First-Time Homebuyers Hit 10-Year Low

2030 Young Adults' Apartment Purchase Share Plummets

Despite LTV 80% Relaxation, "Prices Too High to Buy"

Concerns Over House Poor Spread Amid High Interest Rates and Peak Price Theories

Even Those Determined to Buy Now

Only High-Income Youth See Increased Loan Limits

Low-Income Youth Receive No LTV Benefit Due to DSR Regulations

"Stocks and coins have dropped, and news about record-high housing prices has also become scarce... Now that things around me have quieted down a bit, I wonder if I was being gaslighted into 'Yeongkkeul' (borrowing to the max, even to the soul) all this time. (36, office worker, resident of Goyang-si)"

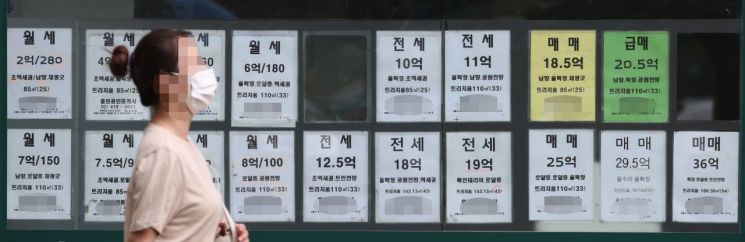

Until last year, the 2030 Yeongkkeul group, who led the housing market by borrowing to the max, has disappeared. It is now rare to see people in their 20s and 30s who used to search real estate listings across Seoul in real-time, thinking "today is the lowest price."

The head of real estate agency A in Dangsan-dong, Yeongdeungpo-gu, Seoul, said, "Until the first half of last year, most visitors were some investors and newlyweds. The two people I contracted with last year were also in their 30s. It is true that there are few listings, but there are no purchase inquiries, and only a few rental inquiries."

According to the Court Registry Information Plaza on the 3rd, the number of people who purchased a collective building (apartments, villas, officetels, etc.) for the first time in their life from January to June this year was 168,921, the lowest in 10 years since 2012 (161,744). Compared to the peak last year (284,815), it decreased by 40.7%.

The 2030 generation is the main age group purchasing a home for the first time in their life. The decrease in first-time purchases directly reflects their movement. According to the Korea Real Estate Agency's statistics on apartment sales transactions by buyer age group, there were 2,014 apartment sales transactions in Seoul in June. Among them, the 2030 generation accounted for 499 purchases, making up 24.8%. This is the lowest figure since the statistics by buyer age group were first compiled in January 2019. When the housing market was overheated in August 2020, the 2030 purchase share first exceeded 40%, recording 40.3%. In July last year, it reached an all-time high of 44.8%.

Loan regulations and interest rate hikes, which intensified from the second half of last year, poured cold water on the Yeongkkeul group's 'panic buying.' Transaction volumes began to plummet, and the 2030 purchase share gradually decreased, falling to the 30% range in May and the 20% range in June. Meanwhile, rental transactions reached record highs. According to the Ministry of Land, Infrastructure and Transport, the number of rental transactions (based on reporting date) in the first half of the year was 1,570,467, a 35.5% increase compared to last year. It also increased by 54.4% compared to the five-year average.

This is analyzed as a result of the increased burden of principal and interest repayments due to interest rate hikes and the spread of the theory that housing prices have peaked, which sharply dampened buying sentiment. Jo Joo-hyun, honorary professor of real estate at Konkuk University, said, "Buying sentiment is influenced by housing market trends and rising interest rates. Those who could afford to buy have already purchased through 'Yeongkkeul,' and since the prevailing view is that housing prices will fall further, a wait-and-see stance continues."

Although the loan-to-value ratio (LTV) limit for first-time homebuyers was relaxed to 80% starting this month, it seems difficult to reverse the depressed buying sentiment. Since housing prices have risen so high, even with loans, the repayment burden is high, making purchases difficult. Kim (26, office worker, resident of Seongbuk-gu, Seoul), who finds it hard to leave Seoul due to work, said, "It's good that the LTV is being relaxed, but the median price of apartments in Seoul is said to be close to 1 billion KRW, and considering the increasing interest burden, I'm not sure if taking out a loan to buy is the right choice."

With the interest rate hike trend expected to continue and the government's announced '2.5 million housing units + α' supply bomb still pending, Kim Hyo-seon, senior real estate advisor at NH Nonghyup Bank, said, "There aren't many buyers who think housing prices have completely fallen, and there is even an expectation that prices will fall further. In a market that has turned downward, buyers are more likely to watch the situation rather than rush to buy a house."

"What use is LTV 80%? Low-income youth have no ladder to climb"

"Even if they loosen the loan-to-value ratio (LTV) to 80%, they capped the debt service ratio (DSR) at 40%, so what does it mean?"

"This policy is for high-income earners who couldn't get loans because of LTV, but it is useless for low-income earners."

(Real estate community on a portal site)

Although the Yoon Seok-yeol administration fulfilled its campaign promise to "loosen the LTV to 80% for first-time homebuyers regardless of the location or price of the house," public opinion remains lukewarm. Even if one decides to buy a house amid the plummeting housing purchase sentiment, for low-income earners, owning a home 'in Seoul' is still a distant dream. The 'asset formation ladder' that low-income, homeless youth could climb is broken and left unattended.

A simulation by a commercial bank for a 29-year-old youth divided by annual income levels (30 million KRW, 50 million KRW, 70 million KRW) to purchase a 900 million KRW apartment in a speculative district in Seoul shows the following loan amounts available under the 'LTV 80% relaxation': 202 million KRW (30 million KRW income), 336 million KRW (50 million KRW income), and 471 million KRW (70 million KRW income).

Because of the 'DSR 40%' rule limiting annual principal and interest repayments to 40% of annual income when total loans exceed 100 million KRW, low-income earners have limited benefit from the LTV relaxation. Until now, for first-time buyers, LTV of 50-60% applied to houses priced under 900 million KRW in speculative or overheated districts. With the increase to 80%, high-income earners can borrow more from banks, but low-income earners’ borrowing capacity remains unchanged before and after the LTV relaxation.

Furthermore, as financial authorities decided to reflect future expected income for youth, the gap in borrowing capacity between low- and high-income earners widened. When both 'LTV 80% relaxation' and 'future expected income' are applied, the loanable amounts are 265 million KRW (30 million KRW income), 442 million KRW (50 million KRW income), and 600 million KRW (70 million KRW income).

Reflecting future income widens gap between low- and high-income earners

The difference between 30 million KRW and 70 million KRW annual incomes when only 'LTV 80%' is applied is 269 million KRW, but when the effect of reflecting 'future expected income' is added, the gap widens to 335 million KRW. This means that low-income youth living in Seoul will find it difficult to escape living in others’ homes unless they move to the metropolitan area or provinces.

High-income earners also face their own difficulties. The Financial Services Commission capped the mortgage loan limit at 600 million KRW while relaxing LTV to 80%. According to the DSR 40% rule, even high-income earners who could borrow more than 600 million KRW can only borrow up to 600 million KRW. For example, a 70 million KRW income youth could borrow up to 619 million KRW when both 'LTV 80% relaxation' and 'future expected income' are applied, but the loanable amount is capped at 600 million KRW.

A commercial bank official said, "Low-income earners are blocked by DSR regulations, so their borrowing capacity does not increase significantly, and high-income earners face a borrowing cap. Therefore, the LTV 80% relaxation policy is ultimately just for show. Only a few high-income dual-income couples can seize the opportunity to own a home," he analyzed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.