[Asia Economy Reporter Song Hwajeong] With the advancement of digital technologies such as big data and cloud computing, coupled with the non-face-to-face trend caused by COVID-19, the adoption of artificial intelligence (AI) is accelerating across industries, and AI adoption is rapidly expanding in the financial sector as well.

According to the financial sector on the 6th, KB Kookmin Bank recently introduced the 'Corporate Credit Automatic Screening Support System (hereinafter Bics: Big data CSS)' based on a machine learning model applied with AI technology.

Bics is a system that provides corporate credit officers with system judgment results for loans with low credit risk by utilizing various non-financial information including financial information and alternative data. The machine learning-based Bics model with AI technology also includes a function to select companies that are expected to grow into high-quality enterprises in the future.

Additionally, to respond to economic fluctuations, a re-learning model development process has been established so that the model can be developed periodically every year using the latest data. For cases where Bics is executed, a Bics report reflecting company overview, financial status and analysis opinions, and system judgment results is automatically generated and provided to corporate credit officers.

Hana Bank introduced 'AI Banker,' which briefs various financial information such as financial markets and exchange rate forecasts through the mobile app 'Hana One Q,' the first in the banking sector.

The newly introduced mobile AI Banker is implemented based on deep learning (a technology that enables computers to think and learn like humans), providing a natural feeling as if an actual bank employee is explaining, with speaking lip movements, gestures, and facial expressions. AI Banker offers briefing services in two menus within Hana One Q: 'Hana Hap' and 'Fund Mall.'

Hana Bank plans to expand the application of AI Banker as a Hana One Q guide that assists with financial product explanations and non-face-to-face product subscriptions. Furthermore, based on voice conversation, AI Banker will provide diverse and convenient AI-based financial services through ▲consultation tasks ▲basic (inquiry and transfer) banking transactions ▲hyper-personalized asset management services.

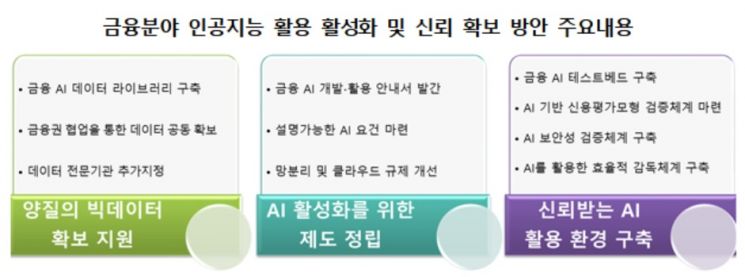

The financial authorities have also announced measures to activate AI and are providing support. On the 4th, the Financial Services Commission announced plans to promote the use of AI in the financial sector and secure trust. These plans include ▲establishing a 'Financial AI Data Library' that allows reuse of pseudonymized information ▲publishing AI development and utilization guides for five major financial sectors ▲allowing exceptions to network separation for AI development and test servers using pseudonymized information ▲building an AI testbed to support test data and computing resources ▲establishing AI-based credit evaluation models and AI security verification systems.

The Financial Services Commission plans to build the AI Data Library by the second quarter of next year and improve network separation cloud regulations in January next year, pushing forward related tasks swiftly to activate AI in the financial sector.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)