[Asia Economy Reporter Buaeri] #Office worker Kim Ah-young (33) is comparing interest rates from various banks to move her time deposit, which she transferred from a commercial bank to KakaoBank in February this year, back to a commercial bank. As banks raised interest rates, she felt like she would lose out if she stayed put. Kim said, "Since I switched not long ago, I judged that switching again to a higher interest rate would be beneficial." As commercial banks consecutively raise deposit interest rates, the phenomenon of commercial bank deposit rates surpassing those of internet-only banks, which had attracted users with competitive rates, is occurring.

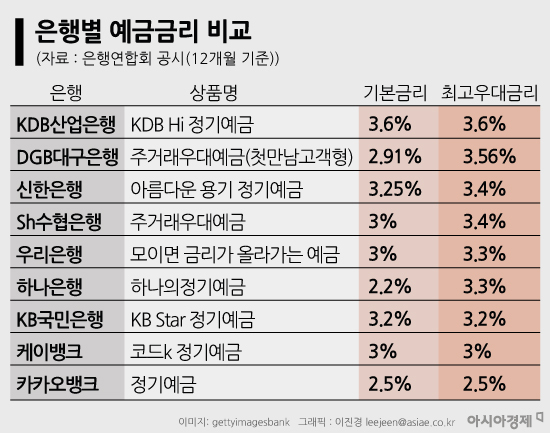

According to the Bankers Association disclosure on the 29th, among 1-year time deposit products, the highest interest rate is offered by KDB Industrial Bank's 'KDB Hi Time Deposit' at up to 3.6%. Following that is DGB Daegu Bank's 'Main Transaction Preferential Deposit (First Meeting Customer Type)' with a maximum interest rate of 3.56%.

Among commercial banks, Shinhan Bank's 'Beautiful Courage Time Deposit' offered up to 3.4%, Woori Bank's 'Deposit with Increasing Interest Rate When Gathered' offered up to 3.3%, Hana Bank's 'Hana One Time Deposit' was 3.3%, and KB Kookmin Bank's 'KB Star Time Deposit' was 3.2%. Internet-only banks, which had boasted higher interest rates compared to commercial banks, did not make the top ranks. K Bank's 'CodeK Time Deposit' offered up to 3%, and KakaoBank's time deposit was around 2.5%.

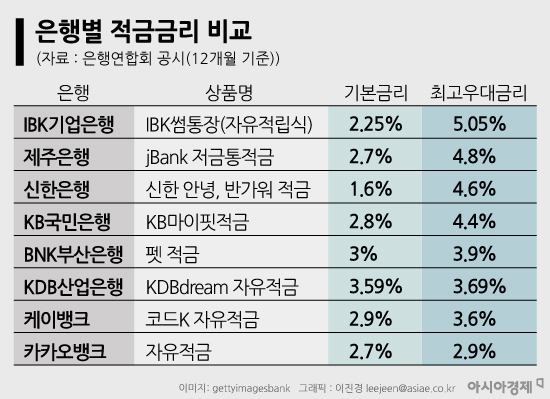

This trend was similar for installment savings products. For 1-year maturity installment savings (free installment, 12 months), IBK Industrial Bank's 'IBK Some Account' offered the highest interest rate at 5.05%. Next was Jeju Bank's jBank Piggy Bank Installment Savings at 4.8%. Among commercial banks, Shinhan Bank's 'Hello Nice to Meet You Installment Savings' offered up to 4.6%, and KB Kookmin Bank's 'KB My Fit Installment Savings' offered up to 4.4%. K Bank's CodeK Free Installment Savings offered up to 3.6%, and KakaoBank's free installment savings offered up to 2.9% interest.

As commercial banks' interest rates rise, large sums of money continue to flow into banks. As of the end of June, the total balance of time deposits and installment savings at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) was 722.5602 trillion KRW, an increase of about 6 trillion KRW compared to 716.5365 trillion KRW at the end of May. Recently, the growth rate has accelerated further. As of the 20th, the five banks' time deposit balance was 741.986 trillion KRW, an increase of 19.4258 trillion KRW compared to the previous month.

On the other hand, the growth of deposit balances at internet-only banks is somewhat slowing down. KakaoBank's deposit balance at the end of June was 33.1808 trillion KRW, down by 19.89 billion KRW compared to 33.3797 trillion KRW at the end of May. A financial industry official said, "Although internet-only banks continue to grow based on convenience, other banks are also focusing on digital transformation, and it has become difficult to differentiate from commercial banks solely through interest rate competitiveness." He advised, "They need to research ways to generate fee income by developing value-added services such as trust services or foreign exchange services."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)