 in the UK is expected to more than double to ?4,226 by January next year.

The UK government privatized the electricity and gas retail sectors in 1999 but set price caps to prevent excessive increases in gas and electricity bills. The UK's energy market regulator, OFGEM, sets and announces the energy price cap twice a year (in April and October), but recently the regulation was changed to allow up to four adjustments per year. This change was made because many small and medium-sized energy companies went bankrupt after the Russian invasion of Ukraine caused energy prices to surge, and these companies failed to timely reflect rising costs in consumer prices.

Cornwall Insight explained that the reason for raising the energy price cap was "due to the shorter cycle for changing the energy price cap and the continued surge in wholesale gas prices."

With energy prices expected to soar, the number of impoverished households is also projected to increase significantly. The End Fuel Poverty Coalition (EFPC) in the UK predicted that "over the three months following early next year, about 30% of all UK households, approximately 10.5 million households, could see their income fall below the poverty line."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)