Considering Closure Due to Performance Decline (32.4%)

[Asia Economy Reporter Park Sun-mi] As the triple crisis of high inflation, high interest rates, and high exchange rates is compounded by the resurgence of COVID-19, concerns are growing over the continued business difficulties in the second half of the year, with 33.0% of small business owners in local commercial districts considering closure.

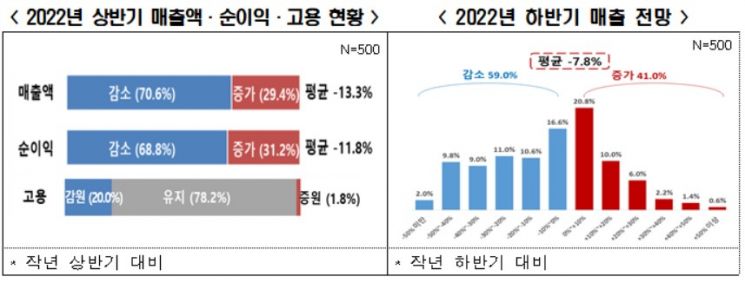

On the 31st, the Federation of Korean Industries commissioned market research firm Mono Research to conduct a survey of 500 self-employed individuals on their "2022 First Half Performance and Second Half Outlook." The results showed that sales in the first half of this year decreased by an average of 13.3% compared to the same period last year, and 70.6% of self-employed individuals experienced a decline in sales.

59.0% of self-employed respondents forecast that sales in the second half of this year will also decline compared to last year, with an average decrease of 7.8%. Although 20.8% of self-employed individuals expected a slight sales increase within 0-10% in the second half, 9.8% anticipated a 40-50% decrease, and 9.0% expected a 30-40% decrease, meaning that 20.8% foresee sales dropping by more than 30% compared to the same period last year.

33.0% of self-employed individuals stated they are considering business closure. The reasons for considering closure included decreased business performance (32.4%), burden of fixed costs such as rent and labor costs (16.2%), worsening financial conditions and loan repayment burdens (14.2%), and management burdens (12.1%).

On the other hand, reasons for not considering closure included "no particular alternative" (22.7%) and "expectation of economic recovery after the end of COVID-19" (20.1%), followed by "business performance is not bad" (14.9%), "business is sluggish but financial burden is not heavy" (13.3%), and "entering new businesses or changing industries is expected to be riskier" (12.4%).

The most burdensome management cost for business owners was rent, including deposits and monthly rent (28.4%), followed by raw material costs (20.0%), labor costs including wages and social insurance (19.6%), and loan repayments including principal and interest (16.0%).

The biggest anticipated difficulty this year was "the burden of purchasing materials due to rising prices" (23.6%). Other difficulties included rising rent and tax burdens (17.2%), loan repayment burdens due to rising interest rates and maturity (14.8%), and limited recovery of overall consumer sentiment due to concerns over the resurgence of COVID-19 (10.5%).

To revitalize local commercial districts, self-employed individuals most frequently cited the need for "expanded support measures to stimulate consumption" (16.1%). There were also responses hoping for expanded financial support such as low-interest loans (15.5%), suppression or reduction of public utility fee increases such as electricity and gas (14.3%), and expanded funding support (10.4%).

Yoo Hwan-ik, head of the Industry Division at the Federation of Korean Industries, pointed out, "Considering that this survey was conducted at the early stage of the COVID-19 resurgence with the Omicron subvariants, the outlook for the second half of the year felt by self-employed individuals is likely worse than the survey results. As the so-called triple crisis of high inflation, high interest rates, and high exchange rates increases the burden on self-employed individuals, support measures that minimize their burdens, such as improving consumer sentiment, expanding financial support, and offering discounts or support for public utility fees, are necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)