[Asia Economy Reporter Lee Seon-ae] The downward stabilization trend of the previously soaring international oil prices is causing the returns on oil-related products to become increasingly sluggish. Investors who bet on a decline are now finally breathing a sigh of relief. The recent drop in international oil prices appears to reflect concerns about an economic recession and potential demand slowdown, but it is also important to note that factors on the supply side are contributing to the price decline. Accordingly, the stock market is busy devising investment strategies aligned with the downward trend of international oil prices.

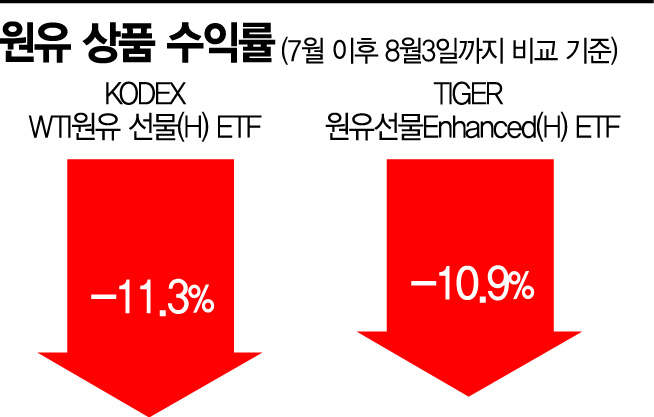

According to the Korea Exchange's aggregation of returns on oil-related products as of the 4th, since July until the previous day, the returns of the 'KODEX WTI Oil Futures (H) ETF' and 'TIGER Oil Futures Enhanced (H) ETF' were -11.3% and -10.9%, respectively. Downward pressure on international oil prices is expected to increase in the second half of the year, suggesting that losses on related products will deepen. Min Byung-gyu, a researcher at Yuanta Securities, stated, "In addition to economic recession and demand slowdown, attention should be paid to the supply side regarding the downward trend of international oil prices," adding, "OECD oil inventories have been increasing for four consecutive months since bottoming out in February, which is also a factor that raises expectations for further stabilization of international oil prices."

Kim So-hyun, a researcher at Daishin Securities, noted, "The leadership of the oil market lies with oil-supplying countries such as Saudi Arabia and Russia," and added, "If oil demand surges, production capacity may reach its limit faster than expected, which increases uncertainty about oil supply."

While investors holding oil products seem increasingly anxious, the returns on inverse oil products have not yet fully turned profitable. Inverse products generate profits when prices fall. The 'KODEX WTI Oil Futures Inverse (H)' closed at 4,480 won the previous day, entering a downward trend, but compared to the end of June (4,070 won), it remains at a relatively high level. The TIGER Oil Futures Inverse (H) also closed at 3,115 won the previous day but is still in the loss zone compared to June 30 (2,835 won). However, investors are relieved that the loss margin is narrowing.

The stock market has adopted a sector-selective strategy in line with the downward stabilization trend of international oil prices. Representative sectors affected when international oil prices collapse include refining, shipbuilding, and renewable energy. The chemical sector, which suffered the most damage from rising oil prices, could conversely become a sector of interest. Oversold stocks (growth stocks) and food and beverage, which may have high margin spreads, are also considered promising sectors. Lee Eun-taek, a researcher at KB Securities, advised, "During periods of oil price decline, attention should be paid to sectors where margin spreads are expected to expand," adding, "Food and beverage, as well as chemical, construction, and automobile sectors, are also targets of interest."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)