National Assembly Legislative Research Office '2022 State Audit Issue Analysis Report'

[Asia Economy Reporter Song Hwajeong] As the extension and repayment deferral measures for small business owners expire at the end of September, opinions have emerged that a hybrid non-performing loan (NPL) resolution system combining public institutions like Korea Asset Management Corporation (KAMCO) and specialized private sectors is needed for efficient NPL management.

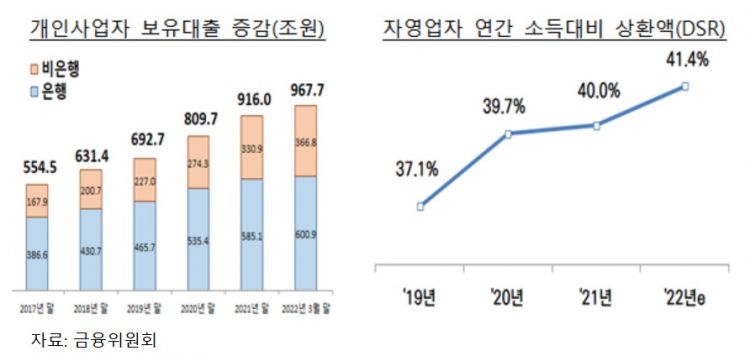

According to the '2022 National Assembly Audit Issue Analysis Report' by the National Assembly Research Service on the 3rd, domestic household debt reached 104.3% of GDP as of the first quarter of this year, becoming a potential trigger that could lead to a financial crisis in the event of an economic downturn. Due to the slowdown in household consumption, it is expected to be difficult for small business owners and self-employed individuals to improve their business performance. Their operating profits are at a level where even interest payments are hard to cover, and with loan maturities approaching at the end of September, without extraordinary measures, they are inevitably pushed into delinquency.

The report emphasized that given the uncertain domestic and international economic conditions, including a global economic downturn, proactive policies to resolve NPLs are necessary. To prepare for a financial crisis and efficiently manage NPLs, it suggested the need to introduce a hybrid NPL resolution system that supplements the limitations of the private sector and ensures fair competition by combining public institutions like KAMCO with specialized private sectors. It also recommended that the government or local governments actively intervene to establish funds and jointly provide roadmaps for debt restructuring, rehabilitation assessment, and recovery methods.

Operating a bad bank to assist the rehabilitation of self-employed individuals is also important. Kim Youngguk, a legislative researcher at the Financial Fair Trade Team of the National Assembly Research Service, said, "The proportion of self-employed individuals in Korea was 23.9% last year, higher than the OECD average of 17%," adding, "A bad bank operation is needed as a method to either rehabilitate through debt restructuring or quickly proceed with business closure to create a foundation for new recovery." Previously, the government introduced a fresh start fund with the characteristics of a bad bank to alleviate the debt burden of small business owners and the self-employed. Through this, it plans to purchase about 30 trillion won worth of NPLs and conduct debt adjustments such as principal reductions of 60-90%. The report pointed out that despite the need for domestic self-employed individuals to close their businesses, the huge repayment amounts incurred upon closure are exacerbating insolvency, and emphasized that bad bank operations should include support measures for bankruptcy and business closure.

Additionally, the report identified key issues related to the Financial Services Commission in the National Assembly’s Political Affairs Committee audit, including ▲ current status and management plans for household debt ▲ strengthening internal controls of financial companies ▲ establishing basic principles for judging intermediary activities of financial platforms ▲ systematic design of youth leap accounts ▲ and financial consumer protection measures.

Amid rising calls for strengthening internal controls in financial companies following recent embezzlement cases, the report pointed out, "Compared to internal control systems in major overseas countries, Korea’s definition of internal control is not significantly different from that of the US, UK, and Japan. However, in practice, Korea tends to understand internal control mainly as compliance with laws and regulations, whereas major countries view internal control from an enterprise-wide operational risk perspective and invest in physical and human resources to strengthen internal controls." It also noted criticism regarding unclear standards on when and how supervisory responsibility should be applied in cases of internal control violations domestically. Therefore, it suggested that discussions are needed on methods such as explicitly defining the scope of supervisory negligence to impose supervisory responsibility similarly to the US and UK.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)